How to Craft a demand letter to insurance company for Faster Settlements

A demand letter to an insurance company is where the rubber meets the road in a personal injury case. It's the official starting gun for settlement talks. This isn't just a letter asking for money; it's a meticulously crafted legal argument that lays out why their insured is at fault, details the full extent of your client's damages, and makes a specific demand to settle the claim without stepping into a courtroom.

The Strategic Role of Your Demand Letter

Think of the demand letter as your opening argument, not just a procedural step. A powerful demand is your most important negotiation tool—it’s your first move in a high-stakes chess match against the insurance adjuster.

A well-written letter does more than list facts. It frames the entire story, sets a professional and serious tone for the negotiation, and can significantly speed up the path to a fair settlement offer. This first impression establishes your firm’s competence and sends a clear signal: we're prepared to go to trial if we have to.

A truly effective demand anticipates the adjuster's likely arguments and shuts them down before they're even made. When you present a logical, evidence-heavy case from day one, you make it much harder for them to lowball your client, question the severity of the injuries, or drag their feet with endless information requests. You're turning a sterile claim file into a compelling human story.

Shaping the Negotiation Landscape

The way you structure your demand letter builds the foundation for every conversation that follows. Your primary objective is to make the adjuster see that going to trial would be a very expensive and risky gamble for them compared to offering a reasonable settlement now.

To get there, your letter needs to do a few critical things:

- Establish Clear Liability: Leave no doubt whatsoever that their insured was at fault.

- Humanize the Client: Don't just list medical terms. Paint a clear picture of how this accident has upended your client's life.

- Justify Every Dollar: Tie every single penny of your demand back to concrete evidence, from medical receipts to the real-world impact of pain and suffering.

- Demonstrate Preparedness: The letter should scream, "We have our act together." The adjuster needs to know you're ready for anything.

The demand letter isn't just about stating what you want; it's about showing the insurance company why a jury would give it to you. It’s your first and best chance to control the narrative.

Knowing what's happening on the other side of the table is always a strategic advantage. Understanding their internal systems, including things like how insurance call center software transforms customer experience, can offer clues into how they handle claims from the first call. By laying this solid groundwork, you build a case that isn’t just documented but is persuasively argued, putting you in the best possible position to maximize your client’s recovery from the start.

Building an Airtight Case with Evidence

A powerful demand letter isn't born from clever writing. Its real strength is forged long before you type a single word, in the mountain of evidence you meticulously gather and organize. Your goal is to build such an undeniable foundation for your claim that the adjuster has a clear, logical path to the settlement figure you’ve proposed. This is about more than just checking boxes on a document list—it's about building a compelling story.

Think of it this way: you are strategically assembling police reports, witness statements, and powerful photographs to construct a vivid, indisputable narrative of liability. Each piece of evidence must lock into the next, creating a chain of facts that leads to one simple conclusion: their insured was at fault, and your client is suffering as a direct result. You're the director, presenting the scenes in an order that leads to an unavoidable climax.

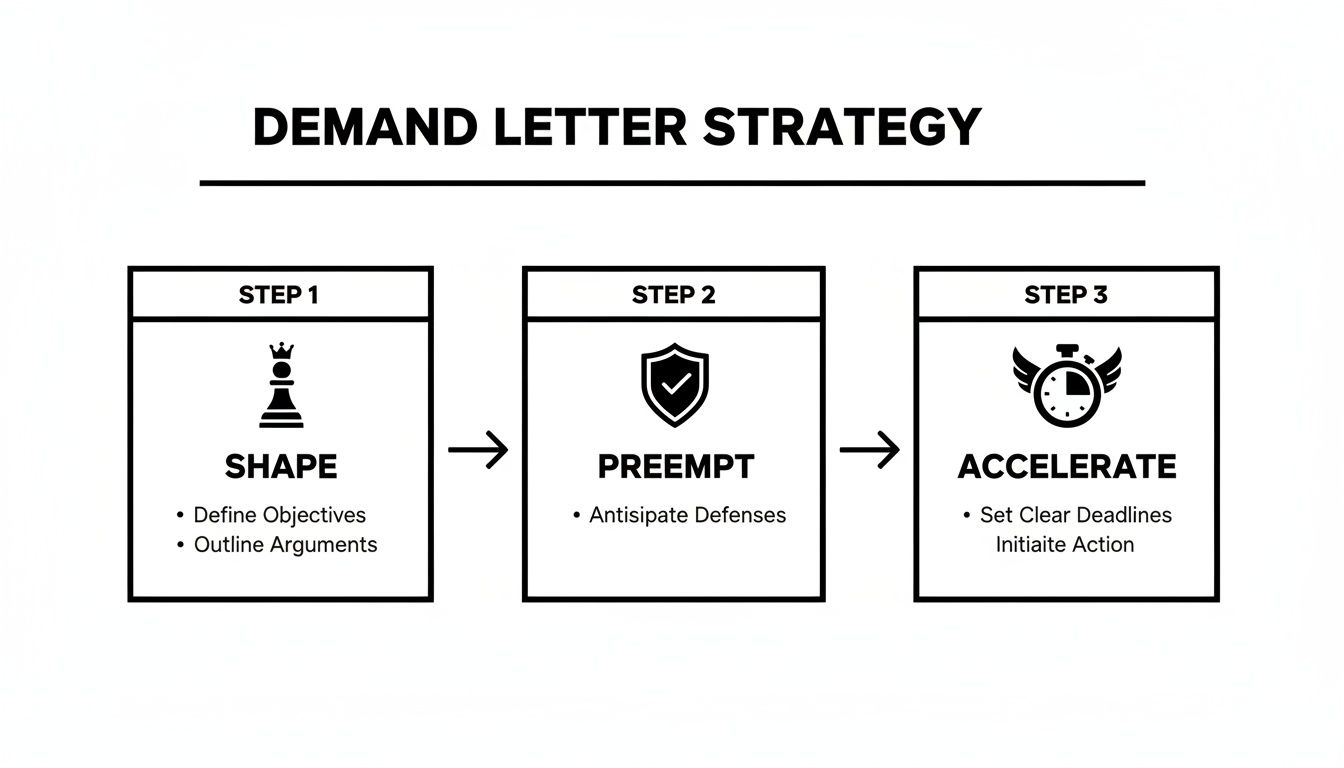

This framework is all about shaping the narrative, preempting the adjuster's arguments, and accelerating the path to a fair settlement.

As the visual shows, a proactive approach is everything. You control the story from the start to drive a faster, better outcome for your client.

Weaving the Medical Narrative

Medical records are the beating heart of your damages argument. But just attaching a thick stack of bills and calling it a day is a rookie mistake. You have to weave those records—from the initial ER report to the ongoing physical therapy notes—into a cohesive, chronological story of your client's entire recovery journey. And it has to be dead simple for a non-medical professional to follow.

An adjuster should be able to read your medical summary and grasp the full arc of the injury—from the moment of impact to the client's current prognosis—without having to decipher a single line of complex medical jargon. Your job is to connect those dots for them.

The story you tell with these records needs to spotlight every procedure, every diagnosis, and every setback. It’s not just about demonstrating the cost of treatment; it’s about showing the real, human toll it has taken on your client's life. This is where the claim truly comes alive.

From Disorganized Records to a Powerful Summary

Let's be honest, one of the biggest bottlenecks for any PI firm is the sheer volume of medical documents. Turning hundreds of pages from a dozen different providers into a clean, powerful summary is a monumental lift. The key is to craft a medical chronology that is both comprehensive and scannable.

Your summary should clearly and cleanly outline:

- Key Dates: The date of the accident, initial diagnosis, surgeries, and all significant follow-ups.

- Providers Involved: A simple list of every doctor, therapist, and facility that has touched the file.

- Treatment Progression: A logical flow showing what was done and how the client responded over time.

- Prognosis and Future Care: The doctor's expert opinion on long-term impacts and the need for future medical care.

The truth is, a well-organized medical summary doesn't just support your demand; it makes the adjuster's job easier, which speeds up their review process. Modern legal tech can now automate much of this data extraction, turning that chaotic pile of records into a case-ready abstract that flags every critical detail. This saves an incredible amount of firm resources and, more importantly, strengthens your negotiating position from day one. To get a better handle on this critical step, check out our complete guide on how to organize medical records.

This level of front-end preparation pays huge dividends. Industry data shows that well-supported demand letters can boost pre-litigation settlement rates by up to 40%. We've seen firms that organize their cases this way save 10+ hours per case and secure 20-30% higher payouts on average. By presenting an airtight case backed by meticulously organized evidence, you make it easy for the adjuster to say "yes" and justify the settlement your client deserves.

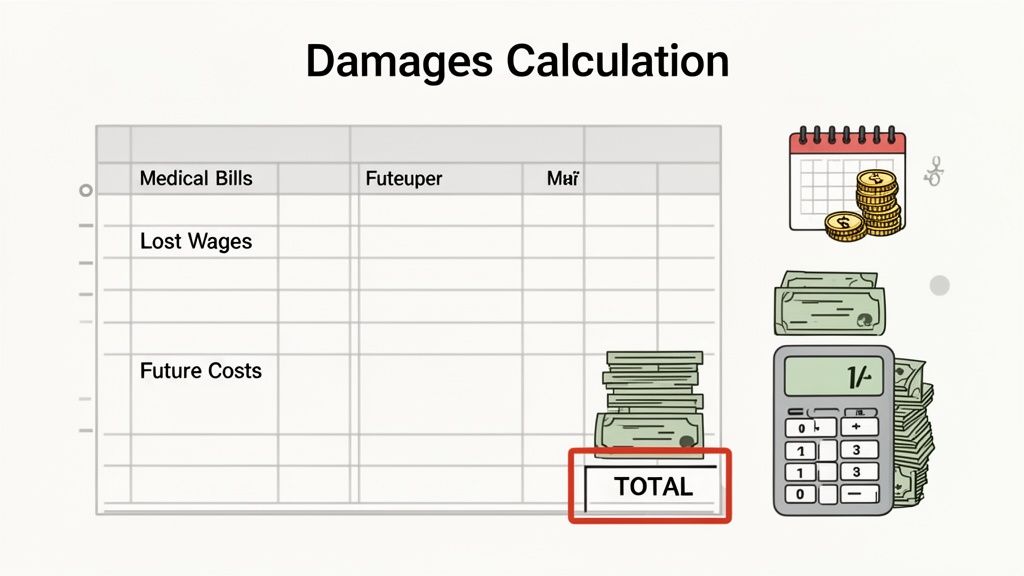

Calculating Damages for Maximum Settlement Value

This is where the rubber meets the road. All the evidence you've meticulously gathered now gets translated into a concrete dollar amount. Calculating damages isn't just about punching numbers into a calculator; it's about building a fortress of logic around your demand—one that an insurance adjuster can’t easily tear down.

A persuasive demand letter connects the dots for the adjuster, clearly linking your client’s suffering to the settlement figure you're requesting. They need to be able to follow your math, see how each piece of evidence supports the total, and understand why it’s a number they should take seriously.

Nailing Down the Special Damages

Let's start with the easy part: special damages. These are the tangible, out-of-pocket economic losses your client has suffered. They're straightforward because they come with a paper trail, and your job is to make sure that trail is complete and easy to follow.

You need to be exhaustive here. Think of it as a financial accounting of the accident's aftermath:

- Medical Bills: Every single one. From the ambulance ride and ER visit to surgeries, follow-up appointments, prescription co-pays, and physical therapy sessions. Did they need crutches or a wheelchair? Add it to the list.

- Lost Wages: This isn't just a guess. Get a clear statement from your client's employer detailing their exact rate of pay and the total earnings lost because they couldn't work.

- Future Earning Capacity: This is a big one for serious injuries. If your client's ability to earn a living has been permanently impacted, you need to project that loss over their lifetime. This is where you bring in the experts—vocational specialists and economists—to give your claim undeniable credibility.

- Property Damage: Don't forget the cost to repair or replace their vehicle and any other personal property destroyed in the incident.

Gather every bill, invoice, receipt, and pay stub. An itemized spreadsheet is your best friend here. Include it as an exhibit in your demand package so the adjuster has no choice but to acknowledge every penny of your client's economic losses.

Putting a Number on Pain and Suffering (General Damages)

Now for the hard part. General damages—compensation for your client’s pain, emotional trauma, and lost quality of life—are subjective. But "subjective" doesn't mean you can just pull a number out of thin air. This is where your storytelling skills become crucial.

You have to paint a vivid, human picture of what your client has been through. It’s not enough to say they were "in pain." You have to show it, connecting the cold medical records to the real-world impact on their daily life.

The key is to transform subjective pain into a quantifiable sum. While no formula is perfect, established methods provide a structured and defensible starting point for negotiations with the insurance company.

Two common methods help bring structure to this calculation: the multiplier method and the per diem approach.

The Multiplier Method

This is the industry-standard approach. You take the total of the special (economic) damages and multiply it by a number, usually between 1.5 and 5. The multiplier you choose depends entirely on the facts of the case.

- A multiplier of 1.5 or 2 might be appropriate for a straightforward soft-tissue injury where the client made a full and quick recovery.

- A multiplier of 4 or 5 is reserved for catastrophic cases involving permanent disability, significant scarring, or a life fundamentally altered by the injury.

You must justify your chosen multiplier. Point to the severity of the injuries, the duration of the recovery, the invasiveness of the medical treatment, and the long-term prognosis.

The Per Diem Method

The "per day" method is another tool in your arsenal. You assign a daily monetary value to your client's suffering, running from the date of the accident until they reach Maximum Medical Improvement (MMI). A common way to anchor this daily rate is to tie it to what your client earned per day, arguing that enduring their injuries was at least as demanding as a full day of work.

For instance, if your client earned $200 a day and their recovery took 150 days, the pain and suffering calculation would be $30,000 ($200 x 150 days). This method can be very effective for injuries with a clear, finite recovery period. For a deeper look at these valuation strategies, check out our guide on how to calculate pain and suffering damages.

A Comprehensive Breakdown of Personal Injury Damages

To ensure nothing is missed, it's helpful to categorize every potential loss. The following table provides a structured guide for identifying, calculating, and documenting the full spectrum of damages in your demand letter.

| Damage Category | Description & Examples | Documentation Required |

|---|---|---|

| Medical Expenses (Past & Future) | All costs related to treatment for the injuries. Examples: Ambulance, ER visits, hospital stays, surgery, prescriptions, physical therapy, chiropractic care, assistive devices (crutches, braces), and projected future medical needs. | Itemized medical bills and receipts; physician's narrative report; reports from medical and life care planning experts for future costs. |

| Lost Wages | Income lost due to time off work for recovery. Examples: Missed salary, wages, bonuses, commissions, and used sick/vacation days. | Letter from employer verifying time missed and rate of pay; pay stubs from before and after the incident; tax returns. |

| Loss of Earning Capacity | Diminished ability to earn income in the future due to permanent injury. Examples: Inability to return to the same job, need to switch to a lower-paying career. | Reports from a vocational rehabilitation expert and an economist; medical records detailing permanent impairment ratings. |

| Property Damage | Cost to repair or replace any personal property damaged in the incident. Examples: Vehicle repair estimates, total loss valuation, cost to replace a damaged cell phone or laptop. | Repair estimates and invoices; Kelly Blue Book or NADA guides for vehicle valuation; receipts for replaced items. |

| Pain and Suffering | Compensation for the physical pain and emotional distress caused by the injury. Examples: Chronic pain, anxiety, depression, PTSD, insomnia, fear. | Medical records detailing pain complaints; photos/videos of injuries; journal entries from the client; reports from mental health professionals. |

| Loss of Consortium / Enjoyment | Compensation for the negative impact on the client's relationships and ability to enjoy daily life. Examples: Inability to engage in hobbies, play with children, or maintain a normal marital relationship. | Testimony/statements from the client, spouse, family, and friends; photos or videos of the client engaging in activities pre-injury. |

By meticulously detailing each category with solid documentation, you build a demand that is both comprehensive and difficult for the insurance carrier to dispute.

Your final demand number should be ambitious but anchored in reality. It needs to be supported by irrefutable evidence for the specials and a compelling, well-reasoned narrative for the generals. This approach gives the adjuster a clear choice: make a fair offer, or prepare to face a well-armed attorney in litigation.

Weaving a Compelling Narrative

Once you've marshaled the evidence and run the numbers, your job shifts from analyst to storyteller. The narrative is the absolute heart of your demand letter to an insurance company. It's what breathes life into a sterile claim file, transforming it into a human story that an adjuster can't just brush aside. This is your chance to connect the cold, hard facts of the incident to the very real consequences your client lives with every single day.

Let's be clear: the goal isn't to be melodramatic or overly aggressive. It's about crafting a narrative that is firm, professional, and ultimately, undeniable. You're building a logical bridge from the at-fault party's negligence to the profound impact on your client's life, making your settlement demand feel not just justified, but inevitable.

Structuring for Maximum Impact

How you sequence the story is everything. An insurance adjuster reads hundreds of these letters. You have to grab their attention immediately and walk them through a logical progression that culminates in your demand.

I always recommend starting with a clear, concise summary of the incident itself. This sets the stage and establishes liability right out of the gate. From there, you pivot directly to the human cost.

- The Incident: A brief, factual account of what happened. Reference the police report number and other key evidence.

- The Immediate Aftermath: Describe the scene, the initial shock, the ambulance ride, and the chaos of the emergency room.

- The Painful Road to Recovery: This is where you detail the surgeries, the grueling physical therapy sessions, and the daily struggles.

- The "New Normal": Explain how life has fundamentally changed. Talk about the hobbies they can no longer enjoy, the chronic pain they now manage, and the emotional toll this has taken.

This structure creates a powerful cause-and-effect arc. It moves seamlessly from "what happened" to "what it cost," making your final damages calculation feel like the only logical conclusion.

A great narrative ensures the adjuster sees your client as a person who has suffered, not just a claim number. It’s about building empathy that is grounded in irrefutable fact.

From Facts to a Compelling Story

Simply listing medical procedures and dates from a chronology isn't a story. The real art is in translating those clinical details into a vivid picture of your client's experience.

Don't just state that your client had knee surgery. Describe the helplessness they felt being unable to walk up the stairs in their own home for three months. Paint a picture.

Consider this common scenario:

Dry Fact: "The client underwent an L4-L5 microdiscectomy on March 15th."

Persuasive Narrative: "Following the collision, Ms. Davis endured months of debilitating sciatic pain that made even simple acts like sitting at her desk an exercise in agony. When conservative treatments failed, a lumbar microdiscectomy on March 15th became her only option to regain a semblance of a normal life. The six-week recovery that followed meant a complete loss of independence, forcing her to rely on family for even the most basic daily needs."

See the difference? This approach doesn't exaggerate; it contextualizes. It connects a medical procedure directly to the human experience of pain, frustration, and loss of autonomy. To keep your facts straight across a complex narrative, some firms are applying Named Entity Recognition (NER) for accurate drafting, ensuring every detail is consistent.

Maintaining a Firm and Confident Tone

Your tone should be professional and assertive, but never angry. Confidence comes from the strength of your evidence, not from aggressive adjectives. You have to avoid accusatory language or emotional pleas that can make your position seem weak or unprofessional.

Instead of this: "Your insured's reckless and unforgivable actions have ruined my client's life."

Try this: "The evidence clearly demonstrates that the collision, and all subsequent injuries, were a direct result of your insured's failure to yield the right-of-way."

The second statement is far more powerful because it's objective and rooted in legal fact. It tells the adjuster you are prepared to prove your case based on evidence, not just rhetoric. This professional confidence signals that you are a serious adversary who has built an airtight case.

Remember, even as insurers tighten their margins, studies show that 70% of cases settle pre-trial when a strong, data-backed demand letter is sent within 90 days of the injury. By combining a compelling story with a firm, evidence-based tone, you create a demand that commands respect and, most importantly, gets a meaningful response.

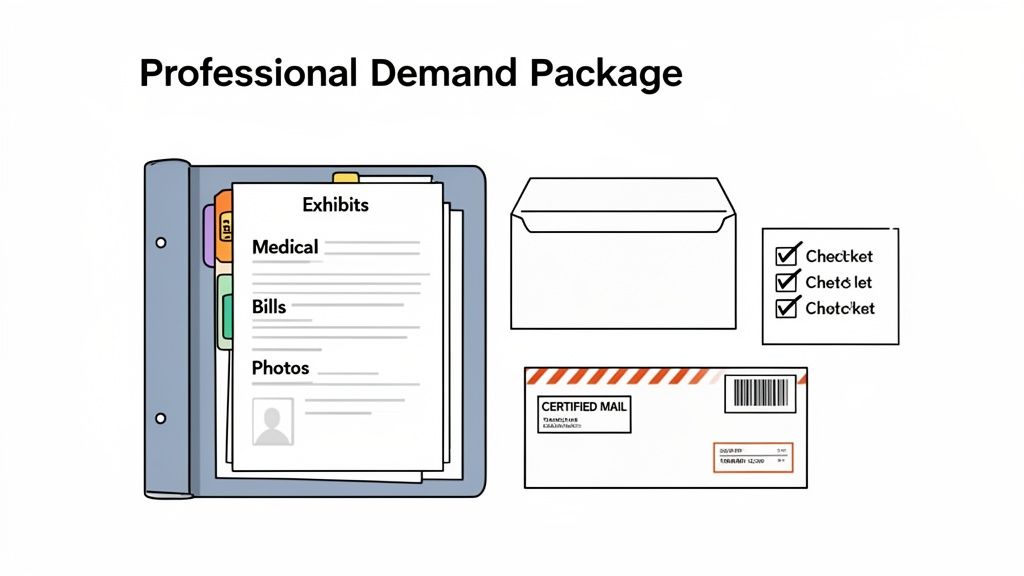

Assembling Your Professional Demand Package

You’ve gathered the evidence and built a compelling story. Now it’s time to put it all together. Think of this final step not just as mailing a letter, but as delivering a comprehensive, professional package that makes your argument undeniable and the adjuster's job easy.

A sloppy, disorganized submission screams that you're unprepared and practically invites a lowball offer. Your goal should be to hand the adjuster a self-contained trial binder—everything they need to grasp liability, confirm the damages, and justify a fair settlement to their superiors without ever having to ask you for a missing document. This level of thoroughness signals that you’re serious and ready for a fight if necessary.

Your Essential Exhibit Checklist

The demand letter is the narrative, but your exhibits are the hard proof. Every single attachment needs to be clearly labeled, paginated, and referenced directly in the letter. A messy stack of papers gets tossed aside; a logically ordered set of exhibits gets reviewed.

Your core exhibits will almost always include:

- Medical Records and Bills: Organize these chronologically or by provider. Don’t leave anything out, from the first ER report to the last physical therapy note.

- Proof of Lost Wages: This isn't a suggestion; it's a requirement. Get a formal letter from your client's employer that spells out their pay rate, hours missed, and total lost income.

- Police and Incident Reports: The official report is often the cornerstone for establishing clear liability.

- Key Photographs and Videos: Clear, high-quality photos are critical. Show the vehicle damage, the accident scene, and—most importantly—your client’s injuries as they progressed.

- Expert Reports: If you brought in an accident reconstructionist or vocational expert, their full, signed report must be included in the package.

The quality of your demand package directly influences the quality of the first offer. An adjuster who can easily verify every fact is more likely to engage in a productive, good-faith negotiation from the outset.

Strategic Timing and Delivery

Knowing when to send your demand letter to an insurance company is just as important as what’s in it. Sending it too early, before your client has reached Maximum Medical Improvement (MMI), is a classic mistake. You’ll undervalue the claim by failing to account for future medical care or permanent limitations.

Of course, you can't wait forever. The statute of limitations is always ticking. The sweet spot is after MMI is clearly established but with plenty of time to spare before any statutory deadlines hit.

When it comes to delivery, you need proof. Always use a method that gives you documented confirmation of receipt.

- Certified Mail with Return Receipt: This is the old-school, gold-standard method. That signed green card is undeniable proof of when the adjuster received your demand.

- Secure Insurer Portals: More and more carriers are pushing for digital submissions. If you use a portal, save a digital confirmation or take a screenshot of the successful upload for your file.

Documenting receipt creates a clear starting line and holds the insurer accountable for responding in a reasonable timeframe. In an industry projected to handle $7.5 trillion in premiums, efficiency is everything. We're seeing firms that present a well-structured case with a clear medical narrative settle up to 50% faster, often avoiding the massive costs and risks of litigation. You can find more on this trend from industry analysts like Accenture.

If you're looking to build a more efficient workflow, starting with a solid foundation is key. Our personal injury demand letter template can give you a strong structural starting point.

Your Top Demand Letter Questions, Answered

Even seasoned attorneys run into tricky situations with demand letters. Let's tackle some of the most common questions that pop up during the pre-litigation process.

When Is the Perfect Time to Send the Demand?

This is a critical judgment call. Sending a demand too early is one of the easiest ways to leave a staggering amount of money on the table.

The sweet spot is right after your client reaches Maximum Medical Improvement (MMI). This is the official point where their doctor says they're as recovered as they're going to get. Only then do you have a full, clear picture of any permanent injuries, long-term limitations, or future medical expenses.

If you jump the gun and send the demand before MMI, you're essentially guessing what the final damages will be. What if your client needs an unexpected surgery down the road? What if their "sore back" becomes a chronic, debilitating condition? Once you settle, there are no do-overs.

Of course, you can't sit on the case forever. The statute of limitations is always looming. The goal is to get the demand out the door once you know the full story of your client's damages, leaving yourself plenty of runway to negotiate or file suit if the clock is ticking.

How Much Should I Ask For in the Initial Demand?

Think of your first demand number as a strategic opening move in a chess match, not your final word. It needs to be ambitious, but it absolutely must be anchored to the evidence you’ve painstakingly laid out.

A solid rule of thumb is to demand a figure that’s significantly higher than what you realistically expect the case to settle for. Why? Because it gives you room to negotiate. Insurance carriers almost never accept the first offer—it's just not how they operate. They will come back with a lowball counter, and the dance begins.

Your opening demand sets the ceiling for what’s possible in negotiation. Starting with a strong, well-supported number gives you the flexibility to come down without ever dipping below what your client truly needs and deserves.

Be careful not to fly too close to the sun. An outrageous, pie-in-the-sky number with no factual basis will just get you laughed out of the room and kill your credibility. Even your high-end demand needs to be logically tied back to your pain and suffering calculations and the specific facts of the case.

How Do I Handle an Unresponsive Adjuster?

It’s incredibly frustrating but all too common: you send a killer demand package, and all you get back is… crickets.

First thing’s first: document every single communication attempt. After a reasonable amount of time has passed—usually around 30 days—send a polite but firm follow-up email. Reference the date the adjuster received the demand and ask for an update on their review.

If you’re still met with silence or obvious delay tactics, take it as a signal. The adjuster is likely testing your resolve and hoping you’ll go away. This is your cue to escalate. More often than not, the next step is to file a lawsuit.

Filing a complaint doesn't mean you’re headed for a trial tomorrow. In fact, for many carriers, the act of filing the lawsuit is the only thing that will get their attention and prompt a serious settlement discussion. It shows you’re not bluffing and immediately ratchets up their own risk and potential costs.

Can My Client Just Write the Demand Letter Themselves?

Technically, anyone can write a demand letter. But for a personal injury client, doing so is almost always a catastrophic mistake.

Insurance adjusters are professional negotiators. They review thousands of claims a year and can spot a letter written by a non-lawyer from a mile away. When they see one, their first instinct is to throw out a nuisance-value offer, knowing the person on the other end has no real leverage.

A demand letter arriving on law firm letterhead instantly changes the entire dynamic. It tells the insurance company:

- An experienced professional has vetted this claim.

- The damages, including complex items like future medical care and loss of earning capacity, have been properly calculated.

- The sender has the resources and intent to file a lawsuit and win at trial if a fair offer isn't made.

That last point is the real power. It's the credible threat of litigation that forces adjusters to take a claim seriously. A misplaced word or a badly calculated damage request in a DIY letter can cost a client tens, if not hundreds, of thousands of dollars.

Turning a mountain of chaotic medical records into a compelling narrative for a demand letter is grueling, non-billable work. Ares completely automates this workflow, converting raw documents into precise medical summaries and ready-to-edit demand drafts in just minutes. You can stop the tedious manual review, justify bigger demands, and get to settlement faster.

Find out how much time you’re losing by visiting https://areslegal.ai.