Personal Injury Settlement Timeline Guide to personal injury settlement timeline

The honest, but often frustrating, answer is that a personal injury settlement can take anywhere from a few short months to well over two years. Most cases, however, tend to wrap up somewhere in the 6 to 18-month range. This huge window exists because every case is unique; it's a personal journey, not a cookie-cutter process, shaped by everything from the severity of your injuries to the complexity of the claim itself.

Mapping Your Personal Injury Settlement Timeline

If you’re asking, "How long will my settlement take?" you need to think of it less like a sprint and more like a journey. It’s not a single event but a series of connected stages, and each one has a specific purpose and its own timeframe. Rushing through these critical milestones almost always means leaving money on the table.

This guide is designed to give you a clear roadmap of what to expect. Knowing these phases from the start helps you set realistic expectations, which is key to navigating the entire process with confidence and patience.

Understanding the Key Stages

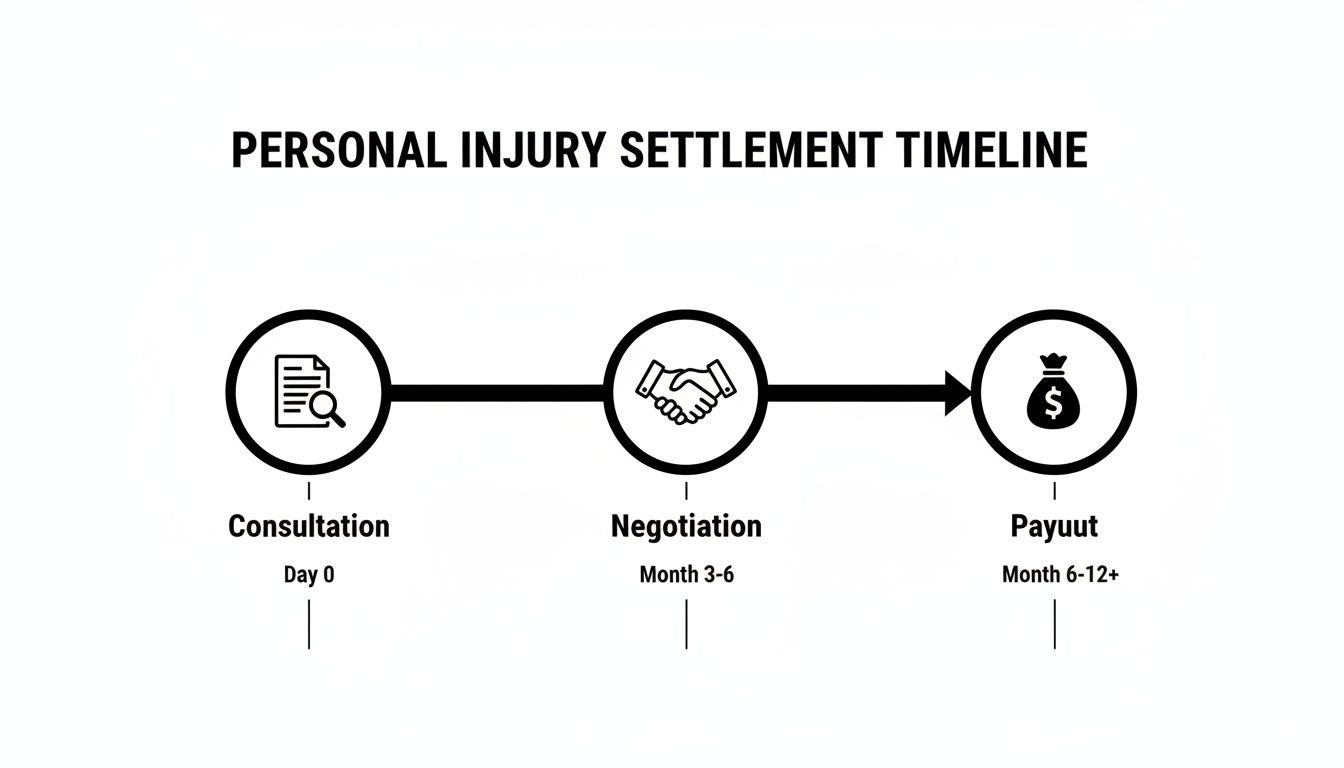

The entire personal injury settlement timeline really boils down to three main phases: building the case, fighting for a fair value, and getting the payout finalized. Each step is absolutely essential to a successful outcome.

- Building the Foundation: This starts the moment you're injured. It involves getting medical care, documenting every detail, and letting your legal team dig in and gather evidence. A critical point in this phase is reaching Maximum Medical Improvement (MMI).

- The Negotiation Dance: Once we know the full extent of your damages, your attorney puts together a demand package and sends it to the insurance company. This kicks off the back-and-forth process of negotiating a settlement amount.

- Resolution and Payout: After an agreement is finally reached, the lawyers handle the paperwork, the funds are processed, and the money is disbursed to you.

The visual below lays out these core steps—from the initial consultation all the way to the final payout—giving you a bird's-eye view of the entire process.

This timeline really drives home that the process is a sequence. You can't effectively start one phase until the one before it is properly completed.

To give you a clearer snapshot, here’s a breakdown of the key stages and what you can generally expect for timing.

Key Stages of a Personal Injury Settlement Timeline

| Stage | Description | Estimated Timeline |

|---|---|---|

| Medical Treatment & MMI | The client receives necessary medical care until they reach Maximum Medical Improvement (MMI)—the point where their condition has stabilized. | 3-12+ Months |

| Records & Evidence Gathering | The legal team collects all medical records, bills, police reports, and other crucial evidence to build the case foundation. | 1-3 Months |

| Demand Package & Negotiation | The attorney prepares and sends a detailed demand letter to the insurer, initiating settlement negotiations. | 1-6 Months |

| Litigation (If Necessary) | If a fair settlement cannot be reached, a lawsuit is filed, leading to discovery, depositions, and potentially a trial. | 6-24+ Months |

| Resolution & Payout | An agreement is reached, release forms are signed, and funds are disbursed to the client after liens and fees are paid. | 4-8 Weeks |

This table serves as a general guide, but remember that the timelines for each stage can stretch or shrink based on the specific facts of your case.

Setting Realistic Expectations

Setting a realistic timeline from day one is one of the most important things you can do to manage the emotional and financial strain of a personal injury claim. For most cases, that 6 to 18-month window is a solid estimate, driven by factors like how complex the case is, how long your medical treatment lasts, and whether there are arguments over who was at fault. This general timeframe has held steady in recent years, as you can see from recent personal injury industry statistics.

A patient, well-documented approach almost always leads to a better result than a rushed settlement. The goal isn't just to settle fast—it's to settle right, ensuring your compensation truly covers what you'll need for the long haul.

At the end of the day, while every case has its own quirks, understanding these fundamental stages gives you a solid foundation for the journey ahead. In the next sections, we'll take a much deeper dive into each of these phases.

The Foundational Post-Incident and Treatment Phase

Everything that happens in the moments, days, and weeks after an injury sets the stage for the entire settlement timeline. Think of it as laying the foundation for a house; if it’s rushed or poorly constructed, everything you build on top of it will be unstable. The steps you take right away—getting medical care, documenting the scene, and seeing your treatment through to the end—directly shape the strength and ultimate value of your claim.

This initial period is almost always the longest and least predictable part of the journey. It’s not driven by legal maneuvering or negotiation tactics, but by the simple, human reality of your physical recovery. The primary goal here is to reach a critical milestone known as Maximum Medical Improvement (MMI).

Why Reaching Maximum Medical Improvement Is Non-Negotiable

Maximum Medical Improvement is a simple concept: it’s the point where your medical condition has stabilized, and further treatment isn’t expected to make you any better. You are, for all intents and purposes, as "healed" as you are going to be. Reaching MMI is a crucial turning point because, until you’re there, you simply don’t know the full story of your injuries.

Settling a case before you hit MMI is one of the biggest gambles you can take. It’s like trying to sell a car without knowing if it has a blown engine or just needs a new set of spark plugs—you have no real way to know its true value.

Only after you’ve reached MMI can your legal team get a clear, complete picture of your damages. This includes:

- Final Medical Bills: The total cost of every surgery, physical therapy session, prescription, and specialist visit.

- Future Medical Needs: A realistic projection of costs for any ongoing care, pain management, or assistive devices you might need for the rest of your life.

- Long-Term Impact: An honest assessment of any permanent disability, disfigurement, or loss of function that will affect your ability to work and live your life.

If you settle before this point, you're essentially guessing at these numbers, and that almost always means leaving money on the table. Insurance adjusters know this, which is why they sometimes push for quick, pre-MMI settlements—it lets them off the hook for future complications they know are likely to surface.

Documenting Everything from Day One

While your body is healing, your legal team should be hard at work building the factual bedrock of your case. This isn’t about just collecting a few documents; it’s about constructing an airtight record of what happened and how it has impacted every facet of your life. The better the documentation, the less room an insurance company has to argue.

Key pieces of evidence gathered during this phase include:

- The Official Accident Report: For a car wreck, the police report is often the most objective account of what happened and can be invaluable in establishing fault.

- Witness Statements: Getting accounts from independent third parties who saw the incident can be incredibly powerful in backing up your version of events.

- Photos and Videos: Nothing tells a story like visual proof. Pictures from the scene, of your injuries as they heal, and of the property damage are compelling evidence.

This evidence gathering happens in parallel with your medical treatment. Each document adds another layer of strength to the demand your attorney will eventually build.

The Role of Medical Records in Your Timeline

Your medical records are the heart of your claim. They create a detailed, chronological narrative of your injuries, the treatments you’ve undergone, and the expert opinions of your doctors. A well-organized set of records forms the undeniable backbone of your settlement demand.

Frankly, this is where many cases get bogged down. Chasing down records from multiple providers—hospitals, surgeons, physical therapists, chiropractors—is a time-consuming administrative headache. But it’s absolutely essential. If you want to see how this process can be managed more efficiently, check out our guide on how to organize medical records.

This phase only really concludes once you reach MMI. At that point, with a complete medical picture and a file full of solid evidence, your lawyer can finally move on to the next stage: calculating your total damages and formally demanding fair compensation. Patience here really does pay off later.

Building Your Case and Crafting the Demand

Once a client reaches Maximum Medical Improvement (MMI), the case enters a new phase. The focus shifts from managing medical care to building a powerful legal argument. Your job now is to take the entire story of your client's injury—the physical pain, the mountain of bills, the daily disruptions—and shape it into a compelling case for compensation.

This is where you construct the demand package. It's the opening salvo in the negotiation process, and getting it right is non-negotiable.

Think of it as the ultimate case summary. It’s not just a letter asking for a check; it's a meticulously organized file that proves liability, documents every penny of damages, and justifies the settlement figure you're demanding. A weak or incomplete package gets a lowball offer and signals a long fight ahead. A strong one, however, earns respect and can dramatically shorten the entire negotiation.

Assembling the Core Components

A persuasive demand package is built on a foundation of solid evidence. Each piece plays a specific role in painting a complete picture for the insurance adjuster, leaving them little room to argue the facts or the value of the claim.

- Proof of Liability: This is where you establish, unequivocally, that the other party was at fault. You'll include the official police report, any witness statements you’ve secured, photos and videos from the scene, and sometimes an expert's analysis to reconstruct what happened.

- Documentation of Damages: Every single financial loss needs to be itemized and backed up with proof. This means gathering all medical bills, pharmacy receipts, and detailed verification of lost wages directly from the client’s employer.

- The Narrative Demand Letter: This is the heart of the package. The letter weaves all the evidence together into a coherent narrative, telling the human story of how the accident and the resulting injuries have impacted your client's life.

For complex cases, translating medical jargon into a clear legal argument is vital. This often means working with a specialized medico-legal consultancy to ensure medical reports powerfully support your claim.

Calculating the Full Value of Your Claim

At this stage, your most critical job is to calculate the claim's total value. This figure isn't pulled out of thin air; it’s based on two distinct categories of damages. Nailing this calculation is fundamental.

- Economic Damages: These are the black-and-white financial losses. You simply add up every verifiable cost your client has incurred—medical treatments, physical therapy, prescriptions, and lost income. These are the hard numbers.

- Non-Economic Damages: This is where your expertise really comes into play. You're putting a number on your client’s pain and suffering, emotional distress, and loss of enjoyment of life. It’s more subjective, but it’s often calculated using a multiplier based on the severity of the injuries and the total economic damages.

The demand letter is where you present these calculations and forcefully argue for their validity. If you need a refresher, our guide on writing a demand letter for personal injury breaks down the process. A well-argued letter sets the tone for the entire negotiation.

The demand package is your opening move, and it sets the benchmark for everything that follows. A thorough, evidence-backed demand forces the adjuster to take your claim seriously from day one.

Once the package is assembled and triple-checked, you send it to the at-fault party's insurance carrier. The ball is now officially in their court. Their response will determine the next steps and move you into the negotiation phase. This entire process of gathering records and building the demand typically takes 30 to 90 days.

Navigating the Negotiation and Settlement Process

Once you’ve sent the demand package, the timeline shifts gears into its most active and often most challenging phase: negotiation. This is where the real back-and-forth begins between your attorney and the insurance adjuster. Think of it as a high-stakes chess match where the evidence you've gathered and your lawyer's experience are your most critical pieces.

The insurance company's opening move is almost always the same. They'll come back with a counteroffer that's disappointingly low—sometimes shockingly so. Don't panic. This is a standard play designed to see if you'll get nervous and accept a quick, cheap payout. Any seasoned attorney expects this and already has a strategy in place to respond.

This initial exchange is just the opening salvo. From here, your lawyer will start methodically breaking down the adjuster's lowball offer, using the hard evidence from your medical records, expert reports, and legal precedent to reinforce your original demand and push for a number that truly reflects your losses.

The Art of the Counteroffer

Negotiating isn't just about throwing numbers back and forth; it's about telling a compelling story backed by irrefutable facts. After that initial low offer comes in, your attorney will draft a formal counteroffer. This isn't just a higher number pulled out of thin air—it’s a detailed rebuttal that directly confronts the adjuster’s weak points.

For example, did the adjuster claim some of your medical treatments were excessive? Your lawyer will fire back with letters of medical necessity from your doctors. Did they question your lost income? Your attorney will counter with detailed pay stubs and a letter from your employer. Each counteroffer is a new opportunity to demonstrate the strength of your case, and this cycle can go on for several weeks or even months.

The negotiation phase is a marathon, not a sprint. The goal is not just to reach a number but to ensure that number fully and fairly reflects the true extent of your damages, both present and future.

This is where all the upfront work in building a solid demand package really pays off. A thoroughly documented case leaves the adjuster with very little room to argue the facts, forcing them to negotiate on the value of the claim, not its validity.

How Case Value Shapes the Timeline

The timeline for negotiation is directly linked to the value and complexity of your case. Nationally, personal injury settlements average around $31,000, and about half of all cases settle for $24,000 or less. But that’s just a baseline. The final number is driven by injury severity, how clear the fault is, and the insurance policy limits—and these same factors determine how long the negotiations will take. You can find more insights on average settlement amounts and what to expect.

When Negotiations Stall: Introducing Mediation

So what happens when both sides have dug in and you’ve reached a standoff? Before everyone starts gearing up for a full-blown lawsuit, there’s a powerful intermediate step that can break the deadlock: mediation.

Mediation is a form of Alternative Dispute Resolution (ADR) where you, your attorney, and the insurance representative meet with a neutral third party. This mediator, often a retired judge or an experienced lawyer, doesn't make any decisions. Instead, their job is to facilitate a productive, good-faith negotiation and help both parties find a path to an agreement.

The process typically unfolds like this:

- Opening Statements: Each side gets to briefly present their case and their position.

- Private Caucuses: This is the core of mediation. The mediator meets privately with each side to have a frank discussion about the case's strengths and weaknesses and explore realistic settlement numbers.

- Facilitated Negotiation: The mediator acts as a go-between, carrying offers and counteroffers between the rooms and guiding the conversation toward a resolution.

Mediation is so often successful because it allows for an honest, confidential conversation away from the rigid procedures of a courtroom. It's a fantastic tool for cutting through the posturing, compressing the settlement timeline, and avoiding the immense cost and uncertainty of a trial. If you reach an agreement, it’s drafted into a legally binding contract, and the case is officially over.

Understanding the Litigation Timeline if Talks Stall

So, what happens when the insurance company just won't budge? You've sent a solid demand, you've negotiated, maybe you've even tried mediation, but their offer is still miles away from fair. This is when the timeline can really stretch, but it's not the end of the road. It's time to escalate.

Filing a lawsuit might conjure images of dramatic courtroom showdowns, but the reality is much more strategic. Think of it less as a declaration of war and more as a powerful negotiating tool. Kicking off the litigation process forces the insurance company to take your claim with the utmost seriousness. They know they'll have to answer to a judge and jury if they continue to lowball you, and that changes everything.

Make no mistake, this decision adds a significant chunk of time to the process, often a year or more. But here's the key: filing a suit doesn't mean settlement talks die. In fact, the pressure of a looming trial often brings everyone back to the table with a new sense of urgency.

The Formal Stages of Litigation

Once your attorney files a formal complaint with the court, the entire game changes. We've now entered a highly regulated phase, governed by strict deadlines and legal procedures. This part of the timeline isn't about casual back-and-forth; it's about systematically building an ironclad case for trial.

The litigation process unfolds in several distinct stages:

- Filing the Complaint and Service: Your lawyer officially files the lawsuit. The defendant is then legally "served" with the court documents, which formally notifies them of the suit and compels them to respond.

- The Answer: The defendant's legal team has a specific window of time to file a formal response. In this document, they will admit or deny the allegations you've made in the complaint.

- Discovery: This is the main event and the longest phase of litigation. Both sides are now legally obligated to exchange all relevant information and evidence. No more hiding the ball.

This structured exchange is designed to put all the cards on the table, eliminating surprises and making sure everyone understands the facts before ever seeing a courtroom.

The discovery phase isn't just about shuffling papers. It's about finding the truth, poking holes in the opponent's arguments, and building a case so compelling that the insurer is forced to rethink its unreasonable offer rather than take its chances at trial.

Unpacking the Discovery Process

Discovery is the heart of litigation and has the single biggest impact on your settlement timeline. It’s a methodical deep dive where your attorney can finally force the defense to hand over information they would never give up willingly during informal negotiations.

The key activities during discovery include:

- Interrogatories: These are essentially homework for the other side—a list of written questions they must answer in detail, under oath.

- Requests for Production: Your attorney can demand copies of just about any relevant document, like a company's internal accident reports, a truck's maintenance logs, or other physical evidence.

- Depositions: This is sworn testimony given outside of court, with a court reporter transcribing every word. Your lawyer will question the defendant and their witnesses, and their attorney will question you. It's a critical chance to lock in testimony that can be used later at trial.

This phase alone can easily take six months to over a year to complete. It's a long haul, but the evidence uncovered here is pure gold. It’s often the smoking gun that finally forces an insurer's hand, leading to a much better settlement offer. The data backs this up, showing that roughly two-thirds of personal injury cases settle before ever going to trial. You can dig deeper into case resolution statistics and settlement averages to see how this plays out.

Ultimately, while litigation adds significant time and complexity to the personal injury settlement timeline, it's a powerful and often necessary step. It shows you're serious about fighting for your claim's full value and can be the final push needed to achieve a fair resolution.

What Speeds Up or Slows Down a Settlement?

No two personal injury cases move at the same speed. The timeline isn't a fixed track; it’s more like a road with green lights and traffic jams. Knowing what these are from the outset helps set realistic expectations for everyone involved.

Think of it this way: when you have a clear-cut case with obvious fault, straightforward injuries, and a reasonable insurance carrier, you're on the expressway to resolution. But if key pieces are missing or fiercely disputed, the process can drag on for months—or even years—while your legal team fights to put everything in its proper place.

Common Timeline Accelerators

Some elements can really grease the wheels and get a case settled quickly. When these factors line up, the path from injury to payout gets a lot shorter.

Clear Liability: When it’s undeniable who was at fault—like a textbook rear-end collision—there's simply less for the insurance company to argue about. This cuts out a huge chunk of potential back-and-forth.

Minimal Injuries: Cases involving minor soft-tissue injuries that heal predictably within a few months can be wrapped up much faster. The damages are easier to calculate, and the future is less uncertain.

Sufficient Insurance Coverage: If the at-fault party has plenty of insurance to cover all the damages, it removes a massive roadblock. Fights over policy limits won't be an issue.

Frequent Causes for Delays

On the flip side, plenty of issues can pump the brakes and add substantial time to your case. These complexities demand more investigation, tougher negotiation, and often, more aggressive legal moves.

One of the biggest variables is the severity of the injuries. For instance, recent 2025 statistics from California highlight this connection perfectly. A minor soft tissue injury might bring a settlement of $2,000 to $25,000 within a few months. In contrast, catastrophic injury cases with multi-million-dollar values can stretch well beyond 18 months. For more details on this, you can see how average settlements vary by injury severity.

The single biggest delay in most cases is the time it takes for the client to reach Maximum Medical Improvement (MMI). Until the long-term prognosis is clear, the true value of the claim can't be calculated, making any early settlement premature and risky.

Reaching MMI is the critical milestone that signals when serious negotiations can finally begin. If you're curious about how hitting this point impacts the final numbers, our article offers a deep dive into the link between Maximum Medical Improvement and your potential payout.

Other common snags include:

Disputed Fault: When the other side denies responsibility or, worse, tries to pin some of the blame on your client, a lengthy and detailed investigation becomes necessary.

Multiple Parties Involved: Accidents with several vehicles or defendants automatically add layers of legal complexity, communication, and time.

Uncooperative Insurance Adjusters: Let's be honest—some insurance companies live by the "delay, deny, defend" playbook. They intentionally drag their feet to frustrate claimants into accepting a lowball offer.

To help you visualize these competing forces, here’s a quick breakdown of the factors that can either push a case forward or hold it back.

Timeline Accelerators vs. Delays in Personal Injury Cases

| Factor | Impact on Timeline | Explanation |

|---|---|---|

| Liability | Clear: Accelerates Disputed: Delays |

When fault is obvious (e.g., rear-end collision), there is less to investigate or argue about. Disputed liability requires depositions, accident reconstruction, and lengthy discovery. |

| Injury Severity | Minor: Accelerates Severe: Delays |

Minor injuries mean a shorter treatment period and a quicker path to MMI. Catastrophic injuries require extensive, long-term treatment, making it impossible to value the case for months or years. |

| Insurance Carrier | Cooperative: Accelerates Stonewalling: Delays |

A reasonable adjuster focused on fair resolution can settle a case quickly. An adjuster using "delay, deny, defend" tactics will intentionally prolong every step of the process. |

| Number of Parties | Single Defendant: Accelerates Multiple Defendants: Delays |

A simple two-party case is straightforward. Adding more defendants or insurance policies introduces cross-claims and complex negotiations, slowing everything down. |

| Medical Records | Organized & Available: Accelerates Disorganized & Slow: Delays |

Having prompt access to complete and well-organized medical records allows for a faster demand package preparation. Delays in receiving records from providers are a common bottleneck. |

Understanding these dynamics is key. Recognizing whether your case has more accelerators or delays allows you to manage client expectations and build a strategy that anticipates potential roadblocks from day one.

Frequently Asked Questions

Even with a good map of the settlement timeline, you're bound to have questions. Let's tackle some of the most common ones that come up as a case moves toward resolution.

How Long Until I Receive My Money After We Settle?

Once you and the insurance company agree on a number, a few final steps have to happen. First, you'll sign the official settlement release documents. From there, the insurance company will send the settlement funds to your attorney's trust account.

Your legal team then acts as the final accountant, paying off any outstanding medical bills or liens from those funds. Whatever is left—the net amount—is disbursed directly to you. All told, you can typically expect this final part of the process to take about four to six weeks from the day you sign the release.

Can I Do Anything to Speed Up My Settlement Timeline?

Absolutely. While your attorney is steering the ship, you’re the engine. Your active participation can be one of the biggest factors in keeping things moving and avoiding frustrating delays.

Here’s how you can help keep your case on the fast track:

- Never miss a medical appointment. Consistent treatment is the backbone of your claim's documentation.

- Be responsive. When your attorney’s office calls or emails for information, try to get back to them quickly.

- Keep your team in the loop. If your condition changes or you remember a key detail, let your paralegal or attorney know right away.

Simply being an engaged, cooperative client is the single best way to prevent your case from stalling.

Never accept the first settlement offer just to get it over with. The initial offer is almost always a lowball, thrown out to see if you're desperate. Letting your attorney push back and negotiate is essential to getting what your case is actually worth.

A little patience during the back-and-forth of negotiation can make a huge difference in your final recovery. It might add a bit of time, but it ensures you aren't leaving money on the table for the sake of a quick, but ultimately unfair, resolution.

Ready to compress your settlement timelines without sacrificing case value? Ares uses AI to automate medical record reviews and demand letter drafting, turning hours of manual work into minutes. See how top personal injury firms are settling cases faster and stronger at https://areslegal.ai.