Your Guide to the Auto Accident Demand Letter Template

When you’re trying to get compensation after a car crash, the auto accident demand letter is your opening move. Think of it as your formal, written request to the at-fault driver's insurance company, laying out the facts of the accident, the extent of your injuries, and exactly what you're demanding in financial damages. This letter officially kicks off settlement talks.

Why a Strong Demand Letter is Your Most Powerful Tool

Before you even think about downloading a template, you need to grasp just how critical this document is. It’s not just another piece of paperwork. The demand letter is the foundation of your entire claim and, frankly, your one and only chance to make a powerful first impression on the insurance adjuster. A well-crafted letter can mean the difference between a quick, fair settlement and a long, frustrating battle.

This is your opening argument. It’s where you frame the entire narrative, establish the facts from your point of view, and set the anchor for the negotiation with your proposed compensation figure. When an adjuster sees a professional, evidence-backed demand, it sends a clear signal: you're organized, you're serious, and you can back up every single dollar you're asking for.

Setting the Stage for Settlement

At its core, a demand letter is designed to get your claim settled without ever seeing the inside of a courtroom. An insurance adjuster’s job is to evaluate their company's risk and financial exposure. Your letter gives them all the ammunition they need to do that job effectively.

When you present the facts clearly and logically, you make it easy for them to justify a fair settlement to their manager and get the file off their desk. This is where the overwhelming majority of cases get resolved. In fact, an estimated 98.2% of civil tort matters in the United States settle before they ever get to trial. That statistic alone shows you how pivotal a thorough demand letter is in turning your claim into cash by clearly laying out medical bills, lost income, and pain and suffering. You can get more great insights on this from the experts at TrialGuides.com.

A common mistake is to treat the demand letter like a simple request for money. It's not. It’s a persuasive legal document that builds your case, establishes your credibility, and forces the insurance company to take you seriously from day one.

Establishing Credibility and Control

Adjusters are juggling hundreds of claims at once. If your letter is vague, emotional, or missing key documents, it's easy for them to push it to the bottom of the pile or throw a lowball offer at you. On the other hand, a detailed, factual demand supported by meticulously organized evidence demands their immediate attention.

By putting your best foot forward from the start, you achieve a few key things:

- Demonstrate Your Seriousness: It proves you’ve done the work and you know what your claim is actually worth.

- Control the Narrative: You get to tell the story first, supported by the police report, medical records, and photos.

- Anchor the Negotiation: Your initial demand becomes the benchmark for all discussions. The burden then shifts to the adjuster to explain why they think you deserve less.

Ultimately, a powerful demand letter isn't just about asking for money—it's about compelling the insurer to engage with you thoughtfully and negotiate in good faith. You can learn more by checking out our complete guide on what is a demand letter.

Breaking Down the Anatomy of a Winning Demand Letter

Think of your demand letter less like a form and more like a carefully constructed argument. Every piece has a job to do. When you assemble them correctly, you create a compelling narrative that walks the insurance adjuster from the crash right to your settlement figure. It's a logical path, and you're the one drawing the map.

Let’s dissect this structure, piece by piece.

The opening is your first impression. It needs to be professional, direct, and nail down the core facts right away. This isn't the time for a long, winding story. Just state your name, the date and location of the accident, the claim number, and the name of their insured—the at-fault driver. Simple and to the point.

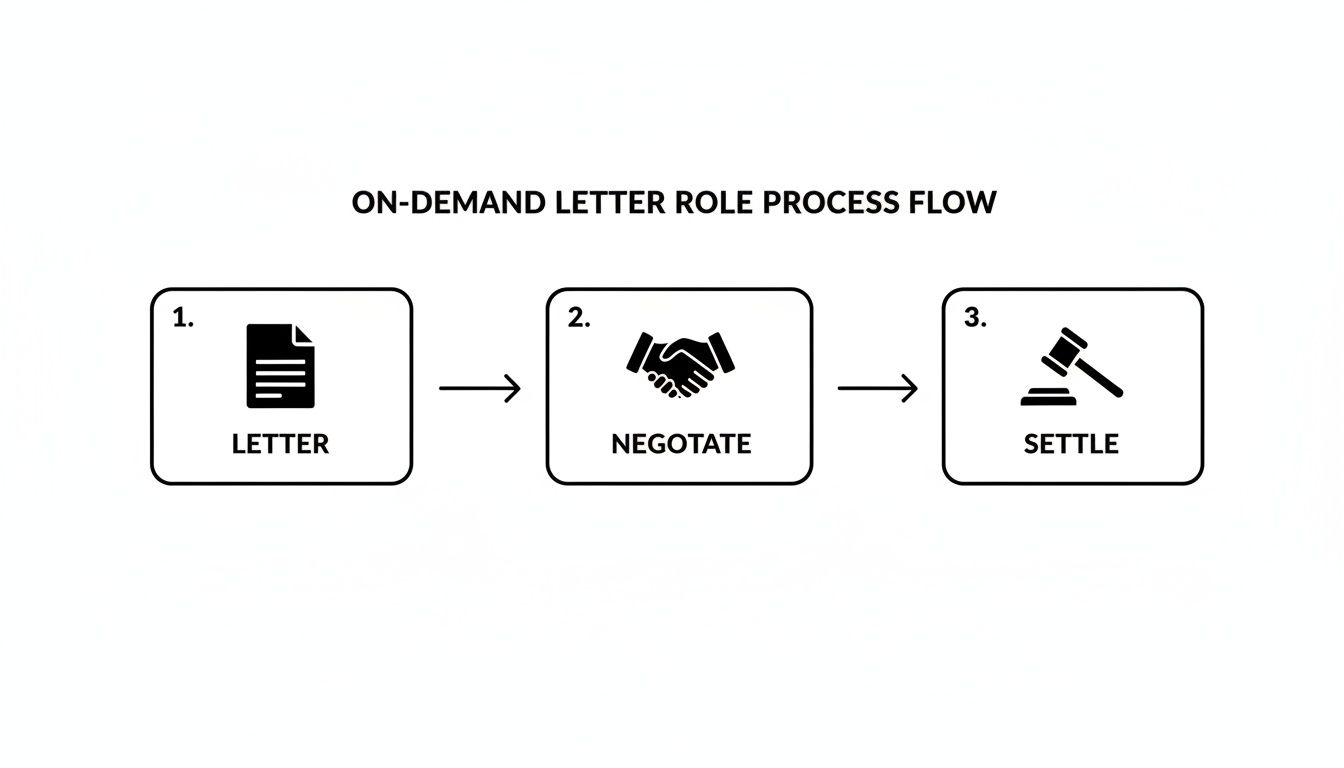

This infographic shows just how central the demand letter is to the whole process. It’s what kicks off the real negotiation and pushes the claim toward a final resolution.

As you can see, the letter is the catalyst. It transforms a messy claim file into a structured negotiation, which is why getting the clarity and details right from the start is so crucial for a smooth settlement.

Constructing the Liability Narrative

Right after the intro, you need to lay out exactly how the accident happened. The goal here is simple: establish, beyond any doubt, that their insured was at fault.

Describe the events as they unfolded, sticking to the facts. This is where you have to resist the urge to use emotional language or point fingers. Instead, let the objective details from the police report, any witness statements, and local traffic laws do the talking for you.

- For example: "I was driving north on Elm Street and had a green light at the Oak Avenue intersection. Your insured, who was heading east on Oak, ran their red light and crashed into the passenger side of my car."

A clean, fact-based description like that leaves no wiggle room. It immediately signals to the adjuster that their client’s liability is clear.

Detailing Your Injuries and Medical Treatment

Frankly, this is the heart of your letter. Your job is to draw a direct, undeniable line connecting the collision to the injuries you suffered. Just listing your diagnoses won't cut it. You have to tell the story of your medical journey.

Start from the moment of impact. Describe the immediate pain and what happened at the scene or in the emergency room. From there, you'll want to build a chronological summary of every step of your treatment.

- List every provider: Include the names and addresses of hospitals, clinics, physical therapists, chiropractors, and any other specialists you saw.

- State the diagnoses: Use the official medical terms from your doctors, like "cervical sprain," "lumbar disc herniation," or "post-concussion syndrome."

- Outline your treatment: Detail the entire course of care—every physical therapy session, all medications prescribed, and any recommendations for future procedures or therapy.

This level of detail gives the adjuster a full picture of what you've been through and the long road to recovery.

Articulating Your Damages

With liability and injuries firmly established, it’s time to talk money. This is where you itemize every single cost that came out of this accident. It’s best to break these into two distinct categories.

First, you have economic damages. These are the tangible, out-of-pocket expenses that have a clear dollar value. Be precise and list everything.

- All medical bills (even what your health insurance paid)

- Lost wages from any time you missed at work

- Costs for prescriptions and over-the-counter medications

- Mileage and transportation costs for your medical appointments

Second, you have non-economic damages, which is the legal term for your pain and suffering. This part is more subjective, but it’s just as important. Here, you'll describe how the injuries upended your life—the physical pain, the mental stress, the sleepless nights, and the inability to do things you once enjoyed. Calculating this figure can be tricky, but our guide on valuing emotional pain and suffering settlements breaks down the strategies.

Pro Tip: An adjuster can easily check your math on economic damages with receipts and bills. It's your ability to persuasively describe your non-economic damages that often makes the biggest difference in the final settlement offer. Get specific about the real-world impact.

Finally, you need to wrap it all up with a clear, firm settlement demand. State the total amount you are demanding to close the claim. This number should be the sum of both your economic and non-economic damages.

Always end by giving them a reasonable deadline for a response, usually 30 days. This creates a sense of urgency and keeps your file from getting buried on an adjuster's desk. Your closing should be professional and confident, signaling that you're ready to negotiate but also prepared to take the next step if a fair offer isn't made.

How to Calculate and Document Your Damages

This is where your demand letter gets down to business, shifting from the narrative of what happened to the financial reality of your losses. Calculating and meticulously documenting your damages is the single most important part of your claim.

Every dollar you demand has to be backed up by a receipt, a record, or a logical calculation. An adjuster is trained to pick apart unsupported numbers, so your goal is to make your claim airtight.

Your damages generally fall into two buckets: economic and non-economic. Economic damages are the black-and-white, calculable losses—think bills, lost paychecks, and repair invoices. Non-economic damages are trickier; they cover the human cost, like your pain, stress, and the overall disruption to your life.

Tallying Your Economic Damages

Economic damages are the financial bedrock of your claim. The math here is straightforward, but it demands obsessive record-keeping. You need proof for every single expense.

These are the core figures you need to track down and document:

- Medical Expenses: This means every single bill connected to your treatment. Gather invoices for the ambulance ride, the ER visit, any hospital stay, follow-up appointments, specialist consultations, physical therapy, and chiropractic care. Don't forget to include costs for prescriptions and medical equipment like crutches or a brace.

- Lost Income: If the accident took you out of work, you need to prove it. Get a formal letter from your employer on company letterhead that confirms your pay rate, your typical schedule, and the exact dates you missed because of your injuries.

- Property Damage: This is mainly the cost to fix or replace your vehicle. You'll need the official repair estimate from a body shop or, if your car was totaled, its actual cash value (ACV) appraisal.

- Out-of-Pocket Expenses: This is a catch-all category for other costs. It can include mileage for driving to doctor's appointments, parking fees at the hospital, or even the cost of hiring someone for yard work or chores you couldn't do yourself.

When you're dealing with property damage, don't forget to look into understanding what a diminished value claim is. It’s a separate claim for the loss in your vehicle's resale value, even after it's been perfectly repaired.

Valuing Your Non-Economic Damages

This is where things get more subjective, but it's often the most significant part of your claim. How do you put a price tag on pain and suffering? While there’s no magic formula, a couple of common methods give you a structured place to start.

One approach is the Multiplier Method. Here, you take your total economic damages (usually just the medical bills) and multiply them by a number between 1.5 and 5. A minor injury with a fast recovery might warrant a 1.5 multiplier. A severe, life-changing injury could justify a multiplier of 4 or 5.

The other common approach is the Per Diem Method. This method assigns a daily rate for your pain and suffering, running from the day of the accident until you reach what doctors call Maximum Medical Improvement (MMI). The daily rate is often based on your daily earnings, working from the idea that enduring pain is at least as demanding as going to your job every day.

Choosing the right method really depends on the specifics of your case. For long-term, nagging injuries like chronic back pain, the per diem method can be very effective. For an accident that causes a lot of initial trauma but has a shorter recovery, the multiplier method might better capture that intensity.

Whichever method you choose, you absolutely must justify your number. Don't just throw a figure out there; explain why you chose it. Describe the daily pain, the family events you missed, the hobbies you had to give up, and the emotional toll. This narrative is what gives your number weight and makes it real for the adjuster.

The Power of Meticulous Documentation

An unsupported demand is just a number on a page. The documents you attach are the proof that turns your requests into a legitimate claim. According to the World Health Organization, road traffic crashes result in up to 50 million non-fatal injuries globally each year. The financial fallout from those injuries is exactly why your documentation has to be flawless.

Your documentation is your leverage. Use this checklist to make sure you have everything you need to build a rock-solid case.

| Your Essential Documentation Checklist |

| :--- | :--- | :--- |

| Damage Category | Key Documents to Include | Expert Tip |

| Liability & The Accident | The official police report, photos/videos of the scene, witness contact information. | The police report is a great start, but your own photos of skid marks, debris, and vehicle positions can be even more powerful. |

| Medical Treatment | All medical bills (itemized), treatment records, diagnostic reports (X-rays, MRIs), prescription receipts. | Don't just submit a lump-sum bill. Itemized invoices show the adjuster exactly what treatment you received and why it was necessary. |

| Lost Income | A formal letter from your employer, copies of recent pay stubs, and tax returns if you're self-employed. | The letter from your employer should explicitly state that your absence was due to injuries sustained in the accident. |

| Vehicle Damage | At least two detailed repair estimates, photos of the damage from all angles, and the ACV report if totaled. | Getting two estimates prevents the adjuster from claiming the first one was inflated. |

| Out-of-Pocket Costs | Receipts for all related expenses (parking, rentals, etc.), and a mileage log for medical travel. | Use a simple spreadsheet to track these small costs. They add up quickly and demonstrate your diligence. |

Putting this all together can feel like a massive task, but it’s non-negotiable. If you're struggling to get your files in order, our guide on how to organize medical records offers a practical system to manage the paperwork.

Ultimately, a perfectly documented damages section sends a clear message to the adjuster: you are prepared, you are professional, and your claim is built on undeniable facts.

Download Your Free Auto Accident Demand Letter Template

Let's get right to it. We've put together a comprehensive auto accident demand letter template to give you a solid starting point. It’s available in both Microsoft Word for easy editing and as a PDF, so you can use whichever format fits your workflow.

Think of this less as a simple form and more as a professional framework. It's structured to walk you through building a compelling, evidence-based argument, making sure you hit all the key points an insurance adjuster needs to see to properly evaluate your client's claim.

Download the Auto Accident Demand Letter Template (Word)

Download the Auto Accident Demand Letter Template (PDF)

Getting the Most Out of This Template

Once you open the document, you'll see bracketed placeholder text, like [Your Name] or [Date of Accident]. These are your cues. The template is already organized to present the case in a logical and persuasive sequence, so your main job is to substitute these placeholders with the specific facts of your case.

Just work your way through the sections, replacing the prompts with your own information.

- Incident Details: Begin with the basics—your contact info, the at-fault driver's details, the claim number, and the crash date and location.

- Liability Section: This is where you swap out the placeholder text with your factual, concise account of how the collision occurred.

- Damages Section: Carefully fill in the itemized list with your calculated economic and non-economic damages. Make sure every single figure you list is supported by the documentation you've collected.

Striking the Right Tone

How you say it is just as important as what you say. The template uses a professional, direct tone, and I strongly recommend you stick with that style. Getting emotional or aggressive in your writing almost never helps; in fact, it often hurts your credibility with the adjuster.

A great example is the difference between saying, "Your client's reckless driving completely destroyed my life and they need to pay up," versus a more powerful statement like, "As a direct result of the collision caused by your insured, I sustained injuries that have significantly impacted my daily activities and earning capacity."

This kind of objective, fact-driven language signals to the adjuster that you're organized, serious, and approaching this negotiation from a position of strength. By using this template's structure and professional voice, you're setting the stage for a much smoother and more successful negotiation. The goal is to lay out a case so clear and well-supported that a fair settlement becomes the only logical conclusion for the insurer.

Mastering the Strategy of Your Demand

Having a perfectly written demand letter is a huge step, but it's only half the battle. Now comes the strategy. The timing, the tone you take, and how you follow up are every bit as important as the words on the page. Think of your demand not as a passive document, but as your opening move in a negotiation.

Timing Your Demand for Maximum Impact

Sending your letter at the right moment is absolutely critical. The sweet spot is after you’ve reached what doctors call Maximum Medical Improvement (MMI). This is the point where your medical condition has stabilized, and everyone has a clear picture of your long-term prognosis and any future care you might need.

It's a common and costly mistake to send a demand too early, before you grasp the full extent of your medical bills and future needs. On the flip side, you have to keep a close eye on your state's statute of limitations, which is a hard deadline for filing a lawsuit. You want to send your demand well before that clock runs out to give yourself plenty of room to negotiate.

Setting the Right Tone for Negotiation

The language you choose sets the stage for the entire settlement discussion. Your tone needs to be firm and professional, but not overly aggressive or emotional. This isn't an angry letter; it's a formal, fact-based proposal to resolve a legal claim.

An overly aggressive tone just puts the adjuster on the defensive, making them far less likely to negotiate in good faith. It creates an adversarial dynamic right from the start, which is the opposite of what you want.

Your goal is to be persuasive, not threatening. Lay out your case with the calm confidence that comes from a well-documented, logical claim. Let the facts do the talking and show the adjuster that settling is their most reasonable, cost-effective option.

Think of it this way: you're showing them you're organized, you know what you're doing, and you’re prepared to take the next step if you have to. But you're also offering a practical way to resolve this without a fight.

Establishing Deadlines and Next Steps

A demand letter without a deadline isn't a demand—it's a suggestion. You have to include a specific date by which you expect a written response. A 30-day window from when the insurer receives the letter is standard. This creates a clear timeline and prevents them from letting your claim sit on a desk collecting dust.

So, what happens if the deadline comes and goes, or if they come back with a laughably low offer? This is where the real negotiation begins. The insurance company’s first offer is almost never their best one.

Here’s what you can generally expect after you send your auto accident demand letter:

- The Initial Offer: Don't be surprised or discouraged if the first offer is way lower than what you asked for. This is standard procedure.

- Your Counteroffer: Respond in writing with a counteroffer. This is your chance to explain exactly why their number is too low and to highlight the strongest points of your case again.

- The Back-and-Forth: This process can go on for several rounds. Just keep your tone professional and always anchor your position to the facts and documentation you've gathered.

Deciding when to send your demand is a data-driven move. Almost all personal injury cases settle before trial. Claims analysis shows that sending a time-limited demand once liability is clear and you have key medical records in hand often encourages an insurer to close the file without dragging things into costly litigation. You can find more facts and statistics about auto insurance to help shape your strategy.

Answering Your Top Questions About Demand Letters

When you're trying to resolve a car accident claim, a lot of questions pop up, especially around the demand letter itself. I've been through this process countless times, and here are the answers to the questions I hear most often.

How Do I Figure Out a Fair Number for Pain and Suffering?

This is the big one, isn't it? It’s also where many people get stuck. Unlike a medical bill, there’s no invoice for your pain. We typically use two main approaches to land on a credible figure: the multiplier method and the per diem method.

With the multiplier method, you take your total hard costs (medical bills plus lost wages) and multiply them by a number between 1.5 and 5. A multiplier of 1.5 or 2 works for straightforward injuries where you bounce back quickly. For serious, life-altering injuries that leave a permanent mark, you're looking at a multiplier of 4 or 5.

The per diem approach is more like a daily wage for your suffering. You determine a daily rate—often based on what you earn in a day—and multiply it by the number of days you were in pain. This clock starts on the accident date and stops when your doctor says you’ve reached maximum medical improvement.

No matter which method you use, the number is meaningless without a story. You have to connect the dots for the adjuster. Explain how the pain kept you from sleeping, forced you to miss your daughter's soccer game, or made you give up hiking. That's what gives your number weight and credibility.

Should I Do This Myself or Get a Lawyer?

For a simple fender-bender where fault is crystal clear and your injuries were minor, you can absolutely handle this yourself. Using a solid auto accident demand letter template is a great way to make sure you cover all your bases in these straightforward situations.

But you should pick up the phone and call a lawyer immediately if your case involves any of the following:

- Significant or long-term injuries: If you needed surgery, face a long road of physical therapy, or have an injury that will affect you for life, you need an expert.

- A fight over fault: The moment the other driver starts pointing fingers or the insurance company questions liability, it's time to lawyer up.

- More than two parties: Pile-ups or accidents with multiple injured people get legally messy, fast.

A seasoned personal injury attorney knows the insurance company's playbook. They can often secure a much larger settlement, even after accounting for their fee, simply because they know what your claim is truly worth and how to fight for it.

What are the Most Common Mistakes I Should Avoid?

I’ve seen simple, preventable errors torpedo an otherwise solid demand letter. These little missteps can completely change how an adjuster views you and your claim.

Make sure you steer clear of these classic blunders:

- Throwing out an absurd number: Demanding a fortune without the facts to back it up makes you look amateurish and unreasonable right from the start.

- Jumping the gun: Never, ever send your demand before you’ve finished all medical treatment. You need to know the full financial picture first.

- Getting emotional: Your letter should be a professional, fact-based argument. Rants, threats, or angry language will only make the adjuster dig in their heels.

- Forgetting the proof: Every single expense you claim needs a corresponding document. If it's not on paper, it didn't happen in the adjuster's eyes.

- Admitting even a shred of fault: Something as simple as "I'm sorry the accident happened" can be twisted. Let the facts and the police report do the talking.

One last, thorough read-through before you send it can save you a world of headaches.

What Happens After I Send the Letter?

Once the demand is out the door, the waiting game begins. The insurance adjuster will review everything you sent, and you can usually expect a response within the 30-day deadline you provided.

Get ready for a lowball counteroffer—it’s the first move in almost every negotiation. Don't be offended; it's just part of the process. In very rare cases, they might accept your demand or deny the claim outright. If your deadline passes with radio silence, a polite follow-up call is your next move. It's also worth thinking about how you'll transmit these sensitive documents. If you're considering faxing, be sure you understand the security risks of online fax services to keep your personal information secure.

If you negotiate for a bit and their offer is still nowhere near reasonable, it might be time to talk to an attorney about taking the next step. The most important thing is to stay patient, professional, and persistent.

Building a powerful demand letter means getting every detail right, and that takes a ton of time and organization. Ares changes the game by pulling all the key medical facts—diagnoses, providers, treatments, and dates—directly from your records and using them to generate a strong first draft. Stop drowning in paperwork and start negotiating smarter. See how it works at https://areslegal.ai.