sample demand letter for personal injury: Quick guide

Think of your personal injury demand letter as your opening move in a high-stakes chess match. It's more than just a formal request for money; it's your first, best chance to frame the narrative, anchor your settlement position, and persuade the insurance adjuster that settling is their most logical and cost-effective option. Get it right, and you can often resolve the case favorably without ever stepping foot in a courthouse.

The Power of a Well-Crafted Demand Letter

Let's be clear: the demand letter is the cornerstone of your entire pre-litigation strategy. It's the document that sets the tone for every conversation that follows. It demonstrates to the claims adjuster that you're not just organized and serious but that you're fully prepared to take this case to a jury if a fair offer isn't made.

A powerful, well-argued letter can be the catalyst that turns a potentially long, drawn-out fight into a swift and fair settlement. This is critical, considering that the vast majority of personal injury cases—somewhere around 95%—settle out of court. A strong demand is often what gets the ball rolling toward that resolution.

Setting the Stage for Success

I always tell junior attorneys to think of the demand letter as their opening statement to a jury. It’s your opportunity to tell your client's story—the whole story—in a compelling, logical, and undeniable way. An adjuster who receives a sloppy, disorganized letter filled with unsubstantiated claims is practically invited to respond with a lowball offer. They see hundreds of these, and they know weakness when they see it.

On the other hand, a meticulously prepared letter backed by solid evidence accomplishes several things right out of the gate:

- It Builds Credibility: It signals that you've done your homework, gathered the necessary proof, and have a firm grasp on the case's true value.

- It Controls the Narrative: You get to frame the incident, the injuries, and the resulting damages on your terms, before the defense has a chance to spin their version.

- It Creates Real Leverage: A strong demand puts the insurer on notice. It shows them the financial risk they’re facing if they push the case to trial, which naturally encourages a more reasonable settlement offer.

- It Speeds Everything Up: By giving the adjuster a complete package with everything they need to evaluate the claim, you cut down on the frustrating back-and-forth and move the process forward.

A demand letter isn't just a list of expenses. It's a persuasive legal document that connects the defendant's negligence directly to the client's suffering and financial losses, making a compelling case for the settlement amount requested.

Ultimately, a great demand letter is a comprehensive roadmap of your claim. To dig deeper into the mechanics, you might find it helpful to read our guide on what a demand letter is and how it functions. Understanding its strategic role is the first step in building a persuasive case from the ground up.

Deconstructing an Effective Demand Letter

So, what separates a demand letter that gets results from one that gets ignored? It’s all about structured persuasion. A powerful demand isn't just a request for a check; it's a meticulously crafted argument that walks an insurance adjuster from the crash to your settlement figure, leaving very little room for pushback.

Each part of the letter has a specific job. When you nail each section, they flow together to build an undeniable claim narrative. Thinking about the general principles of legal letter writing can be helpful here—the end goal is always clarity, professionalism, and persuasion.

The Professional Opening Salvo

The very start of your letter needs to set a professional, no-nonsense tone. This is where you introduce your firm and your client, state the letter's purpose, and give the adjuster everything they need to find the claim in their system.

This isn't the time for a dramatic story. It's about efficiency.

- Key Parties: Clearly name your client (the claimant) and the at-fault party (their insured).

- Claim Details: Make sure you include the claim number, the insured's policy number (if you have it), and the date of the incident.

- Clear Intent: State plainly that this is a formal demand for settlement related to the injuries your client sustained because of their insured's negligence.

A crisp, organized opening signals to the adjuster that you're a professional who has their facts straight. It encourages them to take the claim seriously from the first sentence.

Weaving a Compelling Statement of Facts

Once the formalities are out of the way, you need to present a clear, chronological account of what happened. Your goal here is to tell a concise and compelling story for someone who wasn't there. You're painting a picture that leads them to one logical conclusion: their insured was at fault.

Resist the urge to use emotional language or inject your own opinions. Just stick to the provable facts and lay them out in a sequence that’s easy to follow.

For example, in a simple rear-end collision:

"On October 15, 2023, around 2:30 PM, my client, Ms. Jane Doe, was driving her 2022 Toyota RAV4 eastbound on Maple Avenue. She was fully stopped at a red light at the Oak Street intersection when her vehicle was violently struck from behind by a 2021 Ford F-150, driven by your insured, Mr. John Smith."

This description works because it’s precise and hard to argue with. It establishes the time, location, and the fundamental action—a rear-end collision at a stoplight—which creates a strong presumption of negligence.

Establishing Undeniable Liability

With the facts established, you now have to explicitly connect them to legal liability. This is where you shift from storytelling to making a legal argument. You need to clearly state why their insured is responsible for your client's injuries.

This is the time to bring in your evidence. Reference the specific facts that prove negligence.

- Cite the police report (e.g., "Mr. Smith was cited for violating Vehicle Code §22350, Unsafe Speed for Conditions.").

- Mention any admissions of fault their insured made at the scene.

- Point out clear traffic law violations, like failure to yield or following too closely.

- Note any witness statements that back up your client's version of events.

This section bridges the gap from "here's what happened" to "here's why you're on the hook." For an adjuster to justify a payout, they need this clear legal foundation.

Detailing Injuries and Medical Treatment

Now, you shift to the human cost of the collision. This section has to do more than just list diagnoses from a medical chart. It must draw a clear, straight line from the incident to the medical conditions your client suffered. I find it’s most effective to start from the moment of impact and walk the adjuster through the entire treatment journey.

A persuasive letter documents every single step:

- Immediate Care: Describe the ambulance ride, the emergency room visit, and what the doctors initially found.

- Ongoing Treatment: Detail the follow-up appointments with specialists, the physical therapy regimen, any surgeries performed, and the medications prescribed.

- Future Needs: If the doctors have recommended future care—like another surgery or long-term pain management—be sure to include that prognosis.

For every single treatment you mention, you must have the medical records and bills to back it up. This evidence-based approach makes it incredibly difficult for an adjuster to argue that the care was unnecessary.

A common mistake I see is just listing injuries without explaining their real-world impact. Don't just say "lumbar strain"; explain how it prevented your client from being able to lift their child. Don't just say "concussion"; describe the debilitating headaches that kept them from focusing at work.

This narrative of pain, suffering, and recovery is what justifies your demand for non-economic damages. It gives the adjuster a window into the disruption and misery this incident caused in your client's life. Considering that 95-96% of personal injury cases are resolved before ever reaching a trial, this demand letter is arguably the most critical piece of advocacy you'll undertake.

Documenting Every Economic Loss

The final piece of the puzzle is a clean, itemized accounting of all economic damages, often called "special damages." This section is all about the cold, hard numbers. Every dollar you demand must be documented.

I always recommend breaking down the financial losses into clear categories:

- Medical Expenses: List every single medical bill from every provider, with a clear running total.

- Lost Wages: Show your math for how you calculated the income lost, and back it up with pay stubs and a letter from your client's employer.

- Property Damage: If it hasn't been handled in a separate claim, include the vehicle repair costs or its total loss value.

- Out-of-Pocket Costs: Don't forget the smaller items. Include prescription co-pays, mileage for driving to doctor's appointments, and the cost of things like crutches or braces.

Presenting these figures in an organized, transparent way makes the adjuster's job easy. They can quickly verify your math and see the tangible financial impact on your client. This level of clarity is crucial for justifying the final settlement figure you're about to present.

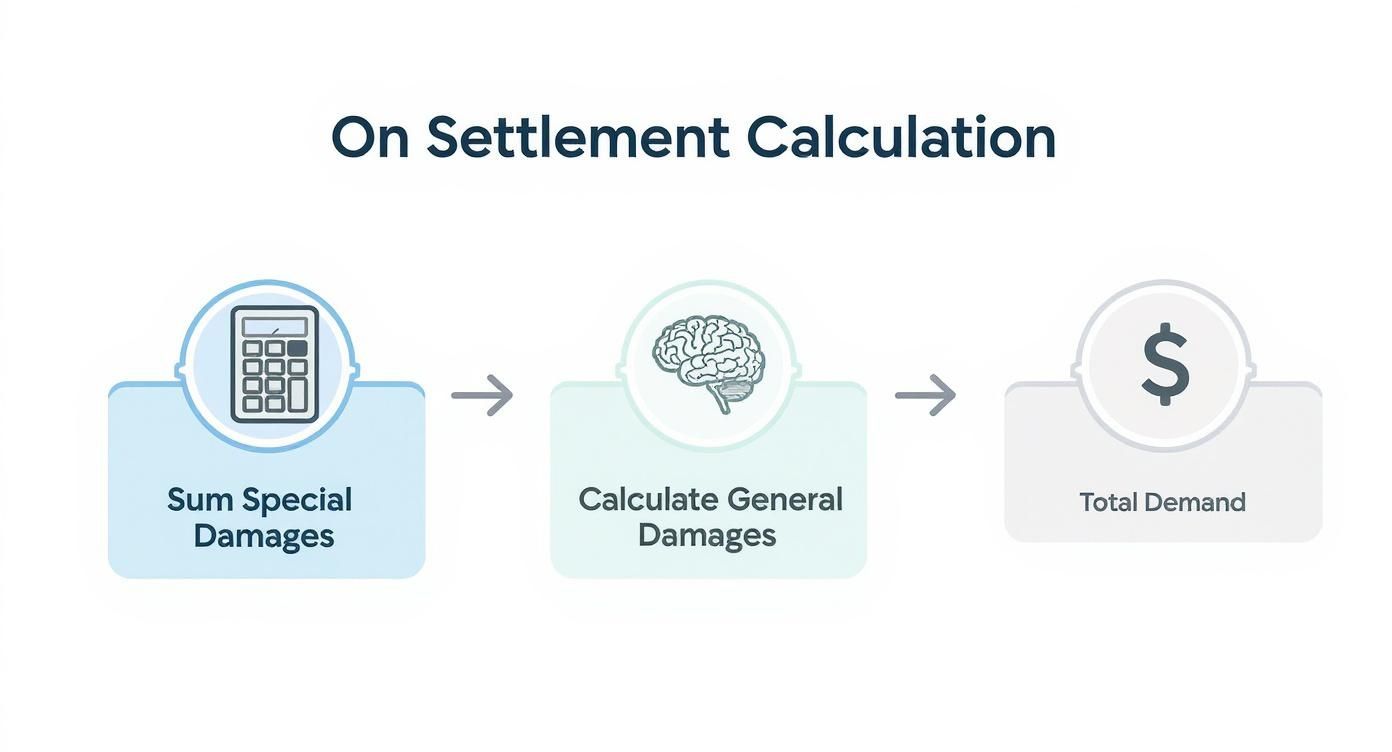

Calculating a Justifiable Settlement Demand

Arriving at the final demand figure is more art than science, blending cold, hard numbers with compelling advocacy. This isn't a number you pull out of thin air. It’s a meticulously built valuation that an insurance adjuster will scrutinize more than any other part of your letter. Your calculation must be transparent, logical, and above all, defensible.

The entire foundation of your demand rests on special damages, or what we commonly call economic damages. These are the tangible, black-and-white losses backed by a paper trail. Your job is to hunt down and account for every single cent your client has lost.

Tallying the Economic Damages

Think of this as creating an ironclad expense report for the insurance company. You need to list every item and be ready to back it up with a receipt, bill, or official record.

Breaking these losses down into clear categories makes your demand easier for the adjuster to follow:

- Medical Expenses (Past and Future): Start by summing up every single medical bill. This means everything—the ambulance ride, the ER visit, physical therapy, prescription co-pays, and specialist appointments. If doctors anticipate future needs, like a follow-up surgery or long-term care, you absolutely must include a professional estimate for those future costs.

- Lost Income and Earning Capacity: This part is straightforward but critical. Calculate the wages your client lost while they were out of work, using pay stubs and a letter from their employer to verify their pay rate and missed hours. If the injury permanently impacts their ability to earn, you'll need to project that loss over their working life, which often requires an expert economist to create a defensible report.

- Out-of-Pocket Expenses: Don't let the small stuff slide. These costs add up fast. We're talking about mileage driving to and from doctor's offices, hospital parking fees, and the cost of crutches, braces, or other necessary medical equipment.

A cleanly organized list of these concrete figures establishes the undisputed baseline of your settlement demand.

Quantifying Pain and Suffering

This is where your advocacy skills really come into play. General damages are meant to compensate for the human toll of the injury—the physical pain, the emotional distress, and the simple loss of life's joys. Since there’s no invoice for suffering, we rely on established methods to put a dollar value on it.

An adjuster's main goal is to chip away at the non-economic damages. Your job is to paint such a vivid, medically supported picture of your client's suffering that a lowball offer becomes indefensible.

The two most common methods for this are the Multiplier Method and the Per Diem Method. For a more detailed breakdown, you can review our firm's guide on how to calculate emotional distress damages.

To help you decide which approach fits your case, here’s a quick comparison of the two leading methods.

Comparing Methods for Calculating Non-Economic Damages

| Calculation Method | Best For | How It Works | Example Scenario |

|---|---|---|---|

| Multiplier Method | Cases with significant, long-term, or permanent injuries where the impact far exceeds the initial medical bills. | Total economic damages are multiplied by a number (typically 1.5 to 5) based on injury severity. | A client with a traumatic brain injury. Their $100,000 in medical bills doesn't reflect the lifelong cognitive challenges, so a multiplier of 5 is used. |

| Per Diem Method | Cases with a clear and finite recovery period where the daily impact is the primary form of suffering. | A specific dollar amount (often based on the client's daily wage) is assigned for each day of recovery, from the accident until they reach maximum medical improvement. | A construction worker who broke their leg and couldn't work for 120 days. Their daily suffering is calculated based on their lost daily earnings. |

Choosing the right method is a strategic decision. The Multiplier approach is often better for capturing the gravity of life-altering injuries, while the Per Diem method can be very effective for injuries with a defined and painful recovery timeline.

Applying the Multiplier Method

The Multiplier Method remains the most widely used approach in the personal injury field. The concept is simple: you take the grand total of the special (economic) damages and apply a multiplier, usually between 1.5 and 5.

But that multiplier isn't just a random number. It’s directly tied to the severity of your client's case.

- A multiplier of 1.5 to 2 is generally for minor injuries with a full and fast recovery—think soft tissue strains that resolve within a month.

- A multiplier of 3 to 4 is more appropriate for serious injuries, like a herniated disc or a bone fracture that required surgery and left the client with a long recovery and some lingering pain.

- A multiplier of 5 or even higher is reserved for the most catastrophic cases. We're talking about permanent injuries like paralysis or a severe TBI that have completely and forever changed the client's life.

Let’s say your client has $50,000 in economic damages from a serious back injury that needed surgery. You might argue for a multiplier of 4, which would result in a demand of $200,000 for their pain and suffering.

The Final Demand Calculation

Pulling it all together is simple. Your total demand is the sum of the special and general damages.

Using our last example:

- Special Damages: $50,000

- General Damages: $200,000

- Total Settlement Demand: $250,000

Lay this math out plainly in your letter. You need to show the adjuster exactly how you got to your number. This transparency forces them to engage with your reasoning on its merits, making it much harder for them to simply dismiss your demand as arbitrary or inflated.

Tying It All Together: A Sample Demand Letter in Action

Theory is one thing, but seeing it on the page is another. Let's break down a complete sample demand letter for personal injury to see how all the pieces we've discussed fit together.

This isn't just a fill-in-the-blank template. It's a fully annotated example built around a classic rear-end collision—the kind of case that lands on your desk every day. I've added commentary after each section to explain the "why" behind the "what"—the strategic choices in phrasing, the evidence I'm pointing to, and how it’s all framed to get an adjuster to sit up and take notice.

Think of this as your playbook.

The Sample Letter

[Your Law Firm Name & Address] [Date]

VIA CERTIFIED MAIL Ms. Carol White Claims Adjuster Major Insurance Company [Address]

RE: Demand for Settlement Our Client: Sarah Jenkins Your Insured: Robert Miller Claim Number: MC-345987 Date of Loss: October 15, 2023

Dear Ms. White:

As you know, this firm represents Ms. Sarah Jenkins for the significant personal injuries she sustained in the October 15, 2023, auto collision. This crash was caused solely by the negligence of your insured, Robert Miller. This letter is our formal demand to settle Ms. Jenkins’ claim.

Annotation: Straight to the point. The header gives the adjuster everything they need to pull the file in seconds. The first paragraph immediately establishes representation and frames the entire narrative: your insured was negligent, and this is what it's going to take to make it right. It sets a firm, professional tone from the get-go.

Statement of Facts

On October 15, 2023, around 2:30 PM, Ms. Jenkins was driving her 2022 Toyota RAV4 eastbound on Maple Avenue. She was lawfully stopped at a red light at the Oak Street intersection when your insured, Mr. Miller, violently struck the rear of her vehicle in his 2021 Ford F-150.

The force of the impact was severe, causing Ms. Jenkins’ head to whip forward and backward. The official police report (Report #23-98765, attached as Exhibit A) corroborates this account. More importantly, it notes Mr. Miller’s on-scene admission that he was "looking down at his phone" just before the impact. He was cited for Following Too Closely under Vehicle Code §21703.

Annotation: This isn't just a recitation of facts; it's a story that preemptively dismantles any argument about liability. Words like "violently struck" paint a picture without being overly dramatic. The real power here is introducing the silver bullet early—the insured's own admission and the resulting citation. This makes it very difficult for the adjuster to argue comparative fault.

Injuries and Medical Treatment

The collision was the direct and proximate cause of Ms. Jenkins’ debilitating injuries, which include a C5-C6 disc herniation and a concussion. She felt immediate dizziness and intense neck pain and was transported by ambulance to City General Hospital, where a CT scan confirmed the concussion.

In the days that followed, the neck pain intensified. An MRI ordered by her physician, Dr. Allen, confirmed a significant disc herniation. To manage this injury, she has undergone an extensive course of treatment, including:

- 12 weeks of intensive physical therapy at ProActive Rehab

- Two epidural steroid injections from Dr. Evans, a pain management specialist

- Ongoing prescriptions for pain medication and muscle relaxants

Despite these efforts, Ms. Jenkins lives with chronic neck pain, radiating nerve pain down her right arm, and frequent headaches. Her life has been fundamentally altered. Simple joys like gardening and running are no longer possible, and daily activities like lifting groceries have become a painful ordeal.

Annotation: Notice how this section forges an unbreakable link between the crash and the injuries. We use precise medical terms ("C5-C6 disc herniation") because they carry weight and are supported by objective evidence (MRI). The bulleted list is a smart, scannable way to show the adjuster the sheer volume of treatment required. It’s not just about the injury; it’s about the long, painful road to recovery.

Economic Damages (Special Damages)

To date, Ms. Jenkins has incurred the following hard costs as a direct result of Mr. Miller’s negligence:

| Expense Category | Provider/Source | Amount |

|---|---|---|

| Ambulance Service | City Ambulance | $2,100.00 |

| Emergency Room | City General Hospital | $4,550.00 |

| Orthopedic Care | Dr. Allen | $3,780.00 |

| MRI Scans | Metro Imaging | $2,800.00 |

| Pain Management | Dr. Evans | $6,200.00 |

| Physical Therapy | ProActive Rehab | $7,500.00 |

| Prescription Costs | Local Pharmacy | $875.00 |

| Total Medical Expenses | $27,805.00 | |

| Lost Wages | ABC Corporation (4 weeks) | $6,400.00 |

| Total Special Damages | $34,205.00 |

All corresponding bills, medical records, and lost wage verification are attached for your review as Exhibits B through G.

Annotation: An organized table is your best friend here. It's clean, transparent, and makes the adjuster's job easy—which is always a good thing. They can quickly see how you arrived at your number. Explicitly stating that every line item is documented with an attached exhibit tells them this isn't a soft number; it's a provable fact.

This next chart shows how these concrete special damages become the foundation for the total demand.

As you can see, the final settlement figure isn’t pulled from thin air. It starts with a solid base of documented special damages, which then serves as the anchor for valuing the human cost of the injury—the general damages.

Settlement Demand

Given the indisputable liability of your insured, the severity and permanent nature of Ms. Jenkins’ disc injury, and the profound impact this has had on her quality of life, we have calculated her general damages using a multiplier of 4.0. This is more than justified by her chronic pain and the long-term prognosis.

Here is the breakdown:

- Special Damages: $34,205.00

- General Damages: ($34,205.00 x 4.0) = $136,820.00

- Total Settlement Demand: $171,025.00

We hereby demand the sum of $171,025.00 to fully and finally resolve Ms. Jenkins’ claim.

Please review this demand and the enclosed documents with your insured and provide your response within thirty (30) days.

Sincerely, [Your Name] [Your Law Firm]

Annotation: The final section is all about confidence and clarity. We don't just ask for money; we show our math. Explicitly stating the multiplier (4.0) and justifying it ("permanent nature," "chronic pain") forces the adjuster to engage with our logic. It frames the negotiation on our terms and makes the final number feel reasoned and defensible, not arbitrary.

Assembling Your Ironclad Evidence Package

A demand letter, no matter how persuasively written, is just words on a page without rock-solid proof to back it up. The collection of documents you attach—what we call the “demand package”—is where your arguments meet cold, hard facts. This is your opportunity to build a case so compelling that the adjuster has no room to argue.

Think of it as your case file in miniature. It needs to be organized, clear, and directly tied to the claims you make in the letter itself.

I find the best approach is to present this package as a series of numbered exhibits, which you can then reference throughout the letter. The easier you make it for the adjuster to connect your statements to the evidence, the more authority your demand will carry.

Organizing the Core Exhibits

For the sake of clarity and impact, group your evidence into logical categories. This structure helps the adjuster quickly grasp the three pillars of your case: who's at fault, the extent of the medical treatment, and the financial toll it has taken.

- Evidence of Liability: This is where you prove the other party was at fault. You'll want to include the complete police or incident report, sharp photos of the scene and any property damage, and any signed witness statements you’ve managed to get.

- Medical Documentation: This is the absolute core of the injury claim. You need every single page of the medical records from every provider your client saw. An itemized list of all medical bills is non-negotiable, and if you can get a narrative report from the primary treating physician, it can be incredibly powerful.

- Proof of Lost Income: To get paid for lost wages, you have to prove them. The best way is with recent pay stubs showing your client's regular earnings, paired with a formal letter from their employer that confirms the exact dates they missed and verifies the absence was unpaid.

Getting these documents in order isn't just busywork; it's a strategic part of building your case. For a more detailed breakdown, our guide on how to organize medical records offers some great, practical tips.

Securely Handling Protected Health Information (PHI)

Remember, your demand package is filled with incredibly sensitive Protected Health Information (PHI). Mishandling this data is more than just sloppy—it's a significant compliance risk that can damage your firm's reputation and expose you to liability.

A Quick Word of Caution: Your duty to protect client data is absolute. Never, ever send a demand package through standard, unencrypted email. Always use a secure, encrypted portal or delivery method. It shows you're a professional and protects both your client and your firm from potential HIPAA violations.

Before you send a single file, double-check that every document is scanned cleanly and is perfectly legible. Sending blurry or cut-off copies just creates delays and makes you look disorganized. Finally, confirm you have a signed HIPAA authorization from your client that is specific to this claim, giving you the explicit right to share their medical history with the insurance company. This attention to detail is what makes a sample demand letter for personal injury a truly effective tool.

Common Mistakes and Smart Negotiation Tactics

Sending your meticulously crafted demand letter is a huge step, but it’s the opening bell for negotiations, not the finish line. The insurance adjuster's response—or even their initial silence—is your first signal. Getting through this phase successfully requires a mix of patience, strategy, and knowing which common pitfalls can derail an otherwise solid claim.

Sidestepping Unforced Errors

I've seen too many strong cases get weakened at this stage by simple, avoidable mistakes. One of the biggest is letting emotion take over.

An overly aggressive or angry tone is a classic rookie move. Adjusters are professionals paid to evaluate risk based on facts, not feelings. Confrontational language just signals you're inexperienced and can make them dig in their heels. Keep it professional and stick to the facts.

Another common misstep is making an unrealistic opening demand. You absolutely should build in room to negotiate, but a number that's completely untethered from your documented damages screams that you don't know how to value a claim. It kills your credibility and invites a dismissive lowball offer or, worse, radio silence.

Reading the Adjuster's First Move

The adjuster’s initial response tells you a lot. A quick, reasonable counteroffer is a good sign; it means they see the liability and want to get the case off their desk.

On the other hand, a ridiculously low offer is just a standard tactic. They're testing you, trying to see if you'll panic and reset your expectations downward. Don’t fall for it. Your job is to respond professionally, calmly pointing back to the specific evidence that justifies your original valuation.

Sometimes, the response is no response at all. This can be a deliberate strategy to make you anxious and get you to lower your demand preemptively. If you haven't heard back within your stated timeframe (usually 30 days), send a polite but firm follow-up. It shows you're organized, on top of your file, and serious about moving the case forward.

Your initial demand sets the "anchor" for the entire negotiation. Even a high demand, as long as it's well-justified by the evidence, forces the adjuster to start their evaluation from a number much higher than they’d like.

Once you’ve opened the door to a potential agreement, the details matter. Knowing practical skills like how to redline a contract like a pro becomes crucial for finalizing the settlement terms in your client's favor.

Using Technology to Your Advantage

In this final stretch, speed and organization give you a serious edge. Manually digging through a mountain of medical records to counter an adjuster's argument about a single treatment creates delays that can kill your momentum. This is where modern legal tech really shines.

Platforms built for personal injury firms can take the grunt work out of organizing medical records and help you draft sharp, fact-based follow-up letters. When you can pull up a clear, chronological summary of treatments and costs in seconds, you can respond to an adjuster's questions instantly and accurately.

That level of preparation sends a clear message: you're ready for litigation if necessary. More often than not, that’s exactly what motivates them to come back with a better settlement offer.

At Ares, we built our AI-powered platform to give personal injury firms this exact edge. By automating medical record review and demand letter drafting, Ares frees you from hours of manual work so you can focus on high-value strategy and negotiation. Settle faster and for more by turning chaotic files into clear, case-winning insights. See how it works at https://areslegal.ai.