How to Write a Powerful Sample Settlement Demand Letter

A well-crafted settlement demand letter is far more than just a formality. It’s your opening move in the personal injury negotiation chess match, and it can be your most powerful one. This is the document that officially kicks off settlement talks, laying out your case for the insurance adjuster in a way that can either fast-track a fair resolution or bog your claim down for months.

Why a Strong Demand Letter Matters in Your Claim

Think of the demand letter as the opening statement in your personal injury case. It's not a simple request for a check; it's a strategic tool that can fundamentally shape the final outcome. A persuasive, well-supported letter is often the key to convincing an adjuster to make a reasonable offer without ever needing to see the inside of a courtroom.

This single document sets the tone for all negotiations to come. It immediately signals your firm's credibility and proves you've built a serious, evidence-backed case right from the start.

It Creates the First Impression

For the insurance adjuster, the demand letter is their first real, in-depth look at your client's claim. A professional, organized, and compelling letter tells them you mean business and have done your homework. That first impression alone can shift the adjuster's entire approach, making them see the real litigation risk if a fair offer isn't put on the table.

On the flip side, a sloppy, incomplete, or poorly argued letter sends the opposite message. It invites them to test you with a lowball offer, assuming you aren't prepared to fight.

It Controls the Narrative

This is your chance to tell your client's story on your own terms, without interruption. You get to frame the facts, detail the true severity of the injuries, and paint a clear picture of how this incident has completely upended their life. This narrative is crucial—it gives a human context to the cold, hard data of medical bills and police reports.

A powerful demand letter does more than just list the facts. It weaves a compelling story that justifies every penny of your demand, making it impossible for an adjuster to dismiss the real-world impact of the defendant's negligence.

It Provides a Roadmap for Settlement

A great demand letter is a roadmap for the adjuster. It lays out all the information they need to evaluate the claim and, just as importantly, justify a payout to their superiors. When you provide organized evidence and a logical breakdown of damages, you make their job easier. That efficiency often translates into a smoother, faster negotiation.

This roadmap should always include:

- A Clear Liability Argument: Directly state why their insured is at fault, citing specific evidence like police reports, traffic laws, or witness accounts.

- Well-Documented Damages: Attach itemized lists of all economic damages—every medical bill, every lost pay stub—with the receipts and records to back them up.

- A Justified Demand Amount: Don't just throw out a number. Show your math, explaining how you calculated the final figure, including your rationale for the pain and suffering component.

Ultimately, this document is the foundation of your entire claim. To get a better handle on its function and key components, you can explore our detailed guide on what is a demand letter and how it fits into the broader legal strategy.

Building Your Demand Letter for Maximum Impact

How you structure your settlement demand letter can be the difference between a productive negotiation and an immediate lowball offer. A generic template just won't cut it. To get the best result, each section needs a clear purpose, building on the last to create a logical and persuasive case that guides the insurance adjuster exactly where you want them to go.

Think of it as presenting a professional, evidence-backed story that makes it easy for them to justify paying your claim.

This letter is the critical step that transforms your case file into a formal claim, kicking off the all-important negotiation phase. Let’s break down how to build it, piece by piece.

Crafting a Compelling Narrative of the Incident

Your first job is to tell the story of what happened. This isn't just about reciting dry facts from a police report; it's your chance to frame the incident in a way that establishes the other party's fault as undeniable.

Lay out a concise, chronological account of the event. Describe what your client was doing right before the crash, detail the at-fault party’s negligent actions, and explain the immediate aftermath. Always use clear, direct language and tie your statements to specific evidence.

For instance, instead of just saying, "The other driver was speeding," you make it concrete: "As confirmed by the police report (Exhibit A) and witness testimony from Jane Doe (Exhibit B), the defendant was traveling 20 mph over the posted speed limit when they ran the red light, violently striking my client's vehicle."

Establishing Clear and Unambiguous Liability

After setting the scene, you need to drive home the argument for liability. This is where you connect the defendant's actions directly to the specific legal duties they breached. Your goal here is to leave the adjuster with zero room to argue comparative negligence.

To really nail this down, you should:

- Cite specific traffic laws or statutes the defendant clearly violated.

- Reference the police report's findings, especially if any citations were issued.

- Incorporate witness statements that back up your client's version of events.

- Point to physical evidence, like photos of the vehicle damage or skid marks, that supports your argument.

This section has to be factual and assertive. You’re not just suggesting fault—you are demonstrating it with irrefutable proof. An adjuster who sees a rock-solid liability argument knows that fighting it in court would be an expensive, and likely losing, battle.

Presenting Injuries and Medical Treatment Logically

Next, you have to detail your client's injuries and their entire medical journey. This section must be meticulously organized to show the direct causal link between the defendant's negligence and the harm your client suffered. Don't just dump a stack of medical bills on them.

Instead, present a clear medical chronology. Start with the initial ER visit and move logically through every appointment—specialists, physical therapists, imaging scans, and prescriptions. For each step, describe the diagnosis, the treatment received, and the associated cost. This narrative approach helps the adjuster grasp the full scope of the injuries in a way a simple list of providers never could.

The strength of a demand letter lies in its organization. When an adjuster can easily follow the timeline, connect evidence to your claims, and see the logic behind your math, you remove friction from the settlement process.

It's also worth noting that settlement rates are shaped by the surrounding legal culture. A comprehensive study revealed that common law jurisdictions like the United States see much higher settlement rates (often over 50%) compared to some civil law countries where rates can be below 15%. This tells us that in a system like ours, where litigation is costly and uncertain, a well-structured demand letter is an incredibly powerful tool for encouraging an early, fair resolution. You can discover more insights about these global settlement behaviors and their implications.

Before we move on, let's look at the core components every letter must contain. A well-organized letter isn't just about telling a story; it's about making sure the adjuster has all the required information in a format they can easily process and use to justify a payment.

Essential Components of a Settlement Demand Letter

| Component | Purpose | Key Information to Include |

|---|---|---|

| Header & Introduction | Formally identifies the parties and claim details. | Your firm's info, adjuster's info, date, claim number, date of loss, insured's name, and your client's name. |

| Facts of the Incident | Provides a clear, chronological narrative of what happened. | Date, time, location, a brief description of events leading up to the incident, and the immediate aftermath. |

| Liability Argument | Establishes why the insured is legally responsible. | Citations to traffic laws, references to the police report, witness statements, and analysis of physical evidence. |

| Injuries and Damages | Details the full extent of the harm suffered by the client. | A complete list of all injuries, from major to minor, supported by initial medical diagnoses. |

| Medical Treatment | Creates a timeline of the client's medical journey. | A chronological summary of all treatments, including ER visits, specialists, therapy, and medications. |

| Damages Calculation | Quantifies all economic and non-economic losses. | Itemized medical bills, lost wages documentation, out-of-pocket expenses, and a clear explanation for the pain and suffering demand. |

| Settlement Demand | States the specific total amount requested for settlement. | A clear, final number representing the total demand and a deadline for the adjuster to respond. |

| Exhibits List | Organizes all supporting documentation for easy review. | A numbered or lettered list of all attachments (police report, medical records, bills, photos, etc.). |

Having this checklist handy ensures you never miss a critical piece of the puzzle, strengthening your position from the outset.

Organizing Your Exhibits for Easy Review

Every single piece of evidence you mention must be included as a clearly labeled exhibit. A sloppy, disorganized submission forces the adjuster to do extra work, which only causes delays and frustration. Make their job easy.

At the end of your letter, create an exhibit list and make sure each corresponding document is clearly labeled.

- Exhibit A: Police Accident Report

- Exhibit B: Witness Statement of Jane Doe

- Exhibit C: Emergency Room Records from City Hospital

- Exhibit D: Itemized Medical Bills Summary

- Exhibit E: Lost Wage Verification from Client's Employer

By creating a professional, well-organized demand letter, you’re doing more than just asking for money. You are presenting a complete, litigation-ready case file. This signals that you're prepared to go to trial if a fair offer isn't made, and that level of professionalism is often the very thing that drives a successful and timely settlement.

How to Calculate and Justify Your Settlement Demand

https://www.youtube.com/embed/O3ubosTFom8

This is where the rubber meets the road. After gathering all the evidence and building a compelling narrative, you have to put a number on the claim. This can feel like a bit of a dark art, but a structured approach can turn a subjective process into a concrete, defensible valuation.

The key is to split your calculation into the two categories every insurance adjuster knows and expects: special damages and general damages. This method ensures nothing gets missed and gives your final demand a logical foundation an adjuster can't easily dismiss.

Quantifying Special Damages: The Hard Numbers

Special damages—often called economic damages—are the straightforward, out-of-pocket losses your client has suffered. These are the easiest to tally because they come with a paper trail. Your job is to create a rock-solid, itemized list that leaves no room for argument.

Make sure your list is exhaustive and includes:

- All Past and Future Medical Expenses: This is everything from the ambulance ride and ER visit to surgeries, physical therapy, prescriptions, and specialist follow-ups. For serious injuries, you'll need to work with medical experts to project the costs of future care, long-term therapy, or necessary medical equipment.

- Lost Wages and Income: Track every single dollar of income lost because your client couldn't work. This isn't just salary; it includes overtime, bonuses, and any commissions they missed out on.

- Loss of Future Earning Capacity: This is a big one. If the injuries permanently affect your client’s ability to earn at their previous level, you must calculate this long-term loss. This usually requires bringing in an economist or vocational expert to produce a credible projection.

- Out-of-Pocket Costs: Don't let the small stuff slip through the cracks, because it adds up fast. Think transportation to doctor’s appointments, hiring household help, or making a vehicle handicap-accessible.

The secret to a bulletproof special damages claim is obsessive documentation. Every single expense needs an invoice, receipt, or official record to back it up. An organized, fully supported list of economic losses gives an adjuster very little wiggle room.

Valuing General Damages: The Human Cost

Now we get to the part that requires real finesse. General damages, or non-economic damages, are about compensating your client for the intangible, human suffering they've been through. You can't produce a receipt for pain or emotional trauma, so you have to build a powerful case that justifies the number you’re asking for.

While it’s subjective, the calculation isn't just pulled out of thin air. Most adjusters and attorneys use a "multiplier" method as a starting point. You simply total the special damages and multiply that figure by a number, typically somewhere between 1.5 and 5.

What multiplier should you use? It depends entirely on the facts of the case:

- How severe and permanent are the injuries?

- What was the level of physical pain involved?

- How long and difficult was the recovery?

- What has the emotional and psychological toll been?

A minor whiplash case where the client fully recovers in two months might get a 1.5x or 2x multiplier. On the other hand, a catastrophic injury leading to permanent disability and chronic pain could easily justify a 5x multiplier, or even more. It’s absolutely critical to learn more about valuing emotional pain and suffering settlements to make a convincing argument.

Remember that the stakes can be enormous. In the class action space, for example, settlements in the U.S. hit a staggering $159.4 billion between 2022 and 2024. These massive resolutions highlight just how crucial accurate damage calculation is.

Ultimately, justifying general damages is all about storytelling. You have to use the evidence—the doctor's notes describing agonizing pain, photos of the scarring, your client's own words—to paint a clear picture of how this incident has shattered their quality of life. That narrative gives your number meaning and transforms it from a demand into a call for justice.

Annotated Sample Demand Letters You Can Use

Theory is one thing, but seeing how it all comes together in a real-world document makes all the difference. To help you put these principles into practice, I’ve broken down two detailed, annotated examples.

Think of these less as templates and more as strategic blueprints. They show you the "why" behind every word choice and structural decision. The first letter handles a common rear-end collision with moderate injuries, while the second tackles a more complex premises liability case with significant damages.

Sample Letter 1: Minor to Moderate Injury Claim

Here, we're dealing with a classic rear-end collision that resulted in whiplash and soft-tissue injuries. Liability is crystal clear, and the damages are relatively straightforward. This makes it a perfect example of how to draft a demand that is direct, professional, and built for a quick resolution.

[Your Law Firm Letterhead]

[Date]

[Adjuster's Full Name] [Insurance Company Name] [Insurance Company Address]

RE: Claim for Sarah Jenkins Claim Number: 123-ABC-456 Date of Loss: October 15, 2023 Your Insured: Robert Smith

Dear [Mr./Ms. Adjuster's Last Name],

Annotation: Get right to it. Start formally and give the adjuster everything they need to pull the file—claim number, date of loss, and names. It shows you’re organized and makes their job easier.

As you know, our firm represents Ms. Sarah Jenkins for the injuries she sustained due to the negligence of your insured, Robert Smith, in the collision on October 15, 2023. This letter is our formal demand to settle her claim.

Annotation: No fluff. This opening sentence clearly states the letter’s purpose.

Facts of the Collision

On October 15, 2023, around 2:30 PM, Ms. Jenkins was lawfully stopped at a red light at the intersection of Main Street and Oak Avenue. At that moment, your insured, Mr. Smith, failed to stop his vehicle and slammed into the rear of Ms. Jenkins’ car. The official police report (Exhibit A) confirms these facts and finds your insured 100% at fault, citing him for following too closely.

Annotation: This is short, factual, and powerful. You’re establishing undeniable liability by immediately referencing the police report and highlighting the key finding—100% fault.

Injuries and Medical Treatment

The violent force of the impact caused Ms. Jenkins to suffer a significant cervical strain (whiplash) and soft tissue damage to her upper back and shoulders. She went directly to the emergency room at City General Hospital for evaluation.

Annotation: Always connect the impact directly to the injuries. Laying out the medical journey chronologically makes it easy for the adjuster to follow.

Her subsequent treatment consisted of:

- Initial ER Visit: Diagnosed with acute cervical strain.

- Primary Care Physician Follow-up: Referred for physical therapy.

- Physical Therapy: Completed a twelve-week course of treatment to restore her range of motion and manage pain.

All medical records and bills detailing her diagnosis and treatment are attached as Exhibit B.

The key to presenting medical treatment is to build a simple, easy-to-follow narrative. A clear timeline, backed by well-organized exhibits, keeps the adjuster from getting bogged down and helps them quickly validate the injuries you're claiming.

Sample Letter 2: Complex Injury Claim

Now for a more complex situation. This sample letter addresses a severe slip-and-fall at a commercial property that resulted in a fractured ankle requiring surgery. It shows you how to structure a demand that includes future medical costs, significant pain and suffering, and a more detailed liability argument.

[Your Law Firm Letterhead]

[Date]

[Adjuster's Full Name] [Insurance Company Name] [Insurance Company Address]

RE: Claim for David Chen Claim Number: 789-XYZ-101 Date of Loss: November 5, 2023 Your Insured: Downtown Retail Group, LLC

Dear [Mr./Ms. Adjuster's Last Name],

Our firm represents Mr. David Chen for the severe and permanent injuries he suffered as a direct result of the hazardous conditions at the property owned by your insured, Downtown Retail Group, LLC.

Annotation: The opening immediately frames the incident around the insured’s negligence—the "hazardous conditions."

Liability of Downtown Retail Group

On November 5, 2023, Mr. Chen was shopping at your insured's store when he slipped on a large, unmarked puddle of water in the main aisle. We have witness statements (Exhibit C) confirming the spill was present for at least 30 minutes with no warning signs posted or any attempt made to clean it up. This constitutes a clear breach of your insured's duty to maintain a safe premises.

Annotation: Here, you’re establishing a timeline of negligence. That 30-minute detail is crucial—it shows the property owner had more than enough time to discover and address the hazard.

Damages Incurred

As a direct result of this fall, Mr. Chen suffered a trimalleolar fracture of his left ankle. This is a severe injury that required open reduction and internal fixation (ORIF) surgery. He has already undergone extensive physical therapy and, according to his orthopedic surgeon, Dr. Evans (Exhibit D), will likely suffer from chronic pain and arthritis. Dr. Evans also notes that a future ankle fusion surgery may be necessary.

Annotation: For serious injuries, use precise medical terms and cite the expert’s prognosis. Mentioning the potential for future surgery is critical for justifying a higher demand value.

His damages are broken down as follows:

| Damage Category | Amount |

|---|---|

| Past Medical Expenses | $48,500.00 |

| Projected Future Medical Costs | $35,000.00 |

| Past Lost Wages | $12,000.00 |

| Total Economic Damages | $95,500.00 |

Annotation: A simple table makes the numbers pop. It visually separates the hard costs (economic damages) from the more subjective general damages you’ll argue next.

Given the severity of the injury, the surgical intervention, the permanent nature of his condition, and the clear negligence of your insured, we demand $350,000.00 to resolve this matter. We look forward to your response within 30 days.

Annotation: The final demand is assertive because you’ve just laid out the justification. Adding a firm deadline creates a sense of urgency and prompts a response.

Assembling the Evidence for Your Demand Package

Your demand letter lays out the argument; your evidence is what proves it. A letter without a meticulously organized demand package is just a collection of unproven claims. To get an insurance adjuster to take your demand seriously, you have to back it up with a professional, comprehensive set of exhibits that validates every single assertion you make. This is how you turn your client's narrative into a factual record they simply can't ignore.

Step into the adjuster’s shoes for a moment. They're reviewing dozens of claims a week, and a disorganized, incomplete file is an immediate red flag. A clean, logically structured evidence package, on the other hand, signals that your firm is professional, prepared, and not afraid of litigation. It makes their job easier, which ultimately makes your path to a fair settlement that much smoother.

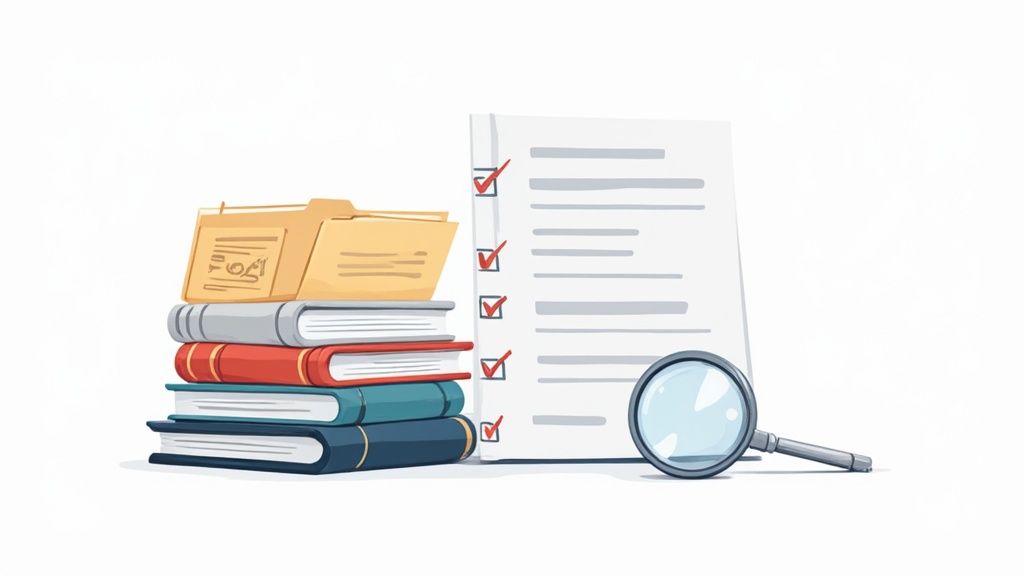

Creating the Essential Evidence Checklist

Before you start attaching anything, you need a game plan—a comprehensive checklist. Every piece of evidence should directly support a specific part of your letter, from proving liability to justifying every dollar in your damages calculation. A scattered approach just gives the adjuster an excuse to pick your case apart.

Your core evidence package has to include these fundamentals:

- Official Reports: The police report is non-negotiable. It gives you an objective, third-party account of the incident and often includes a preliminary finding of fault.

- Visual Documentation: High-quality photos and videos are incredibly powerful. You need shots of the accident scene, vehicle damage from multiple angles, and clear photos of your client’s visible injuries as they heal.

- Witness Information: Get the full names, contact information, and, if possible, signed statements from any witnesses. Their unbiased accounts can be the key to cementing your liability argument.

This initial layer of evidence sets the stage, painting an undeniable picture of what happened and who was responsible.

Documenting Medical Treatment and Expenses

This is where many claims live or die. Sloppy medical documentation is one of the fastest ways to devalue a case. Your job is to create a complete, easy-to-follow record of your client’s entire medical journey, from the first ER visit to their final physical therapy session.

Your medical exhibits should be organized chronologically and include:

- All physician’s notes, specialist reports, and operative summaries.

- Results from any diagnostic imaging, like X-rays, MRIs, and CT scans.

- A complete, itemized list of every single medical bill—no exceptions.

- Proof of payment for out-of-pocket expenses, such as prescriptions or medical devices.

An adjuster should be able to pick up your medical records and immediately understand the injury, the treatment timeline, and the total cost without having to play detective. Clarity and organization are paramount. Our detailed guide on how to organize medical records provides a step-by-step process for this crucial task.

The power of well-documented claims isn't just a local phenomenon. Global trends in shareholder litigation, for example, show that between 2020 and 2024, over 50% of cases were concentrated in Australia, the UK, and the Netherlands. The success of major settlements in these jurisdictions often hinged on robust documentation presented early in the process—a testament to the universal importance of a strong evidence package.

Proving Financial Losses Beyond Medical Bills

Finally, you have to meticulously document every other economic loss your client has suffered. These damages are just as real as the medical bills, and they must be proven with concrete evidence. Don't leave money on the table by being lazy here.

Your financial loss documentation should always include:

- Lost Wage Verification: A letter from the client's employer on company letterhead is the gold standard. It needs to detail their pay rate, typical hours, and the specific dates they missed work because of their injuries.

- Tax Returns and Pay Stubs: These documents are essential for establishing a clear history of earnings, which becomes critical if you're making a claim for diminished future earning capacity.

- Receipts for Miscellaneous Expenses: Compile receipts for everything—transportation to medical appointments, home assistance services, or even modifications made to a home or vehicle.

By assembling a professional, comprehensive, and logically organized demand package, you're handing the adjuster everything they need to validate your claim. This preparation does more than just support your demand letter; it shows you’re ready to win at trial. And that’s the most powerful negotiation tool you have.

Answering Your Questions About Demand Letters

Navigating the settlement process always brings up a lot of questions. We see the same concerns from clients time and again: when to send the letter, what to expect after hitting "send," and whether to go it alone or bring in an attorney.

Getting these answers straight from the start helps you avoid common pitfalls and walk into negotiations with your eyes wide open.

When Is the Right Time to Send a Settlement Demand Letter?

Timing is everything. The absolute best time to send your demand is after you’ve either finished all medical treatment or a doctor has declared you've reached Maximum Medical Improvement (MMI).

MMI is a critical milestone. It means your condition is stable, and your doctor can give a clear picture of what your long-term recovery and future needs look like.

Sending a demand too early is one of the biggest mistakes you can make. If you haven't finished treatment, you can't possibly know the full extent of your medical bills, future care costs, or any long-term limitations. This all but guarantees you'll undervalue your claim and leave a lot of money on the table. You need the complete picture of your damages to make your first demand a strong and accurate one.

What Happens After I Send the Demand Letter?

Once your demand package lands on the adjuster’s desk, they’ll start their review. Don't expect a call the next day; this can easily take several weeks, sometimes even a couple of months. Patience is a virtue here.

From there, you’ll typically see one of three responses:

- They accept your demand. This almost never happens on the first try. It's the unicorn of PI claims.

- They reject the claim outright. This is also rare, especially if you've built a solid case with clear liability.

- They send a counteroffer. This is the most likely outcome and the official start of back-and-forth negotiations.

Be ready for that first counteroffer to be frustratingly low. It's a standard opening move in their playbook, not the final word on what your claim is worth. This is where your well-documented sample settlement demand letter becomes your anchor, giving you the evidence you need to push back effectively.

Can I Write a Demand Letter Without a Lawyer?

Yes, you absolutely can write your own demand letter. For smaller, straightforward claims where the other party is clearly at fault and your injuries were minor and have completely healed, handling it yourself is a reasonable option.

But for anything more complex? I’d strongly advise against it. If your case involves serious injuries, questions about who was at fault, or the potential for future medical needs, it's time to talk to an expert.

A good personal injury attorney knows how to put a real number on abstract damages like pain and suffering. They can anticipate and navigate the legal roadblocks the insurance company will throw up and have the experience to negotiate a settlement that's often significantly higher than what you could get on your own.

Accelerate your case resolution with Ares, the AI-powered platform designed for personal injury firms. Automate medical record review and demand letter drafting to turn complex documents into clear, actionable insights in minutes. Discover how leading PI firms are saving over 10 hours per case by visiting https://areslegal.ai.