A Guide to Personal Injury Demand Letter Templates

In the world of personal injury claims, your demand letter isn't just another piece of paperwork. It's the single most powerful tool you have for securing a fair settlement before ever seeing the inside of a courtroom. This letter is your opening argument, laying out the unassailable facts, proving liability, and making a rock-solid case for the compensation you're demanding.

Think of it as the strategic blueprint for your entire claim.

Why Your Demand Letter Is Your Most Critical Tool

Before you even think about finding a template, you need to grasp the strategic weight of this document. A demand letter is far more than a simple request for money; it's your chance to seize control of the narrative and frame the entire case on your terms.

When an insurance adjuster receives a well-crafted, meticulously detailed demand letter, it sends a clear signal: they're dealing with someone who is serious, organized, and ready to fight for their claim's full value. This one document can fundamentally shift the entire dynamic of the negotiation in your favor.

It's your opportunity to present such a clear, logical, and evidence-backed argument that settling becomes the only sensible option for the insurance company. If you'd like to dig deeper into the basics, you can learn more about what is a demand letter and its role across different legal claims.

Setting the Tone for Negotiation

First impressions are everything. Your demand letter is your chance to show the adjuster they're dealing with a credible and knowledgeable claimant. A professional, persuasive, and thorough letter builds immediate respect.

On the flip side, a sloppy, incomplete, or poorly-argued letter is an open invitation for a lowball offer or an outright denial. It signals weakness and inexperience.

Your mission is to make the adjuster's job easy—but on your terms. You're giving them all the ammunition they need to go to their supervisor and justify the settlement figure you’re asking for. For a great hands-on example, this guide provides A Winning Personal Injury Demand Letter Template that’s worth reviewing.

The Core of Your Pre-Litigation Strategy

The personal injury legal market is massive, valued at over $53 billion, and efficiency is the name of the game. With nearly 40 million Americans seeking medical attention for injuries each year from things like car accidents and slip-and-falls, your demand letter is what cuts through the noise.

A powerful demand letter does more than state facts—it tells a compelling story. It connects the other party's negligence directly to your injuries, your medical treatments, your financial losses, and your personal suffering, creating an undeniable basis for your settlement figure.

This document accomplishes several crucial goals for your claim:

- Establishes a Factual Record: It formally puts your side of the story, your injuries, and your total damages on the record.

- Demonstrates Liability: It lays out a clear, logical argument for why the other party is at fault.

- Initiates Formal Negotiations: It officially kicks off settlement talks and anchors the discussion around your compensation figure.

- Preserves Your Legal Rights: In many jurisdictions, sending a formal demand letter is a necessary step you must take before you're even allowed to file a lawsuit.

Ultimately, a masterfully written demand letter is your opening gambit in a high-stakes negotiation, designed to get you the compensation you deserve without the time and expense of a trial.

Anatomy of a Powerful Demand Letter Template

Let's move from theory to action. A strong personal injury demand letter isn't just a form you fill out; it's a carefully constructed narrative meant to persuade an insurance adjuster. Think of each section as a building block in your argument, each with a specific job to do in proving why your client’s settlement figure is the right one.

Forget about generic templates. The real power comes from breaking the letter down into its essential parts and then loading each one with specific, verifiable facts from your case. This is how you transform a simple letter into a compelling legal argument they can't ignore.

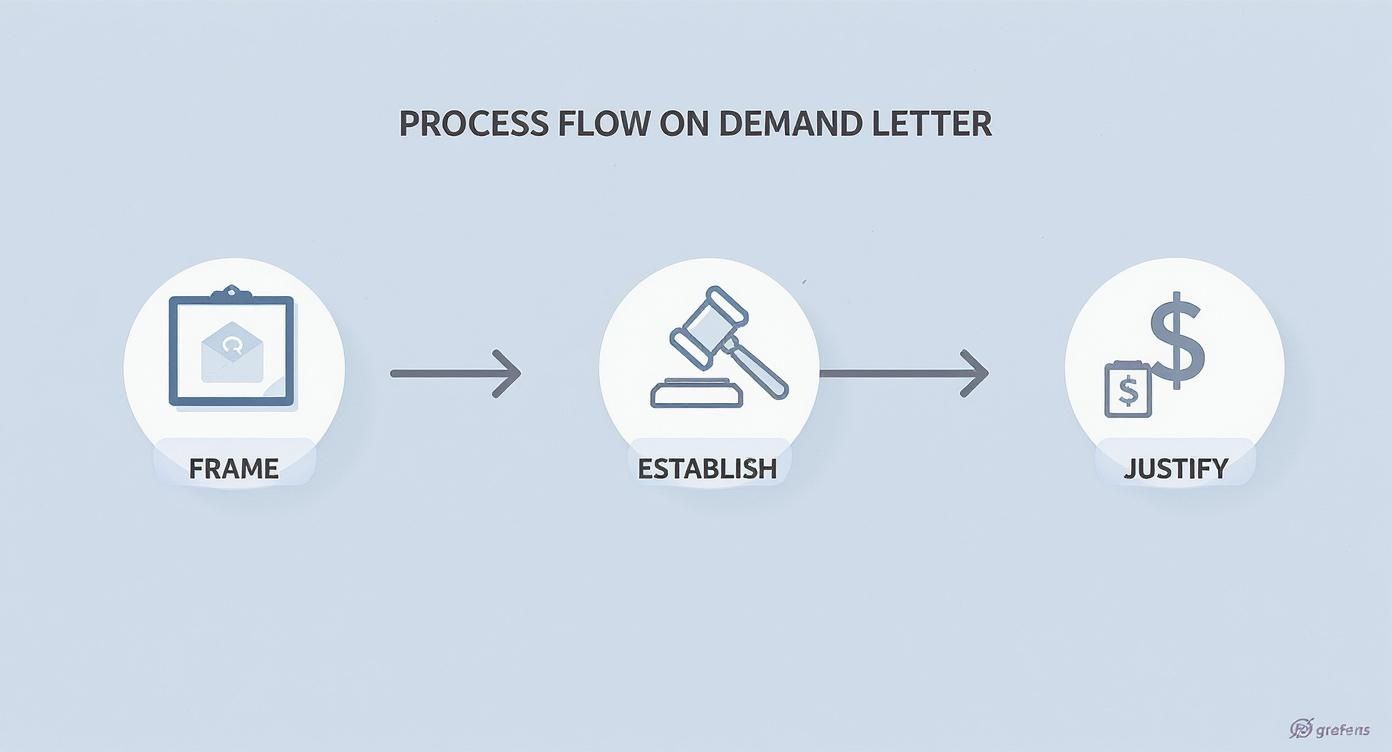

This simple workflow breaks down the entire process into three core stages.

As you can see, the strategy is straightforward. First, you Frame the incident to control the narrative. Then, you Establish undeniable liability. Finally, you Justify your monetary demand with cold, hard evidence. Each piece logically follows the last, creating a powerful and cohesive case.

To give you a clearer picture, here’s a breakdown of the essential components and the strategic purpose behind each one.

Key Sections of a Personal Injury Demand Letter

| Section Heading | Purpose | Key Information to Include |

|---|---|---|

| Introduction | Administrative setup. Gets the letter to the right person and file. | Your contact info, client name, insured's name, date of incident, and claim number. |

| Factual Background | Control the narrative by presenting a clear, client-favorable version of events. | A chronological, fact-based account of the incident. Focus on the insured's actions. |

| Liability Analysis | Connect the insured's actions to legal responsibility. Show why they are at fault. | Cite specific traffic laws or statutes the insured violated (e.g., speeding, illegal turn). |

| Injuries & Medical Treatment | Detail the full scope of physical harm and the subsequent medical journey. | Specific diagnoses, a timeline of all medical care, and any prognosis for future treatment. |

| Economic Damages | Present a clear, documented accounting of all financial losses. | A line-item list of medical bills, lost wages, and other out-of-pocket costs with totals. |

| Non-Economic Damages | Argue for compensation for pain, suffering, and diminished quality of life. | Describe the real-world impact on your client's daily life, hobbies, and emotional state. |

| Settlement Demand | State the total monetary amount you are demanding to settle the claim. | The final number, often presented as a lump sum without a detailed breakdown. |

| Conclusion & Deadline | Create urgency and outline the next steps if the demand is not met. | A professional closing and a firm deadline (e.g., 30 days) for the adjuster to respond. |

Each of these sections plays a critical role in building a persuasive argument that can lead to a successful pre-litigation settlement.

The Introduction and Factual Background

Your opening paragraph needs to be direct and professional. It’s purely administrative but absolutely critical. You’ll identify your client, the insured (the at-fault party), the date of the incident, and the claim number. Get this basic information on the table so the adjuster can immediately pull the correct file.

Right after that, you dive into the facts. Your goal is to paint a clear, chronological picture of what happened, leaving no room for misinterpretation. You need to describe the date, time, and location with precision. Detail the events leading up to the injury, but do it from your client's perspective and without admitting a shred of fault.

For example, a client might say, "I didn't see the other car until it was too late." That’s a disaster in a demand letter. Instead, you frame it factually: "Mr. Smith was proceeding lawfully through the intersection on a green light when the insured failed to stop for their red light, striking Mr. Smith's vehicle on the driver's side." The first version suggests inattention; the second establishes clear negligence.

Pro Tip: Your factual background is the first—and best—opportunity to control the story. Present the events from a position of strength, focusing exclusively on what the other party did wrong. Stick to objective facts you can prove.

Proving Liability and Citing Statutes

This is where you connect the dots for the adjuster. It’s not enough to just say what happened; you have to explain why their insured is legally on the hook for your client’s injuries. This section is where your legal argument truly takes shape.

One of the most effective tactics here is to cite the specific state vehicle codes or local ordinances the other party broke. For instance, if the accident was caused by a distracted driver, you’d want to include language like this:

- "The insured's conduct was in direct violation of [State Vehicle Code § XYZ], which prohibits the use of a handheld electronic device while operating a motor vehicle."

- "This statutory violation establishes negligence per se, which means their actions are presumed to be negligent as a matter of law."

Using this kind of precise legal terminology sends a clear signal. It tells the adjuster you're not just hoping for a settlement—you understand the legal framework of the claim and are fully prepared to argue it.

Detailing Injuries and Medical Treatment

Here, you need to provide an exhaustive account of every single injury, from the most severe fractures down to the "minor" soft tissue damage that causes chronic pain. Be incredibly specific. "Hurt my back" is weak. "A herniated disc at the L4-L5 level, confirmed by MRI, causing radiating sciatic pain down the left leg" is compelling.

Next, you'll walk the adjuster through the client's medical journey chronologically:

- Immediate Care: Start with the ambulance ride and the emergency room visit.

- Hospitalizations & Surgeries: List admission dates, the names of procedures performed, and the treating surgeons.

- Follow-Up Care: Document every appointment with specialists, physical therapists, and chiropractors.

- Future Treatment: This is crucial. If doctors anticipate future surgeries, ongoing pain management, or long-term therapy, you must include that prognosis along with an estimated cost.

This detailed narrative accomplishes two things at once: it justifies every dollar of your medical bills and paints a vivid picture of the human cost of the injury, which is the foundation of your pain and suffering claim.

Itemizing Economic Damages

Now we get to the math. This section must be a clear, organized ledger of every single financial loss your client has suffered. These are your economic damages (sometimes called special damages), and there’s no room for ambiguity. Every dollar you claim must be backed up with a piece of paper.

Make your itemization clean and easy to follow. An adjuster shouldn't have to hunt for the numbers.

- Medical Expenses: $45,750 (ER visit, surgery, physical therapy, prescriptions)

- Lost Wages: $9,600 (8 weeks of missed work at $1,200/week)

- Property Damage: $1,000 (Vehicle repair deductible)

- Out-of-Pocket Costs: $450 (Transportation, medical devices, etc.)

- Total Economic Damages: $56,800

Attaching every corresponding bill, receipt, and a letter from the employer verifying the lost income is non-negotiable. This level of meticulous documentation makes it extremely difficult for an adjuster to argue with your hard costs and provides the concrete financial base for your total demand.

Calculating Your Damages Beyond Just Medical Bills

Figuring out the final number for your settlement demand is both an art and a science. It’s a common mistake to think it’s just about adding up your medical bills. In reality, the true value of a personal injury claim comes from quantifying every single loss you've suffered—financial, physical, and emotional.

A demand letter that only lists medical receipts is weak and basically invites a lowball offer. To build a truly compelling case, you need to present a detailed account of two key types of damages: economic (also called "special") damages and non-economic (or "general") damages.

Economic damages are the tangible, provable financial hits you’ve taken. Non-economic damages are more subjective, but they're just as real—they compensate for the human cost of what you’ve been through.

Tallying Your Economic Damages

This is the most straightforward part of the calculation because it's based on hard numbers. Your job here is to create an exhaustive, itemized list of every penny you lost or had to spend because of the injury. Be meticulous; accuracy and documentation are everything.

Your economic damages list should include:

- All Medical Expenses: This is everything from the ambulance ride and ER visit to surgeries, specialist appointments, prescriptions, and physical therapy. Don't leave anything out.

- Future Medical Costs: Is your doctor recommending another surgery or long-term pain management? Get a professional estimate for these future costs. This is a critical component that many people miss.

- Lost Wages and Income: Calculate every dollar you lost from being out of work. You’ll need a letter from your employer confirming your pay rate and the exact time you missed.

- Loss of Future Earning Capacity: If your injuries are permanent and you can no longer do your old job or earn what you used to, you can claim damages for that loss. This often requires an expert vocational or economic report to calculate properly.

- Out-of-Pocket Expenses: This bucket includes things like crutches, a brace, transportation costs to and from doctor’s appointments, and other direct expenses.

Think of this as building the concrete foundation of your claim. Every number must be backed by a receipt, an invoice, or an official statement. This level of detail makes it very difficult for an insurance adjuster to argue with your hard costs.

Valuing Your Pain and Suffering

This is where the "art" comes in, and it's where many people get stuck. How do you put a dollar figure on chronic pain, anxiety, or not being able to play with your kids? This is the heart of your non-economic damages.

While it's subjective, there are established methods for arriving at a reasonable number. The most common approach, especially in a personal injury demand letter template, is the multiplier method.

It works like this: you take your total economic damages—the hard numbers from above—and multiply them by a number, usually between 1.5 and 5. The multiplier you choose hinges entirely on the severity of your injuries and how profoundly they've impacted your life.

A minor injury with a quick, full recovery might only justify a 1.5x or 2x multiplier. But a severe, life-altering injury that leaves you with a permanent disability, disfigurement, or chronic pain could easily warrant a multiplier of 4x or 5x.

Crucial Insight: The multiplier isn't just a number you pull out of thin air. You have to justify it by painting a vivid, human picture of your suffering. Describe how the injury has disrupted your daily life, strained your relationships, affected your mental health, and stolen the joy from activities you once loved.

For example, a broken leg that heals perfectly in eight weeks is worlds apart from one that results in a permanent limp and chronic arthritis. The second scenario commands a much higher multiplier because the long-term human cost is so much greater. For a deeper dive, check out our guide on https://areslegal.ai/blog/how-to-calculate-emotional-distress-damages.

Justifying Your Final Demand Number

Once you’ve calculated your total economic damages and applied a justifiable multiplier to figure out your non-economic damages, you add them together. This final sum is the anchor for your entire settlement negotiation.

It’s critical to remember that this initial demand is a starting point. And it's a powerful one. Over 95% of personal injury cases in the U.S. are resolved through negotiated settlements that kick off with a demand letter. With the average bodily injury payout in 2022 hovering around $26,501 and many settlements climbing much higher, a well-supported demand is your best tool for getting a fair outcome.

Your demand letter must walk the adjuster through your math. Present the itemized economic damages first to establish a solid, fact-based floor. Then, use the narrative of your pain and suffering to justify the multiplier you chose, making the case for your non-economic damages. This data-backed storytelling transforms your demand from a hopeful ask into a logical, defensible calculation that the insurance company has to take seriously.

Gathering Evidence to Strengthen Your Claim

A demand letter without proof is just a story. The real leverage comes from the organized, compelling evidence you attach to it. This collection of documents is what turns your narrative into a set of hard facts that an insurance adjuster can't ignore. Your mission is to build a claim so well-supported that a fair settlement is their only logical option.

Think of it this way: your letter tells them what you're demanding, but your evidence shows them why they should pay it. Each document is a building block for your case. Without a solid foundation of proof, your demand will crumble under scrutiny.

Building Your Evidence Checklist

Before you even think about drafting the letter, your first job is to collect every single piece of paper related to the incident and your recovery. You can't be haphazard about this; you need a methodical approach so nothing slips through the cracks. The adjuster on the other side is expecting a complete, professional file.

Here's a breakdown of the essential documents you’ll need to track down:

- Official Police or Incident Report: This is your foundational document. It’s an objective, third-party account that establishes the basic facts: date, time, location, and who was involved. It often includes an initial assessment of fault, which is incredibly valuable.

- Witness Information and Statements: Get the names and contact details for anyone who saw what happened. If you can get them to sign a written statement summarizing their account, its value skyrockets.

- Photographs and Videos: Nothing tells a story like visual evidence. You need pictures of the accident scene, damage to the vehicles or property, and—this is crucial—photos of your injuries taken over time to show the healing process.

- Complete Medical Records and Bills: This is the heart of your damages claim. Gather everything: ambulance reports, ER records, doctor's notes, specialist consults, physical therapy logs, and every prescription receipt. For a case with extensive treatment, knowing how to organize medical records properly can make a huge difference.

- Proof of Lost Income: You'll need an official letter from your employer, printed on company letterhead. It must specify your job title, your rate of pay, and the exact dates you missed work because of your injuries.

The Power of Professional Documentation

How you organize this evidence is just as important as what you gather. When you cite these documents in the demand letter, treat them like formal exhibits, referencing them with clarity and precision. It sends a powerful message that you are organized, serious, and prepared to take the next step if they don't cooperate.

Key Takeaway: Your evidence package should be so thorough that it anticipates and answers the adjuster's questions before they're even asked. A well-organized file builds your credibility and shows that your settlement figure is based on cold, hard facts.

For any recorded statements or depositions, using professional legal transcription services to create a clean, accurate transcript can be a game-changer. An official transcript of a key witness's account adds a layer of undeniable proof to your file. This level of detail demonstrates to the insurer that you're building a case ready for litigation, dramatically strengthening your negotiating position from the start.

Common Mistakes and Smart Negotiation Tactics

https://www.youtube.com/embed/3j05KGmIIYA

Drafting a solid demand letter is a huge accomplishment, but it’s really just the opening move. Once you hit send, you’re officially at the negotiating table, and this is where many otherwise strong claims start to fall apart. You need to sidestep common pitfalls and understand the psychology of the process to get what you deserve.

Let’s be clear: an insurance adjuster’s job is to close your file for the lowest amount possible. They are seasoned negotiators who see hundreds of claims a year and are trained to spot tactical mistakes and emotional triggers they can use against you. Your job is to stay professional, be patient, and let your well-prepared demand letter do the heavy lifting.

The whole claims process can feel overwhelming, and frankly, that's by design. It’s a major reason why so many people walk away. In 2023, 62 million Americans needed medical care for preventable injuries, but only a tiny fraction ever filed a claim. While personal injury filings did jump by 78% in the year ending March 2024, countless others are still leaving money on the table. You can find more personal injury claim statistics on Clio.com that highlight this trend.

Critical Errors That Can Weaken Your Position

The mistakes made after you send the letter are often far more damaging than any small error in the document itself. Knowing what these traps look like is the best way to avoid them.

Here are the most common—and costly—blunders I see people make:

- Admitting Any Fault: Never, ever use language that hints you were even 1% responsible. Seemingly innocent phrases like, "I probably should have been more careful," or "I didn't see the other car at first" will be twisted to argue comparative negligence, which can slash your settlement amount.

- Downplaying Your Injuries: Trying to be tough or agreeable can backfire spectacularly. If you tell an adjuster, "I'm feeling a lot better," or "It's not so bad anymore," you can bet it's going into their notes. They will use that statement later to argue your pain and suffering claim is overblown.

- Giving a Recorded Statement Without a Lawyer: When an adjuster asks for a recorded statement, it's not to help you. It's a fishing expedition designed to get you on record saying something—anything—that undermines your case. Politely refuse and insist that all communication be handled in writing.

Expert Insight: Never, ever accept the first offer. It is almost always a lowball figure designed to test your resolve. They want to see if you’ll take a quick, cheap payout and go away. Treat it as nothing more than the opening bid in a negotiation.

Smart Tactics for Negotiating a Better Settlement

Successful negotiation isn't about being loud or aggressive; it's about being strategic. Your power comes from the meticulous evidence you’ve already provided and a calm, professional demeanor.

When that predictably low first offer lands in your inbox, it's time to shift gears from presenting facts to strategic bargaining.

How to Formulate a Strong Counter-Offer

Don't just reject their offer with a "no." Your counter-offer needs to be a reasoned, confident response. Briefly reiterate the strongest parts of your case—the other party’s clear fault, the severity of your medical diagnosis, or your doctor's long-term prognosis.

Your counter should come down slightly from your initial demand, but it should still be significantly higher than their offer. This signals you’re willing to negotiate in good faith but that you aren't going to budge on the core value of your claim.

Set Clear Deadlines and Keep Control

Every piece of communication you send should include a firm deadline for a response, usually 14 to 30 days. This creates a sense of urgency and prevents the adjuster from using a common delay tactic: dragging out the process to wear you down.

A simple, professional sentence is all you need: "Please provide your written response to this counter-offer by [Date]." This structured approach keeps the momentum on your side and shows you’re serious about resolving the claim, one way or another.

Common Questions About Demand Letters

When you're putting together a demand letter, a lot of questions pop up. It's a critical moment in your claim, and getting it right matters. Let's walk through some of the most common sticking points I see people run into.

How Long Should I Wait to Send My Demand Letter?

This is all about timing, and it’s a big one. You should only send your demand letter after you’ve finished all your medical treatment or hit what’s known as maximum medical improvement (MMI). MMI is the point where your doctors agree your condition is stable and they have a clear picture of any future care you might need.

Sending it too soon is one of the worst mistakes you can make. If you haven't finished treatment, you can't possibly know your final medical bills or if you'll need surgery down the road. You'll be guessing at your total damages, and I can almost guarantee you'll end up undervaluing your claim. Don't rush it.

What If I Make a Mistake in the Letter?

It happens. If you spot a minor typo or a small factual error after you've sent it, you can usually fix it by sending a revised letter. Just be sure to label it clearly as an "Amended Demand Letter" and include a brief note explaining the change. Being upfront is always the best policy.

But if the mistake is a big one—like getting the facts of the accident wrong or completely botching your damage calculations—that's a much bigger problem. A major error can destroy your credibility with the adjuster. If you find yourself in this situation, it’s a clear sign you need to stop and consult with a personal injury lawyer immediately before you do any more harm to your case.

What Happens If the Insurance Company Ignores My Letter?

First, understand that an insurance company has a legal duty to respond to your claim. If the deadline you provided comes and goes without a peep, your next move is a follow-up. A polite but firm email or letter, reminding them of the original demand and its deadline, is the right first step. Give them a new, shorter deadline to respond.

If they still give you the silent treatment, you're likely dealing with delay tactics, which can be a form of bad faith. This is where you really need to consider getting professional help. The threat of a lawsuit from an attorney often lights a fire under an adjuster in a way a claimant simply can't.

A Pro Tip: Silence is a strategy. Adjusters know that ignoring you can make you frustrated, anxious, and more likely to give up or accept a ridiculously low offer when they finally decide to make one. Don't fall for it. Persistence is key.

When Is It Time to Hire an Attorney?

A well-crafted demand letter can be effective for straightforward, minor injury claims. But certain situations are just too complex to handle on your own. You absolutely need an attorney on your side if:

- Your injuries are severe or permanent. Think long-term care, disability, or anything that impacts your ability to earn a living.

- The insurance company denies liability and tries to pin the blame on you.

- You receive a lowball settlement offer that doesn't even cover your medical bills and lost wages.

- The case is complicated. Accidents involving multiple parties, commercial trucks, or tricky legal questions are not DIY projects.

Trying to navigate these waters alone could easily cost you tens of thousands of dollars, if not more. A seasoned lawyer knows the adjuster’s playbook and has the experience to build a case that maximizes your compensation.

Drafting a powerful demand letter takes a huge amount of time and attention to detail—time that you should be using to focus on your recovery. Ares was built for personal injury law firms to slash the hours spent digging through medical records and writing these documents. Our platform uses AI to transform disorganized case files into persuasive, well-supported demand packages. See how we help build stronger cases in a fraction of the time at https://areslegal.ai.