Your Guide to the Ultimate Settlement Demand Letter Template

A truly effective settlement demand letter is much more than a simple summary of facts. It's a strategic narrative, carefully constructed to steer negotiations toward the best possible outcome for your client. Using a well-structured settlement demand letter template isn't about cutting corners; it's about making sure every critical component is in place—from a compelling factual story and a clear liability argument to meticulously documented damages. Think of it as the blueprint for a letter that insurance adjusters have no choice but to take seriously.

The Modern Blueprint for a Winning Demand Letter

A powerful demand letter is often the single most influential document in a personal injury claim. It’s your best shot at building a persuasive argument that compels the insurance adjuster to justify a higher settlement authority. To do that, the letter needs to evolve from a simple document into a powerful advocacy tool. This requires a structured, repeatable approach.

The most successful personal injury firms don't just wing it. They implement standardized processes and frameworks to ensure every demand they send is consistent, comprehensive, and ultimately, compelling. This isn't just about being organized; it brings significant advantages.

- Ensures Consistency: A solid blueprint guarantees that no critical element gets overlooked, from pinning down liability to justifying non-economic damages.

- Improves Efficiency: When paralegals and attorneys follow a repeatable model, they can draft high-quality letters much faster, which frees them up to handle a larger caseload.

- Strengthens Negotiations: A clear, logical, and well-supported demand gives the adjuster the ammunition they need to go to their supervisor and get a fair settlement approved.

- Secures Better Outcomes: A professional, evidence-backed letter sets a serious tone right from the start, often leading to quicker and more substantial resolutions for your clients.

The Power of a Repeatable Process

Implementing a standardized approach to your demand letters isn't just about good practice—it delivers measurable results. We're seeing the demand letter process become a critical differentiator in settlement outcomes. In fact, research shows that firms with standardized demand processes close 23% more cases within six months compared to firms that lack consistent procedures. That statistic alone, highlighted in settlement data from Casepeer.com, really underscores how vital an organized approach is.

This blueprint is about creating a system that works, time and time again. It transforms the demand letter from a reactive summary of what happened into a proactive tool that drives the negotiation. Each section should build on the last, creating an undeniable case for your client’s compensation.

A great demand letter tells a story, but it's a story backed by irrefutable facts and evidence. It logically walks the adjuster from the incident to the injury, and finally, to the inescapable conclusion that your settlement demand is fair and justified.

Integrating Structure and Strategy

The modern approach also understands that presentation matters. An adjuster might review dozens of claims in a single day. A letter that’s disorganized, poorly written, or missing key evidence is easy to dismiss or lowball. On the other hand, a demand that is clean, well-organized, and meticulously documented commands respect and immediate attention. The strategic use of technology in law firms plays a huge part in achieving this level of professionalism and efficiency.

Ultimately, a modern settlement demand letter template provides the framework. The real art is filling that framework with a compelling narrative, strong legal arguments, and flawless documentation. When you do that, you move beyond just stating a number; you build a case so strong that the adjuster sees settling as their best—and most logical—option.

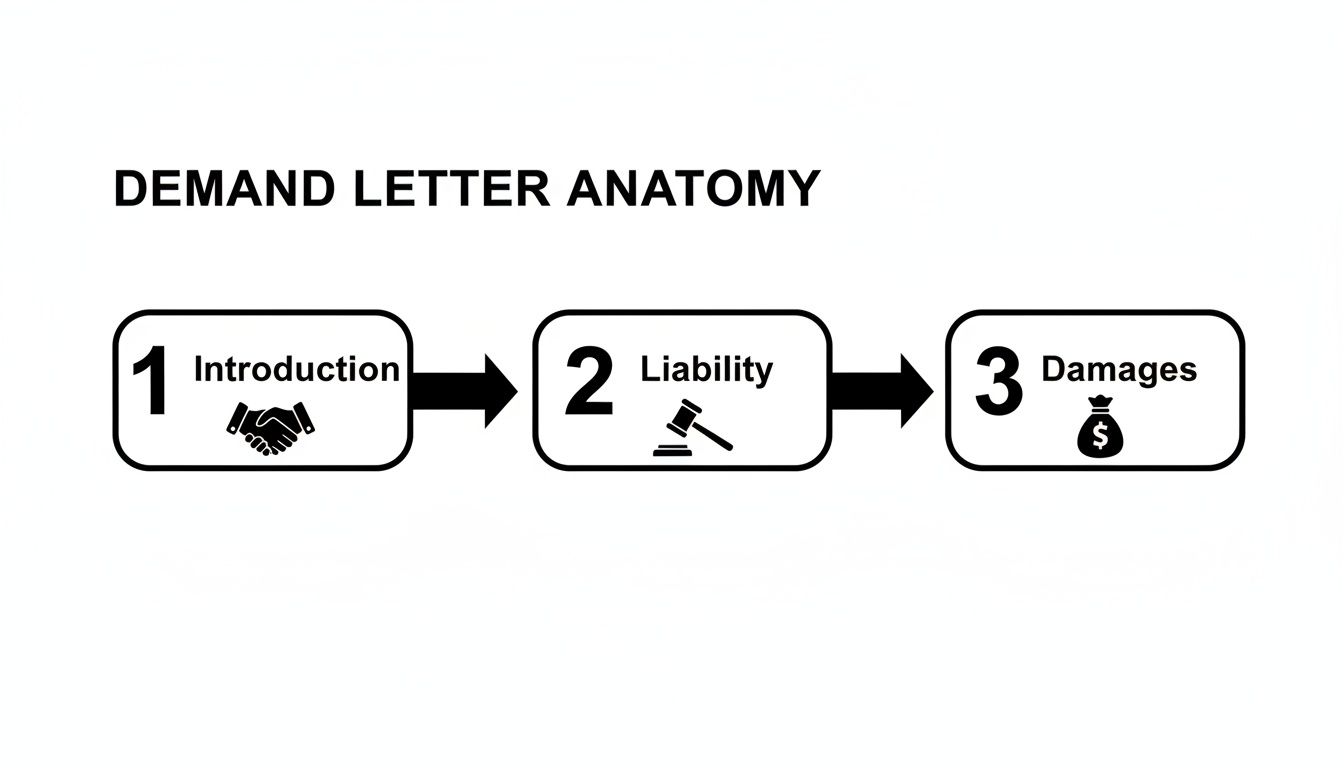

Anatomy of a Powerful Demand Letter

A great settlement demand letter isn’t just a summary of facts; it’s a work of persuasion. You're building a narrative, brick by brick, that guides an insurance adjuster toward one conclusion: settling this case is their best and most logical option. Think of it as your opening argument, laid out so clearly and compellingly that it becomes difficult to refute.

A sloppy or disorganized letter is an open invitation for a lowball offer. Every section has a job to do, and getting each one right is critical to maximizing your client's recovery.

The Introduction: Your Opening Statement

The first few paragraphs set the stage for the entire negotiation. You need to be direct, professional, and unambiguous. This isn't the time for a long wind-up; get straight to the point.

Your opening should immediately establish:

- Who you represent: Your client's full name.

- Who is at fault: The insured party's full name.

- The basics: The date and location of the incident.

- The purpose: A clear statement that this is a formal demand for settlement due to the negligence of their insured.

For example:

"This letter is a formal demand for settlement on behalf of my client, Jane Doe, for the significant injuries and damages she suffered due to the negligence of your insured, John Smith. The collision occurred on January 15, 2024, at the intersection of Main Street and Oak Avenue."

This kind of opening is concise and authoritative. It frames the conversation around your client's claim and the insured's liability from the very first sentence.

Crafting a Persuasive Statement of Facts

This is where you tell the story. But this isn't creative writing—it’s a chronological, fact-based account of what happened. Your goal is to present a narrative that is easy to follow and paints an undeniable picture of the defendant's negligence.

Start by describing the moments just before the incident, the collision itself, and the immediate aftermath. Stick to objective language and, wherever possible, tie your statements to a piece of evidence, like a police report.

For instance, instead of saying, "Your insured recklessly slammed into my client," try this: "As Ms. Doe proceeded lawfully through the green light, your insured, Mr. Smith, failed to stop for his red light and caused a violent T-bone collision with the driver's side of her vehicle. The responding officer, Officer Davis, cited Mr. Smith for violating Vehicle Code §21453(a), as documented in Police Report #12345 (see Exhibit A)."

Key Takeaway: The statement of facts should read like an indisputable record. When every claim you make is backed by evidence you’re attaching, you build credibility and make it tough for the adjuster to poke holes in the core narrative.

This approach shows the adjuster that your case is built on a solid foundation, not just your client's version of events.

Articulating a Strong Liability Argument

Once the facts are laid out, you have to connect the dots legally. This is where you explain why their insured is responsible for your client's damages. It’s the part of the letter that translates the story into a legal conclusion.

Reference the specific traffic laws or common law negligence principles that the insured violated. If the police report assigns fault, make sure to highlight that finding loud and clear. Your liability argument should leave no room for doubt.

Here’s a simple way to structure the argument:

- State the Duty of Care: Explain the legal obligation the at-fault party had. "All drivers have a duty to operate their vehicle with reasonable care and obey traffic signals."

- Show the Breach of Duty: Detail how their insured failed. "Mr. Smith breached this duty when he ignored a steady red light and drove directly into oncoming traffic."

- Establish Causation: Link the breach directly to the harm. "This breach was the direct cause of the collision and all of Ms. Doe's resulting injuries and damages."

This logical progression—Duty, Breach, Causation—makes your legal argument airtight and easy for the adjuster to understand and justify to their superiors.

Detailing Injuries and Medical Treatment

Now we get to the human element of your demand. Here, you paint a picture of the physical and emotional toll this incident took on your client. Don't just list medical diagnoses from a chart; describe how the injuries upended your client’s life.

Start with the immediate aftermath—the ER visit, the initial shock—and then walk the adjuster through the medical timeline. List each provider, the dates of treatment, and the nature of the care they provided.

An effective description might look like this:

"Immediately after the crash, Ms. Doe was taken by ambulance to City General Hospital, where an MRI confirmed a herniated disc at C5-C6 and a concussion. For the next six months, she endured a painful regimen of physical therapy and received three cervical epidural injections to manage the debilitating radicular pain. As a registered nurse, she was unable to return to work for eight weeks."

That narrative has a much bigger impact than a simple list of medical bills. It connects the treatment to real-life suffering and disruption, which is what justifies a serious demand for non-economic damages.

Before you present your final number, it's helpful to understand how all these pieces fit together. The most effective demand letters follow a proven structure where each section builds on the last.

Core Components of a Settlement Demand Letter

This table breaks down the essential elements of a high-impact demand letter, outlining what each component needs to accomplish. Think of it as your strategic checklist for building a case that an adjuster can't easily dismiss.

| Component | Purpose | Key Information to Include |

|---|---|---|

| Introduction | Establishes the parties, date of incident, and the letter's purpose: to demand a settlement. | Client and insured names, date of loss, claim number, and a clear statement of purpose. |

| Statement of Facts | Provides a clear, chronological, and evidence-based narrative of the incident. | A detailed, objective account of events leading up to, during, and after the incident. |

| Liability Argument | Legally connects the insured's actions (breach of duty) to the client's injuries (causation). | Reference specific statutes, police report findings, and the legal principles of negligence. |

| Injuries & Treatment | Details the full extent of the client's medical journey and its real-world impact. | A narrative of diagnoses, treatments, providers, and how the injuries affected daily life and work. |

| Damages Calculation | Presents a clear, itemized breakdown of all economic and non-economic losses, ending in a specific demand. | An itemized list of medical bills, lost wages, and other hard costs, followed by the total demand. |

By breaking down the demand letter into these distinct, powerful sections, you create a persuasive document that systematically makes the case for your client. Each part supports the next, leading the adjuster to the inescapable conclusion that your demand is well-founded and paying it is their best move.

How to Accurately Calculate and Justify Damages

The damages section is the absolute heart of your demand letter. This is where you translate your client's pain, loss, and suffering into a concrete dollar amount. If you're vague or your numbers seem pulled out of thin air, you’re practically inviting the adjuster to slash your demand and send a lowball offer. To be persuasive, you need to present a meticulous, evidence-backed calculation that leaves no room for argument.

Think of this section as telling a story with numbers. You're building a bridge that connects the initial injury to the final figure you're demanding. This calculation breaks down into two main categories: special damages (the hard economic losses) and general damages (the non-economic, human cost). Each requires a different method, but both demand painstaking documentation.

As you can see, laying out the damages is the final, powerful crescendo of your letter. It’s the logical conclusion to the liability argument you’ve just built, leading directly to your settlement demand.

Itemizing Special Damages

Special damages are the tangible, out-of-pocket costs your client has shouldered because of their injury. These are the "easy" numbers to calculate because they come with a paper trail. Your job is to become a detective, gathering every single bill, receipt, and statement to create an exhaustive, itemized list.

Every dollar you claim here must be supported by a document in your exhibits. You're essentially building a fortress of proof around your economic claim.

Common special damages include things like:

- Medical Bills: This isn't just the big-ticket items. It's everything from the ambulance ride and ER visit to surgeries, follow-up appointments, physical therapy, prescriptions, and medical devices.

- Lost Wages: Document every hour of work your client missed. You'll need pay stubs or a formal letter from their employer to confirm their pay rate and the exact time lost.

- Future Lost Earnings: If the injury permanently affects your client's ability to earn a living, this is a critical component. You'll almost certainly need an expert report from a vocational specialist to project this loss of earning capacity over their lifetime.

- Out-of-Pocket Expenses: Don’t forget the small stuff, because it adds up. This includes mileage to and from doctor's appointments, parking fees, co-pays, and the cost of crutches or a wheelchair ramp for their home.

I always recommend presenting these costs in a clean, easy-to-scan format—a simple table or a bulleted list works best. Finish with a clear subtotal for all economic losses. This clarity makes it incredibly simple for the adjuster to check your math and justify the numbers on their end.

Quantifying General Damages

General damages, what we often call "pain and suffering," are tougher to pin down. How do you put a price tag on the human cost of an injury? This is where you justify compensation for the physical pain, emotional trauma, and the loss of life’s simple joys. Since there’s no invoice for suffering, you have to use a logical, defensible method to arrive at a figure.

The most widely accepted approach is the multiplier method. You take the total of your special damages—the hard economic costs—and multiply it by a number, usually between 1.5 and 5. The multiplier you choose is everything; it’s dictated entirely by the severity of the injuries and their impact on your client's life.

Pro Tip: Never just state a multiplier out of the blue. You have to earn it. Your letter must explain why this case warrants a 3x, 4x, or 5x multiplier. Higher multipliers are reserved for cases involving permanent injuries, a grueling recovery, or a profound disruption to your client's world.

A straightforward whiplash case that fully resolves in a couple of months might only justify a 1.5x or 2x multiplier. But a case involving a spinal fusion surgery that leaves your client with permanent lifting restrictions and daily chronic pain? That could easily command a 5x multiplier.

Your argument should be built on factors like:

- The severity and permanence of the injuries.

- The intensity and duration of the pain.

- The degree of disruption to the client's daily life, career, and relationships.

- Any visible scarring, disfigurement, or documented emotional trauma like PTSD.

This is a nuanced area, and knowing how to frame these arguments effectively is a skill in itself. For a more detailed breakdown, you can learn more about how to calculate pain and suffering damages in our comprehensive guide.

Bringing It All Together in the Final Demand

Finally, you combine your special and general damages to arrive at your total demand. Lay out the math so simply that anyone can follow your logic.

Example Calculation:

- Total Special Damages: $55,000 (Medical Bills + Lost Wages)

- General Damages Multiplier: 4x (Justified by a permanent back injury and chronic pain)

- Total General Damages: $220,000 ($55,000 x 4)

- Total Settlement Demand: $275,000

When you present a meticulously documented and logically calculated demand, you shift the entire dynamic of the negotiation. The conversation is no longer if the insurance company should pay, but how much. You're handing the adjuster a clear, defensible rationale they can take to their superiors to get your settlement approved, which is exactly what you need to get the case resolved favorably.

Why Your Demand Letter Is the Key to Settlement

It surprises a lot of people to learn that most personal injury cases never see the inside of a courtroom. The high-drama trials you see on TV are a tiny fraction of what really happens. Grasping this reality is the first step to mastering the demand letter—because this document is often the single most important piece of paper in your entire case.

This isn't by chance. Our civil justice system is intentionally designed with powerful incentives, both financial and procedural, that guide everyone toward a resolution. Trials are a massive gamble. They're expensive, they drain time and resources, and their outcomes are notoriously unpredictable for everyone involved, from the injured client to the insurance carrier. A well-crafted demand letter plays directly into this reality.

Speaking the Adjuster's Language

Think about the person on the other side of the table: the insurance adjuster. Their main goal is to close files, and to do it efficiently within the budget they've been given. Your demand letter isn't just a plea for money; it's a business proposal. It’s the tool that gives the adjuster the exact justification they need to pay your client.

A persuasive letter, backed by solid documentation, gives them the ammo to walk into their supervisor's office and confidently say, "The evidence is here, liability is clear, and this demand is reasonable. Settling now is the smartest, most cost-effective move we can make."

Your demand letter is your opening argument, trial, and closing statement all rolled into one. Your goal is to make going to trial look like a risky and completely unnecessary expense for the insurance company.

When you lay out a compelling story supported by irrefutable proof—medical records, police reports, photos, and a clear breakdown of damages—you're actually making the adjuster's job easier. You're handing them a defensible reason to approve a higher settlement, which dramatically boosts your chances of getting a great result without ever stepping foot in court.

The Overwhelming Trend Toward Settlement

The numbers don't lie. Settling is, by far, the most common outcome for civil cases. Research consistently shows that aggregate settlement rates hover between 57.8% and 71.6%, with the exact number depending on the type of case and where it's filed.

What's really telling is that personal injury claims (torts) settle even more frequently. One major study found that tort cases resolved before trial at a rate of 87.2%, far higher than other civil disputes. You can explore the full research on settlement rates to dig deeper into these trends.

This is the "why" behind your letter. It’s not just a formality or a preliminary step. For all intents and purposes, it is the main event. When you start with a strong settlement demand letter template, you are engaging in the most critical part of the advocacy for your client, setting the tone for a successful resolution right from the start.

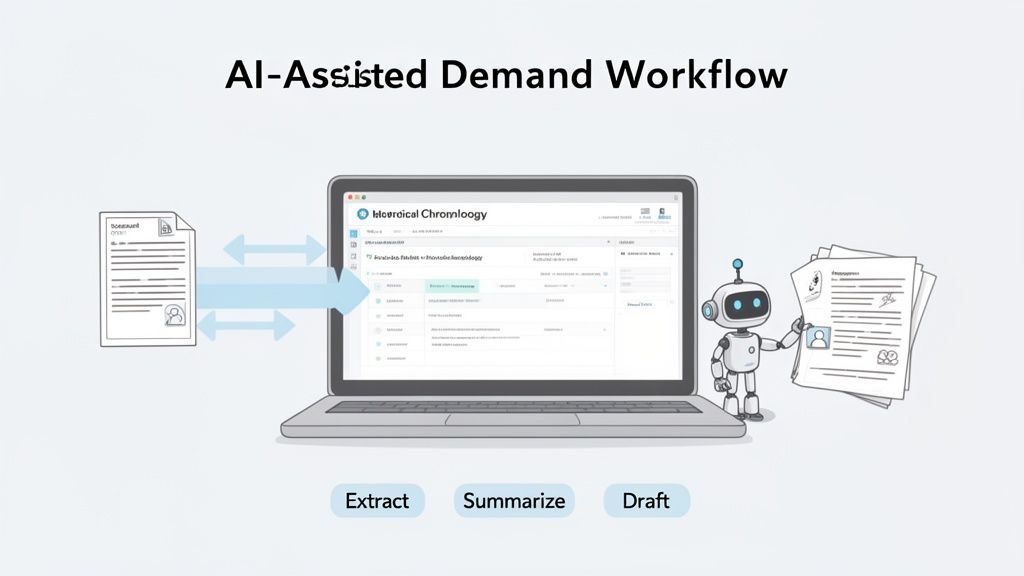

Using AI to Make Your Demand Process Faster and Smarter

Anyone who's drafted a demand letter knows the grind. It's a meticulous, time-sucking process that involves hours—sometimes days—of poring over dense medical records, piecing together a coherent treatment timeline, and painstakingly calculating damages. This traditional workflow isn't just tedious; it’s a major bottleneck that can slow down a case and limit how many clients a firm can effectively help.

Now, what if you could eliminate the most grueling parts of that process? That's exactly where modern AI platforms come in, and they're changing how personal injury firms get this crucial work done. These tools aren't just glorified word processors. They’re intelligent systems built to read, understand, and pull together complex medical information.

Automating the Heavy Lifting: Data Extraction and Chronologies

The single biggest time-sink in preparing a demand is that initial mountain of medical records. A single client’s file can contain thousands of pages from different providers, all with their own unique formatting and jargon. An AI-powered system can take all of it—physician's notes, imaging reports, billing statements—and automatically pull out the vital information you need.

It zeroes in on key data points like:

- Specific diagnoses and their ICD codes

- Dates of service for every single appointment and procedure

- Names of the doctors and facilities involved

- Itemized costs for each service rendered

Once the AI extracts this information, it organizes everything into a clean, chronological summary. This medical timeline becomes the factual backbone of your demand letter, ensuring every statement you make is backed by a precise date and a documented event. This step alone can easily save a legal team more than 10 hours of manual work on a single case, freeing them up to focus on strategy.

Think of it this way: the technology turns a chaotic pile of documents into a clear, data-driven narrative. It gives you pinpoint accuracy and consistency, wiping out the risk of human error that creeps in when you're manually transcribing dates or billing codes from hundreds of pages.

This automated summary lets you grasp the core facts of a case in minutes, not days. It also flags potential gaps in treatment or missing records, which is critical for building a claim that can stand up to scrutiny.

From Raw Data to a Powerful First Draft

Beyond just organizing the facts, the best AI tools take the next logical step: they generate a solid first draft of the settlement demand letter for you. Using the medical chronology and damages it just compiled, the platform can construct the key sections of your letter. It builds the factual story, details the medical treatments, and itemizes the special damages with absolute precision.

This isn't about replacing an attorney's judgment. It’s about providing a comprehensive, well-structured draft that your team can then polish and personalize. The AI handles the repetitive, formulaic work, letting the attorney concentrate on what really matters—crafting persuasive legal arguments and a compelling pain and suffering story that will actually connect with an adjuster.

This isn’t just a theoretical benefit; the results are proving out in real-world negotiations. Some firms are reporting a 69% higher likelihood of hitting policy limit settlements when using AI-assisted demand letters. One attorney even noted their firm went from settling 2-3 out of 10 cases to 6-7 successful settlements, calling the technology a "game changer." You can learn more about these findings on AI's impact on settlement negotiations.

Understanding the broader world of legal technology helps put these tools in context. The efficiency gains are undeniable, allowing firms to start negotiations from a much stronger position. For a deeper look at how roles are shifting, our guide on the rise of the artificial intelligence paralegal offers more insight. By automating the foundational work, AI gives legal professionals the power to secure better outcomes for their clients, and to do it faster.

Frequently Asked Questions About Demand Letters

Crafting the perfect demand letter often brings up a handful of practical, strategic questions. Even seasoned attorneys fine-tune their approach. Let's walk through some of the most common questions I get and how to handle them.

When Is the Best Time to Send the Letter?

This is all about strategy, and timing is everything. You absolutely want to wait until your client has reached Maximum Medical Improvement (MMI). That’s the point where their doctor says their condition has stabilized and isn't expected to get any better (or worse).

If you jump the gun and send the demand before MMI, you're flying blind. You risk massively undervaluing the claim if your client suddenly needs another surgery or develops a chronic condition you didn't anticipate. Once the primary treatment is finished, you have a complete set of medical bills and a clear prognosis. That’s the certainty an insurance adjuster needs to see to properly evaluate the claim and take your demand seriously.

What Are the Most Common Mistakes to Avoid?

A well-crafted demand can be completely undermined by a few simple, avoidable mistakes. Your credibility with the adjuster is your most valuable asset, so don't give them any reason to doubt you.

Watch out for these classic pitfalls:

- Sloppy Factual Errors: Get the dates, names, and locations right. A single inaccuracy, even a typo, gives the adjuster an opening to question everything else in your letter.

- Incomplete Damages: Did you include the mileage for every doctor's visit? The cost of prescription co-pays? Leaving any money on the table is a disservice to your client. Be meticulous.

- Getting Emotional: Keep your tone professional and objective. Ranting or using overly aggressive language just makes you look amateurish and suggests you're compensating for a weak case. Stick to the facts.

- Missing Documentation: Every single claim you make needs to be backed up by an exhibit. If you say your client had an MRI, the MRI report better be attached. Without proof, your demand is just a story.

Should I Always Use a Template?

Yes, but with a major caveat. Using a standardized settlement demand letter template is smart practice. It builds efficiency and consistency across your firm and acts as a checklist to make sure you don't miss any critical legal elements.

But a template is just the skeleton. It’s not a fill-in-the-blank form. The real work—and the real power—comes from weaving your client's unique story into that framework. The template gives you the structure; you have to provide the persuasive narrative that makes an adjuster understand why you’re demanding what you’re demanding.

How Should I Describe Pain and Suffering?

This is your chance to show the human cost behind the medical bills. The secret is to be specific and tangible. Vague phrases like "suffered greatly" are meaningless to an adjuster who reads them all day.

Instead, paint a clear picture. "Could no longer pick up his four-year-old daughter for six months" is powerful. "The nerve damage in her hand meant she had to give up her lifelong passion for painting" creates a real sense of loss.

Always tie the suffering back to a documented injury. For example, you can explain how a diagnosed rotator cuff tear made simple daily tasks, like combing their hair or reaching for a plate, an agonizing ordeal. Using a direct quote from your client or their spouse can also be incredibly effective, adding a genuine voice that helps the adjuster see your client as a person, not just a claim number.

Ready to eliminate the manual work and create data-driven demand letters in a fraction of the time? Ares automatically extracts critical information from medical records and generates a powerful first draft, letting you focus on strategy and win bigger settlements. Discover how Ares can transform your demand process.