How to Write a Personal Injury Demand Letter That Gets Results

A personal injury demand letter is your opening move in settlement negotiations. It's the formal document you send to the at-fault party's insurance company, laying out the facts of your case, detailing your injuries and financial losses, and making a specific demand for compensation before things escalate to a lawsuit.

Why Your Demand Letter Is the Most Critical Document in Your Claim

Don't think of your demand letter as just another piece of paperwork. It's the strategic cornerstone of your entire settlement effort. This document is your first, and frankly, best opportunity to present a clear, persuasive, and authoritative case to the insurance adjuster who controls the settlement funds.

A well-written letter does more than just state your claim; it frames the entire narrative in your favor. Instead of letting the insurer dictate the story, you establish the facts, prove liability, and draw a clear line from their insured's negligence to your injuries and suffering. This immediately sets a professional and serious tone, showing the adjuster you're organized, prepared, and not to be trifled with.

Establishing the Foundation for Negotiation

Your demand letter is where you build the foundation for everything that comes next. It’s a comprehensive summary that methodically outlines every critical component of your claim, leaving no room for doubt or misinterpretation.

Before you even think about numbers, you need to make sure the adjuster has a complete picture. A strong demand letter will always include a few non-negotiable elements that form the basis for any serious negotiation.

Essential Components of a Winning Demand Letter

Here's a quick overview of the absolute must-haves for a letter that an adjuster will take seriously.

| Component | Its Strategic Purpose |

|---|---|

| A Clear Factual Narrative | Establishes exactly how the incident occurred and why their insured is liable. |

| Detailed Injury Description | Paints a vivid picture of your physical pain and emotional suffering. |

| Comprehensive Medical Evidence | Provides objective proof of your injuries through medical records and bills. |

| Itemized Financial Losses | Quantifies all economic damages, including lost wages and out-of-pocket costs. |

| A Justified Settlement Demand | Presents a specific, well-reasoned monetary figure for total compensation. |

Putting these pieces together effectively is your chance to make a powerful first impression. With nearly 400,000 personal injury claims filed each year in the U.S. and about 95% of them settling before trial, this letter is your primary negotiation tool. You can explore more personal injury statistics to get a better sense of the landscape.

Key Takeaway: Your demand letter isn't just a request for money. It's a strategic legal document that shows you're ready for a fight, which is precisely what motivates an insurer to negotiate a fair settlement instead of facing a costly lawsuit.

The Critical Importance of Timing

This is where many people go wrong. The single most important strategic decision you'll make is when to send the demand letter. Sending it too early can be a catastrophic mistake.

You absolutely must wait until you have reached what’s known in the legal world as Maximum Medical Improvement (MMI).

MMI is the point at which your doctors believe your condition has stabilized. They can now reasonably predict your future medical needs, what follow-up care you’ll require, and whether you'll have any permanent impairment.

If you send a demand before reaching MMI, you're guessing. You can't possibly account for the full scope of your damages—a future surgery, the need for lifelong physical therapy, or chronic pain management. And once you accept a settlement, that’s it. You waive your right to claim any future expenses, even if your condition takes a turn for the worse. Waiting for MMI is the only way to ensure every single past, present, and future cost is baked into your demand.

Building an Irrefutable Case with Strong Evidence

Before you even think about writing your demand letter, you need to build your case on a foundation of solid, well-organized evidence. This is more than just collecting documents; it’s about weaving them into a compelling story that an insurance adjuster simply can't pick apart.

Think of it this way: the adjuster's job is to find cracks in your claim. Your job is to make sure there are none. A disorganized file with missing pieces gives them an opening. A meticulously assembled case file shuts them down from the start.

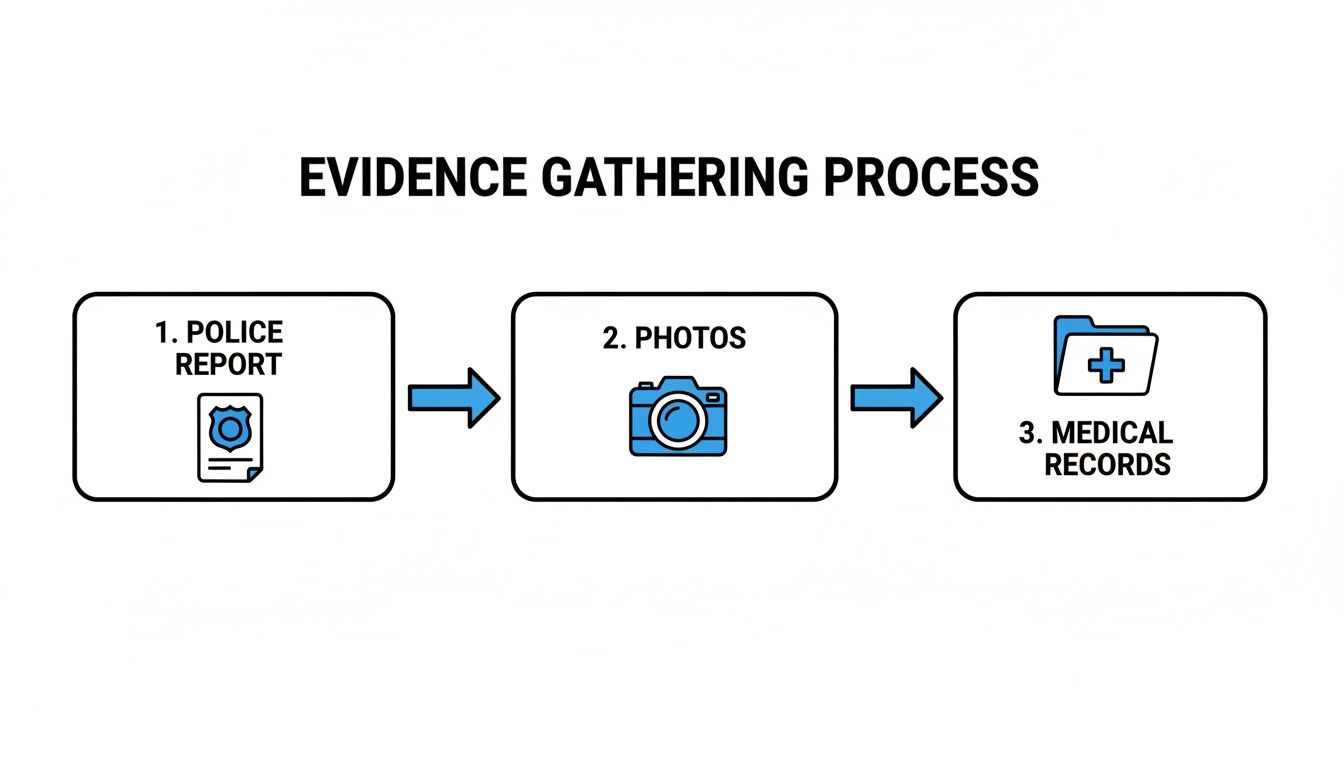

Assembling Your Primary Evidence File

The first layer of evidence establishes the undisputed facts of the case. These are the objective, third-party documents that set the scene long before you get into the personal impact of the injury.

You'll want to gather these official records right away:

- Police or Incident Reports: This is almost always the first thing an adjuster looks at. It provides a neutral account of what happened, often noting who was at fault, if any tickets were issued, and the officer's initial observations.

- Witness Statements: A statement from an independent third party is gold. When someone with nothing to gain confirms your side of the story, it becomes incredibly difficult for the insurer to argue liability.

- Photos and Videos: Nothing tells a story like visual proof. Pictures of the crash scene, property damage, and your visible injuries—ideally taken right after the incident—can be far more powerful than words. Time-stamped photos are even better.

Documenting the Medical Journey

Your medical records are the heart of your damages claim. They need to be complete and chronological, drawing a clear, unbroken line from the incident to every single doctor's visit, prescription, and procedure that followed.

Adjusters are trained to hunt for gaps in treatment or pre-existing conditions they can use to lowball your offer. Don't give them the chance. A complete medical file isn't just the final bills; it's every piece of paper generated during your recovery. For a more dynamic approach to reviewing and extracting information from legal documents and evidence, exploring interactive document analysis tools can significantly enhance your workflow.

Your goal is to present a medical timeline so clear and well-documented that the adjuster can easily follow the path from the incident to the diagnosis, the treatment, and the final prognosis without any unanswered questions.

Getting all this paperwork in order is no small task. To make sure nothing gets missed, check out our guide on how to organize medical records for a proven, step-by-step process.

Your file should include:

- Physician's notes and detailed reports

- All imaging results (X-rays, MRIs, CT scans)

- Hospital admission and discharge papers

- Records of every prescription filled

- Itemized billing statements from all providers

- Physical therapy logs and progress notes

Proving Financial and Non-Economic Losses

Your damages go beyond medical bills. The demand letter has to account for every dollar you've lost, and lost income is often a huge part of that. You can't just throw out a number; you have to prove it.

Start by gathering your pay stubs from the months before the incident to establish a clear earnings history. Then, ask your employer for a formal letter on company letterhead confirming your job title, pay rate, and the exact dates you missed work because of your injuries. This official verification is critical.

Finally, you have to address the non-economic damages, like pain and suffering. While these are harder to put a number on, they are a real and significant part of your claim. A personal journal is one of the best tools here. Document your daily pain levels, your emotional struggles, and all the ways the injury has affected your life—from missing a child's soccer game to being unable to sleep through the night. This journal transforms your suffering from an abstract concept into a powerful, personal story.

Laying Out Your Demand for Maximum Impact

A powerful demand letter is more than just a list of facts—it's a structured, persuasive argument. From years of experience, I can tell you that insurance adjusters see thousands of claims. They can spot a professionally drafted letter a mile away, and they give it the respect it deserves. A logical, clean format guides them through your argument, making it clear, compelling, and hard to push back on.

Think of each section as a building block. Get the structure right, and you're signaling that you're serious, organized, and ready to fight for your claim's value. A sloppy, disorganized letter, on the other hand, just invites a lowball offer from the start.

The Opening: Get Straight to the Point

Your introduction needs to be direct and professional. This isn't the place for a dramatic narrative; it's about establishing the essential facts immediately. The adjuster needs to know who you are, who their insured is, and what claim you're writing about.

Make sure this section clearly states:

- Your Information: Your full name and contact details.

- The At-Fault Party: The full name of their insured.

- Claim Information: The insurance claim number and the date of the incident.

This no-nonsense opening gives the adjuster everything they need to pull the file and get oriented. It sets a professional, business-like tone right out of the gate.

The Narrative: Proving How They Were at Fault

Now it's time to tell the story of what happened. The goal here is to present a detailed, fact-based account that leaves no question as to why their insured is liable. This is critical: leave emotion out of it. Stick to a chronological, objective description of the events.

Explain exactly what happened, where it took place, and how the other party’s negligence was the direct cause. For example, instead of saying, "the other driver was reckless," be specific: "Your insured failed to stop at the marked stop sign at the intersection of Main Street and Oak Avenue, striking my vehicle on the passenger side." That kind of detail is what builds an irrefutable case for liability.

To back up your narrative, you need solid evidence. The basics are always the same.

A strong liability argument is always built on a foundation of official reports, visual proof, and comprehensive medical records.

The Consequences: Detailing Your Injuries and Treatment

Once you've established how the incident happened, you need to show the adjuster what it did to you. This section is a complete summary of your medical journey, connecting their insured’s negligence directly to your physical harm.

Start from the beginning—the emergency room visit, the urgent care diagnosis—and create a clear timeline of your treatment. You'll want to list every medical provider you saw, from specialists and surgeons to physical therapists and chiropractors. Summarize the diagnoses, the procedures you underwent, and any medications you were prescribed, all in a logical order.

Expert Tip: Don't just list your injuries. Describe what they meant for your life. A "fractured tibia" isn't just a medical term. It meant you were non-weight-bearing for eight weeks, unable to work, drive, or even take care of your family. This context is what makes the damage real for the adjuster.

The Bottom Line: Presenting Your Damages

This is where you translate your pain, suffering, and financial losses into a specific dollar amount. The best way to do this is to break it down into two clear categories so that every single loss is accounted for and justified.

- Special Damages (Economic Losses): These are the hard numbers—your quantifiable, out-of-pocket expenses. Create an itemized list with exact dollar amounts for every medical bill, prescription receipt, lost wage statement, and property damage estimate.

- General Damages (Non-Economic Losses): This is where you make the case for compensation for your pain, suffering, emotional distress, and the loss of enjoyment of your life. While this figure is more subjective, it must be firmly grounded in the severity of your injuries and the profound impact the incident had on your day-to-day existence.

Getting this section right is absolutely crucial. This is where the real negotiation happens. Remember, with only one in twenty personal injury cases actually going to trial, your demand letter is your primary and most powerful tool for resolving your claim.

To see exactly how these sections fit together in a real-world document, take a look at our complete personal injury demand letter template. A well-built structure is your single best asset for securing a fair settlement without ever having to step inside a courtroom.

Calculating a Fair and Justifiable Settlement Demand

This is where the rubber meets the road. You have to translate the pain, financial stress, and disruption to your life into a concrete, defensible number. A well-calculated settlement figure isn't just pulled from thin air; it’s a logical sum built from every single loss you've suffered, both on paper and in your personal life.

Your demand has to be fair to you but also justifiable to an insurance adjuster who sees these all day. The personal injury law market in the U.S. is a massive industry, valued at over $50 billion and projected to hit $61.3 billion in 2024. For the 39.5 million Americans who need medical care for injuries each year, a thoughtfully prepared demand letter is what separates a real recovery from a quick, lowball offer.

Itemizing Your Economic Damages

First things first, you need to tally up every out-of-pocket financial loss. These are called economic damages (or "specials" in legal-speak), and they form the undisputed financial foundation of your entire claim. Precision is everything here, because every dollar should be backed up by a receipt, a bill, or a pay stub.

Make sure your checklist for economic damages includes:

- All Medical Expenses: This is everything from the ambulance ride and ER visit to surgeries, hospital stays, prescriptions, and physical therapy. Don't leave anything out.

- Future Medical Costs: If your doctor has confirmed you’ll need ongoing care—like another surgery down the road or long-term pain management—those projected costs need to be in your calculation.

- Lost Wages and Income: Document every dollar you lost from being unable to work. A precise work hours calculator can be a huge help in nailing down this figure accurately.

- Loss of Earning Capacity: This is a big one. If your injuries mean you can't return to your old job or work at the same level, you can claim the difference in what you would have earned in the future.

- Out-of-Pocket Expenses: Think about the little things that add up, like gas for trips to the doctor, installing a wheelchair ramp at home, or hiring someone to mow the lawn because you can't.

Adding all these up gives you a hard number for your economic losses. This total becomes the baseline for everything that follows.

Valuing Your Non-Economic Damages

Now we get to the tricky part: putting a value on your non-economic damages, often called "general damages." This is where you account for the human cost of the injury—the things that don't have a price tag but are just as real.

Key Takeaway: Non-economic damages are compensation for the intangible suffering caused by the incident. This includes your physical pain, emotional distress, anxiety, loss of enjoyment of life, and the general hassle and inconvenience that’s been forced on you.

Insurance adjusters often use a "multiplier method" to put a number on this suffering. They take your total economic damages and multiply that figure by a number, usually somewhere between 1.5 and 5.

What multiplier they use depends on a few key factors:

- The severity of your injuries and whether they're permanent.

- The level of pain you've had to endure.

- How long and difficult your recovery has been (or will be).

- The overall impact the injury has had on your daily life.

A minor soft-tissue injury with a quick, full recovery might only get a 1.5x multiplier. On the other hand, a catastrophic injury that causes a permanent disability and chronic pain could easily justify a multiplier of 5x or even higher. It’s a nuanced part of the process, which is why we've put together a full guide on how to calculate pain and suffering damages.

Arriving at Your Final Demand Figure

To get your final number, you simply add your total economic damages to your calculated non-economic damages.

Total Economic Damages + Total Non-Economic Damages = Final Settlement Demand

It’s standard practice to make your initial demand higher than the amount you’d actually be willing to accept. This is crucial because it leaves room for negotiation—and you can bet the insurance company will counter with a lower offer. A common strategy is to demand a figure that’s about 75% to 100% higher than what you believe is a truly fair settlement amount.

When you present a number that’s grounded in meticulously documented financial losses and a logical justification for your suffering, you make your demand very difficult for an adjuster to just dismiss. You aren't just asking for money; you're presenting a data-backed case for exactly what you are owed.

Navigating Negotiations and Avoiding Common Pitfalls

Sending your demand letter is the opening salvo in the settlement chess match. It's a critical move, but it's far from the last one. What comes next requires patience, a firm grasp of the insurance adjuster's playbook, and a good dose of strategy. Preparing for this phase is every bit as important as crafting the letter itself.

Once you’ve sent your demand, the ball is in their court. But don't sit by the phone waiting for it to ring. You should realistically expect a reply within 30 to 60 days. This gives the adjuster enough time to review everything you sent, run their own initial investigation, and decide on their first move.

Decoding the Adjuster's Response

When that response finally lands in your inbox or mailbox, it will almost certainly be one of three things. Knowing which one you’re looking at is the first step in plotting your counter-move.

- A Reasonable Counter-Offer: This is the ideal scenario. It shows the insurer is taking your claim seriously and is actually willing to negotiate in good faith.

- A Lowball Offer: By far, this is the most common response. It's a classic tactic to see if you’re desperate or inexperienced enough to accept a fraction of what your claim is really worth. Don't fall for it.

- An Outright Denial: Sometimes, the insurer will just reject the claim entirely. They'll typically argue about who was at fault or claim your injuries aren't as bad as you say. It’s an aggressive posture designed to make you back down.

No matter what they send back, the game plan is the same: stay calm and professional. Flying off the handle or getting aggressive only plays into their hands and weakens your negotiating position.

Strategies for a Successful Negotiation

The back-and-forth negotiation is where the rubber meets the road. Go into it without a solid plan, and you're almost guaranteed to leave money on the table.

Before you even think about picking up the phone, you absolutely must know your walk-away number. This is your rock-bottom, absolute minimum settlement figure. Keep this number to yourself, and make sure it’s based on a realistic calculation of your damages, not just what you hope to get.

When you receive a counter-offer, don't just say "no." Put together a thoughtful, evidence-based reply that systematically dismantles their arguments. If they dispute a medical bill, be ready to explain precisely why that treatment was necessary. If they downplay your pain and suffering, point them back to specific entries in your journal or the prognosis from your doctor.

Expert Tip: Never, ever accept the first offer. It's practically guaranteed to be a lowball figure meant to anchor the negotiation in a range that benefits the insurance company. Politely decline it and follow up with a written counter-demand that methodically explains why your valuation is the correct one.

Critical Pitfalls to Sidestep

The negotiation process is a minefield of potential mistakes that can seriously torpedo your claim. Knowing what these common traps are is your best defense.

The single biggest error people make is undervaluing their own case. This happens when you get tunnel vision on current medical bills and lost wages, completely forgetting about future medical needs, permanent impairments, or the true cost of your pain and suffering. Settling too quickly can leave you paying for long-term care out of your own pocket years down the road.

Watch out for these other common blunders that can sink your settlement:

- Giving a Recorded Statement: Adjusters are trained to ask tricky, leading questions to get you to accidentally admit partial fault or minimize your injuries. Just politely decline and state that all communication should be in writing.

- Exaggerating Your Claim: Nothing will kill your credibility faster than stretching the truth or inflating your damages. Stick to the hard evidence and let the facts speak for themselves.

- Showing Impatience: Insurance companies love to drag things out. They hope you'll get so frustrated that you’ll take a low offer just to be done with the whole ordeal. Patience is one of your most powerful weapons.

In the end, a successful negotiation comes down to solid preparation and unwavering professionalism. Know your numbers, anticipate the adjuster's moves, and be ready to defend the value of your claim with confidence and proof.

Answering Your Top Questions About Demand Letters

Crafting a demand letter can feel like navigating a minefield. It’s a critical step, and naturally, a lot of questions come up along the way. Getting clear on these points from the start can make a world of difference in your confidence and, more importantly, the final outcome of your claim.

Let’s tackle some of the most common questions I hear from people putting together their first demand letter.

Can I Write a Personal Injury Demand Letter Myself?

Technically, yes. For a minor fender-bender where the other driver was clearly at fault and your injuries were simple (think a few chiropractor visits), you can certainly write your own personal injury demand letter. Many people handle these smaller claims on their own and reach a fair settlement.

But—and this is a big but—you're taking on a real risk. If your case involves serious injuries, questions about who was at fault, or the possibility of needing future medical care, you should strongly consider talking to a lawyer. An experienced attorney knows how to put a dollar value on things like pain and suffering, they’ve seen all the insurance company’s tricks, and they can often negotiate a settlement that’s multiples higher than what you could get on your own.

What's the Single Biggest Mistake to Avoid?

Without a doubt, the most costly error is sending your demand letter too soon. You must wait until you've reached what doctors call Maximum Medical Improvement (MMI). This is the official point where your condition has stabilized and your doctor can give a clear picture of what your long-term prognosis and future medical needs look like.

A premature demand is a trap. Once you accept a settlement, the case is closed forever. If you settle before knowing the full extent of your injuries, you give up all rights to claim money for future medical bills—even if they’re directly from the accident. You could be left paying for surgeries or long-term therapy out of pocket.

How Long Should I Wait for the Insurance Company to Respond?

After you send the letter, you have to play the waiting game. There’s no law that says an adjuster has to respond by a certain date, but a reasonable window to expect an answer is anywhere from 30 to 60 days. This gives them time to review your medical records, check the facts, and get the authority to make an offer.

If you hit the 60-day mark with radio silence, it’s time to pick up the phone. A polite but firm follow-up call is perfectly acceptable. Sometimes, a long delay is just the adjuster being overworked. Other times, it's a tactic to see if you'll get desperate and take a low offer. If they continue to drag their feet, it might be a signal that you need to get more aggressive.

Should I Actually Name a Price?

Yes, you absolutely should include a specific dollar amount. Your demand figure is the anchor for the entire negotiation. If you leave it open-ended, you’re inviting the adjuster to throw out a ridiculously low number, which immediately puts you on the defensive.

When you calculate your demand, aim high, but not absurdly so. A smart strategy is to ask for 75% to 100% more than the rock-bottom amount you’d be willing to accept. This shows the insurance company you’re serious about your claim while leaving plenty of room to negotiate down to a number that you’re still happy with. It's all part of the process.

Pulling together all the facts for a demand letter is a ton of work, especially when you’re sorting through piles of medical records. Ares is designed to do that heavy lifting for you. It automatically finds the key medical details, dates, and treatments, then uses them to generate a solid first draft and a clear narrative of your case. This lets you build a stronger argument and get to a fair settlement faster. See how it works at https://areslegal.ai.