What is a Demand Letter from a Lawyer: A Practical Guide to Settlements

When you're trying to resolve a personal injury claim, the demand letter is arguably the most critical document you'll create. It's a formal letter, prepared by an attorney, that gets sent to the at-fault party's insurance company.

This isn't just a simple request for money. It’s a meticulously constructed argument that lays out every detail of your client's case and makes a specific demand for a settlement. Think of it as your official opening statement, presented before a lawsuit even enters the picture.

Your First Move in Legal Negotiations

A demand letter isn't a threat; it's the opening move in a high-stakes negotiation. It’s your chance to present the entire case—the facts, the injuries, the financial losses, and the human suffering—in one comprehensive package.

The goal is to build such a compelling and well-documented case that the insurance adjuster sees the wisdom in settling the claim fairly and quickly. A strong demand letter sets the tone for the entire negotiation process.

A well-written letter will:

- Establish the facts: It tells the story of what happened, clearly explaining how the other party's negligence led to your client's injuries.

- Document the damages: It provides an exhaustive list of all damages, from medical bills and lost wages to the profound impact of pain and suffering.

- Propose a resolution: It concludes with a clear, specific monetary demand to settle the claim and avoid the time and expense of a lawsuit.

This pre-litigation step is where the foundation for a successful settlement is built. The quality of your demand letter can often mean the difference between a quick resolution and a long, drawn-out court battle.

The Cornerstone of Personal Injury Claims

In the world of personal injury law, the demand letter is the cornerstone of settlement negotiations. Why? Because the overwhelming majority of these cases are settled out of court. This letter is the primary tool used to make that happen.

It gives both sides a formal opportunity to evaluate the case's strengths and weaknesses and negotiate a resolution without ever setting foot in a courtroom. Firms that have perfected their demand letter process often see a dramatic improvement in their results. In fact, many report a 300% increased average case value and find they can settle two or three times as many cases before litigation is even considered. You can learn more about the impact of effective demand letters from The Bradley Law Firm.

A demand letter's primary purpose is to organize and present your case in a way that leads to a favorable settlement. It serves several crucial functions in the negotiation process.

The table below breaks down these key objectives.

Key Functions of a Personal Injury Demand Letter

| Function | Purpose in Negotiation |

|---|---|

| Set the Narrative | Establishes your version of events as the authoritative account, supported by evidence. |

| Demonstrate Liability | Clearly proves why the opposing party is legally responsible for the incident and damages. |

| Quantify Damages | Translates injuries, expenses, and suffering into a specific, justifiable monetary figure. |

| Show Preparedness | Signals to the insurer that you are ready and willing to litigate if a fair offer is not made. |

| Initiate Dialogue | Opens a formal channel for negotiation, moving the claim from an administrative to a resolution-focused phase. |

Ultimately, the demand letter is your firm's best opportunity to frame the conversation and steer it toward a successful outcome for your client.

A powerful demand letter does more than just state facts; it tells a compelling story backed by irrefutable evidence. It frames the narrative in a way that guides the insurance adjuster toward one logical conclusion: your proposed settlement is a fair and reasonable outcome.

Anatomy of a Powerful Demand Letter

Think of a great demand letter less like a simple list of facts and more like a compelling story. It's a carefully crafted narrative that walks an insurance adjuster down a path, leading them to one, and only one, logical conclusion: your client deserves fair compensation. Every single piece, from the incident description to the final demand amount, needs to work together to build a rock-solid case.

To really hit the mark, the letter has to do three things flawlessly: explain exactly what happened, prove who was at fault, and document every last dollar of the resulting damages. This isn't just about throwing numbers on a page; it's about giving those numbers context and making the adjuster understand the real human story behind the claim.

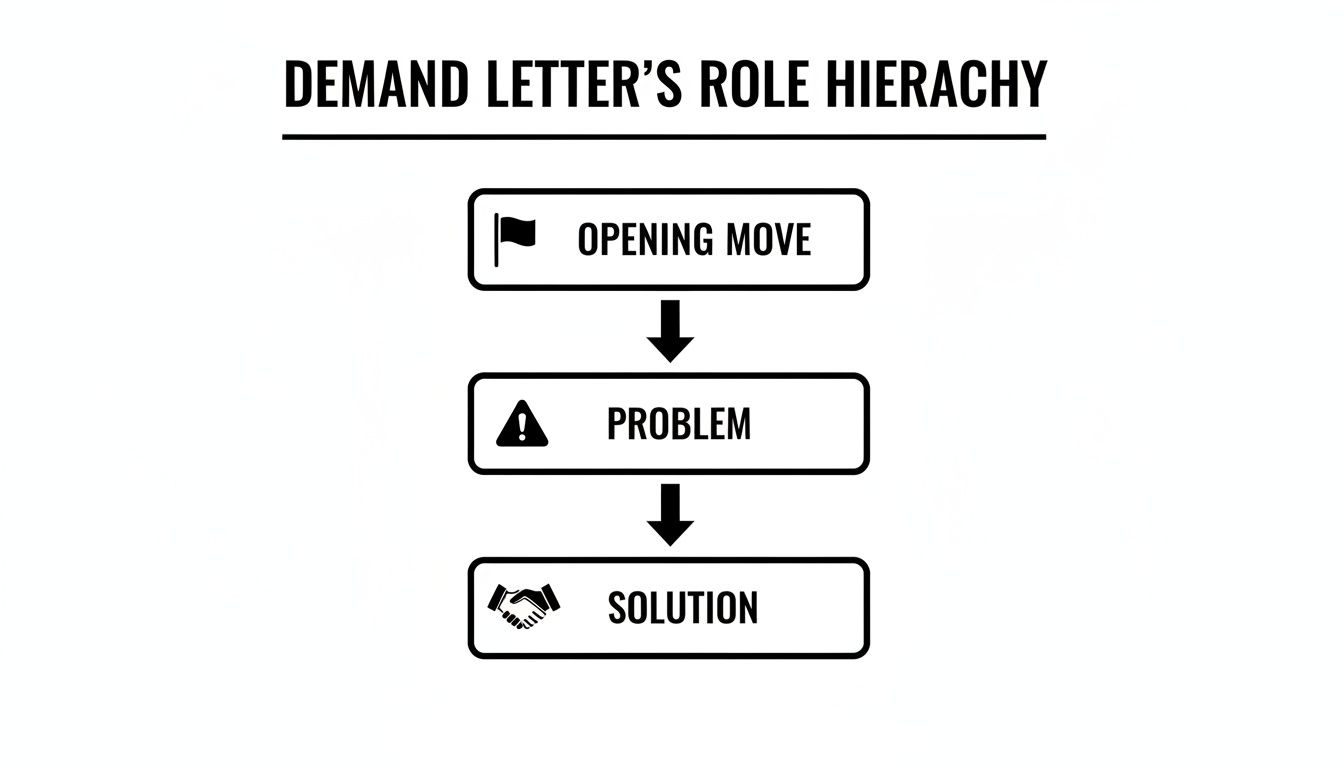

This diagram breaks down the basic flow and function of the demand letter in the negotiation process.

As you can see, it’s a simple but powerful structure. The letter is your opening move, it clearly defines the problem (the accident and its consequences), and it proposes a reasonable solution (the settlement amount).

Crafting the Incident Narrative

First things first, you have to tell the story of what happened. The incident narrative sets the stage, providing a clear, step-by-step account of the event. You need to be so thorough that there are no lingering questions about how the accident unfolded and, critically, why the other party is responsible.

This is where you lock in liability. By weaving together evidence like the police report, witness accounts, and scene photos, you build an argument that proves the other party’s carelessness directly caused your client’s injuries. If this part is weak or fuzzy, you’re practically inviting the insurance company to fight you on the claim.

Detailing Injuries and Medical Treatment

Once you've established how the accident happened, you shift focus to the consequences. This section needs to lay out the full extent of your client's injuries and the entire course of their medical treatment. Be exhaustive—list every diagnosis, every procedure, every therapy appointment.

But remember, this isn't just a medical diary. Your job is to explicitly connect the dots, showing how each treatment was a direct result of the injuries from the incident. Presenting everything in chronological order makes it easy for the adjuster to follow your client’s difficult road to recovery.

A rookie mistake is to just dump a stack of medical records on the adjuster's desk and hope they figure it out. A truly powerful demand letter does the work for them. It translates dense medical jargon into a clear story of pain, treatment, and recovery, making sure to emphasize the most significant parts of the client's medical journey.

Calculating and Presenting Damages

Finally, it's time to talk money. Your demand letter must put a specific number on your client's losses, which requires a meticulous breakdown of both economic and non-economic damages.

- Economic Damages: These are the straightforward, out-of-pocket costs. We're talking about all medical bills, prescription receipts, lost wages from time off work, and any other expenses that have a paper trail. Every dollar you claim here must be backed by solid documentation.

- Non-Economic Damages: This is where you account for the human cost of the injury—things like pain and suffering, emotional distress, and loss of enjoyment of life. While these are harder to put a price tag on, they often make up the largest part of a settlement. You have to paint a vivid picture of how the injury has turned your client's world upside down.

To make sure your demand letter has all the right components, looking at examples like a powerful template demand letter can be a huge help in structuring your case. For an even more detailed walkthrough with concrete examples, check out our guide on https://areslegal.ai/blog/how-to-write-a-powerful-sample-settlement-demand-letter.

Building Your Case with Compelling Evidence

A demand letter from a lawyer is only as strong as the evidence backing it up. Without solid proof, your arguments are just words on a page—easy for an insurance adjuster to brush aside. To build a truly persuasive case, you need to assemble a comprehensive “demand package” that tells a clear, chronological, and undeniable story of everything your client has lost.

This package is what elevates your letter from a simple request into a powerful, fact-based argument. It's the difference between merely stating that your client was injured and proving the full extent of their medical journey, financial hardship, and personal suffering. Think of each piece of evidence as a foundational block, reinforcing the entire structure of your claim.

Key Evidence to Assemble

Gathering the right documents is where it all starts. Your goal is to leave no part of the claim open to question. A rock-solid demand package will almost always include:

- Medical Records and Bills: This is the heart of your evidence. It documents every diagnosis, treatment, and dollar spent.

- Police or Incident Reports: These official reports offer an objective, third-party account of what happened and are often critical for establishing liability from the get-go.

- Proof of Lost Income: Recent pay stubs and a wage verification letter from the client's employer put a hard number on the financial fallout from missed work.

- Photos and Videos: Visuals are incredibly powerful. Photos of the accident scene, vehicle damage, and your client’s injuries can tell a story far more effectively than words alone.

- Witness Statements: First-hand accounts from people who saw what happened can corroborate your client’s story and dismantle any attempts to shift blame.

When you're dealing with spoken evidence like depositions or witness interviews, every word matters. Using professional legal transcription services is non-negotiable to ensure you have a precise, reliable record to support your arguments.

Organizing Evidence for Maximum Impact

Just having a pile of documents isn't enough. The real magic is in how you organize them to tell a compelling story. This means arranging medical records chronologically and pulling out the key findings so the adjuster can immediately grasp the narrative. But manually sifting through hundreds of pages of records is a monumental task, and it's easy to miss a crucial detail.

This is where modern tools can give you a serious edge. AI-powered platforms can digest stacks of medical files in minutes, instantly pulling out the most important data points. For a deeper dive into how this works, check out our complete guide on https://areslegal.ai/blog/medical-record-review-for-attorneys.

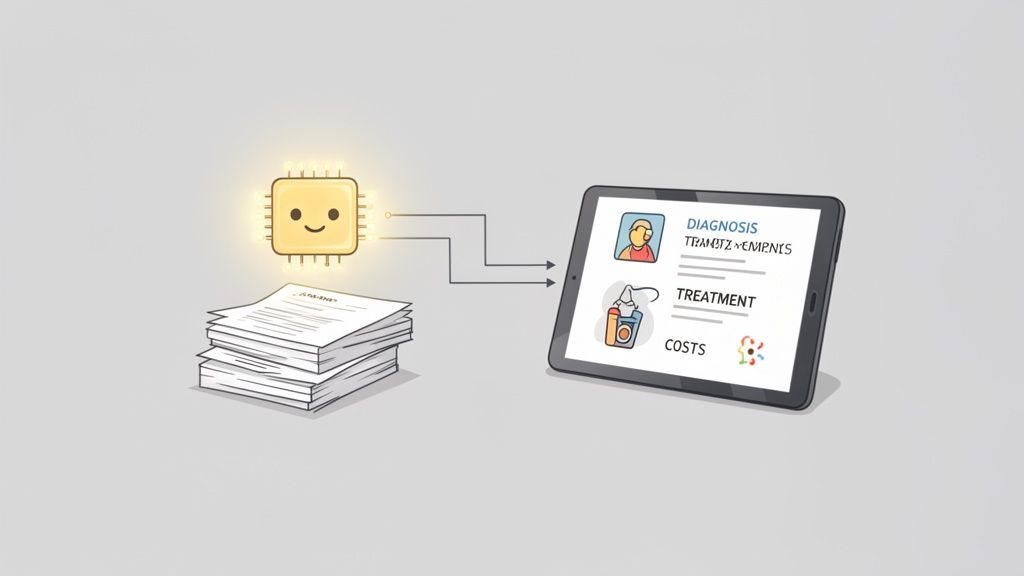

Here’s a perfect example of what that looks like in practice. A tool like Ares can take a complex medical history and distill it into a clean, actionable summary.

An organized summary like this transforms a mountain of paper into a clear narrative. It highlights diagnoses, treatments, and providers in a format that makes your demand letter incredibly potent. When you present the evidence this way, you're drawing a straight, undeniable line from the incident to the damages you're claiming, making it much harder for the adjuster to push back.

Mastering the Timing of Your Demand

In personal injury negotiations, timing isn't just a detail—it's everything. Sending a demand letter too soon is one of the most damaging and irreversible mistakes a lawyer can make. Think of it like a chef pulling a cake from the oven halfway through baking. The result is an underdeveloped mess that simply can't be salvaged.

An early demand letter slams the door shut on future claims before you even know they exist. If a client’s condition worsens or they suddenly need surgery after a settlement is finalized, there's no going back to ask for more. The case is closed for good.

Waiting for Maximum Medical Improvement

This is precisely why the concept of Maximum Medical Improvement (MMI) is a cornerstone of personal injury law. MMI is the point where a doctor determines that a patient’s condition has stabilized and isn't likely to get any better. Hitting this milestone is the absolute, non-negotiable green light for sending a demand.

Waiting for MMI gives your legal team a clear and complete picture of the long-term consequences:

- Future Medical Needs: Will your client need ongoing physical therapy, more surgeries down the road, or a lifetime of medication?

- Permanent Impairments: Has the injury left them with a permanent disability or a loss of function that will impact their ability to earn a living?

- Total Financial Impact: What are the final, comprehensive costs of all medical care, lost income, and other related expenses?

Only when you have solid answers to these questions can you calculate a settlement demand that is both fair and complete. Anything less is just a shot in the dark, and you can't afford to gamble with your client's future.

Rushing to send a demand letter before MMI is reached does a profound disservice to your client. It chases a quick, small settlement instead of securing the full compensation they are rightfully owed for the entire scope of their injuries and future needs.

The Dangers of a Premature Demand

Deciding when to send the demand letter is a critical strategic move. Sending it before your client has reached MMI is a fundamental error that can block you from recovering compensation for future medical care. This isn't just a tactical blunder; it's a matter of ethical duty to protect your client's long-term well-being. Discover more insights about demand letter timing from Injury Law of Minnesota.

When a demand arrives too early, the insurance adjuster has zero obligation to consider what might happen in the future. They will only assess the evidence you've provided up to that point. This hands them all the leverage to make a lowball offer that covers only the bills you've already documented, completely ignoring the potentially massive costs that could pop up later. In this process, patience isn't just a virtue—it's a strategic necessity for securing the compensation your client truly deserves.

Of course. Here is the rewritten section, designed to sound completely human-written, with a natural flow and expert tone.

Avoiding Common Mistakes That Undermine Your Claim

Drafting a demand letter is a high-stakes moment in any personal injury case. Small mistakes can have huge consequences. Even when you have a rock-solid case with great evidence, simple unforced errors can give an insurance adjuster the opening they need to chip away at your settlement, or even deny it outright.

Think of your demand letter as the opening argument in a trial you're trying to avoid. A single factual error, a hint of exaggeration, or an emotional outburst can instantly damage your credibility. The goal is to present an airtight case that is professional, logical, and impossible for the adjuster to ignore. Steering clear of these common pitfalls isn't just about good practice—it's about protecting your client's right to a fair recovery.

Inaccuracies and Exaggerations

One of the fastest ways to lose an adjuster’s trust is to get the facts wrong. These professionals are trained to scrutinize every detail, from the exact time of the accident to the specific CPT codes on a medical bill.

If they spot a discrepancy, even a minor one, it puts the entire claim under a microscope. It gives them the perfect excuse to question everything else you’ve presented.

- Mistake: Getting dates mixed up, misstating a medical diagnosis, or fudging the numbers on lost wages.

- Solution: Triple-check every single fact against your source documents. Make sure your math is perfect and backed by clear proof like pay stubs, physician reports, and billing statements.

Emotional and Aggressive Language

Your client is undoubtedly going through an emotional ordeal, but the demand letter is not the place to vent that frustration. Angry, accusatory, or threatening language is almost always counterproductive.

This kind of tone immediately puts the adjuster on the defensive, making them far less likely to engage in a good-faith negotiation.

Professionalism signals confidence. A case built on cold, hard facts is infinitely more powerful than one driven by emotion. Let the evidence do the heavy lifting.

Remember, an adjuster's job is to evaluate risk based on evidence, not to react to emotional pleas. A firm, respectful, and serious tone gets the job done.

Weak Liability Arguments and Unrealistic Demands

Two other mistakes can shut down negotiations before they even begin. The first is a weak or muddled argument for liability. You have to draw a clear, undeniable line from the defendant's negligence to your client's injuries. If you don't, you’re practically inviting the adjuster to shift the blame onto your client.

The second is making a settlement demand that isn't tethered to reality. Asking for a number that has no basis in the documented damages signals that you're not serious about reaching a fair agreement. This can wreck your credibility and often results in an immediate lowball offer or, worse, radio silence. Your demand should be ambitious, yes, but it must be firmly anchored to the evidence you’ve so carefully laid out.

To help you stay on track, here is a quick guide to what works and what doesn't.

Demand Letter Dos and Don'ts

| Best Practice (Do) | Common Mistake (Don't) |

|---|---|

| Be Meticulously Accurate: Verify every date, name, and figure. | Exaggerate or Guess: Don't inflate lost wages or "round up" medical costs. |

| Stay Professional and Objective: Let the facts speak for themselves. | Use Emotional or Aggressive Language: Avoid threats, insults, or accusations. |

| Build a Strong Liability Case: Clearly connect negligence to the injury. | Assume Liability is Obvious: Never skip a detailed explanation of fault. |

| Justify Your Demand: Base your settlement figure on concrete evidence. | Make an Unrealistic Demand: Don't pull a number out of thin air. |

| Organize Evidence Logically: Present a clear, easy-to-follow narrative. | Submit a Disorganized File: Don't make the adjuster hunt for information. |

| Be Concise and Clear: Get straight to the point without unnecessary jargon. | Write a Novel: Avoid overly long, rambling letters that bury the key facts. |

Ultimately, avoiding these mistakes comes down to discipline and attention to detail. A well-crafted, error-free demand letter shows the insurance company you are a serious professional who has built a case they can’t easily dismiss.

How AI Is Changing the Game for Demand Letters

The days of paralegals sifting through mountains of medical records for weeks on end are numbered. For today's personal injury firms, drafting a compelling demand letter is becoming a completely different process, powered by smart AI platforms that do the heavy lifting. This isn't just about working faster; it's about building a much stronger, fact-based case right from the start.

This technology fundamentally changes the entire workflow. It takes over the tedious administrative work, allowing legal teams to create data-driven drafts with a level of accuracy that was once incredibly time-consuming to achieve. The real magic is its ability to instantly analyze and pull out the crucial facts from a huge pile of documents.

From Manual Slog to Automated Insight

Picture this: you upload hundreds of pages of medical files, and in just a few minutes, you get back a perfectly structured, chronological summary. This is no longer science fiction; it's the new reality for many firms. AI tools can pinpoint and organize the key information that forms the backbone of any persuasive demand letter.

This includes pulling out critical details like:

- Specific Diagnoses: Instantly identifying every official diagnosis connected to the injury.

- Treatment Timelines: Creating a clear, chronological map of every appointment, procedure, and therapy session.

- Billing Details: Systematically extracting and totaling every medical expense from every provider.

- Symptom Progression: Tracking how the client’s reported pain and suffering evolved over time.

By automating the extraction of these crucial data points, AI gives legal teams a complete, high-level overview of a case in a fraction of the time. This frees them from clerical tasks and allows them to focus on high-value strategic thinking and narrative building.

This shift does far more than just save a few hours. It fundamentally boosts a firm’s capacity. Teams can handle higher caseloads without ever compromising on the quality or detail of their work. Bringing these tools on board is quickly becoming a necessity for firms that want to get better results. For a closer look at how this technology is reshaping the industry, you can learn more about the various applications of AI for personal injury lawyers and see how they contribute to building stronger cases.

Common Questions About Demand Letters

When a demand letter from a lawyer lands on your desk, it’s natural to have questions. Let's walk through some of the most common ones that come up during the settlement process.

Do I Have to Respond to a Demand Letter?

While you're not legally obligated to respond, ignoring a demand letter is a risky move. It sends a clear message that you aren't taking the claim seriously, and that almost guarantees the other side will escalate things by filing a lawsuit. A timely, professional response, on the other hand, signals you're open to negotiation and can keep the matter out of court.

How Long Do I Have to Respond?

The letter itself will almost always give you a deadline, which is typically somewhere between 14 and 30 days. This isn't a court-mandated timeline; it's set by the sender. However, you should treat it seriously to show you're acting in good faith. If you genuinely need more time to investigate the claim, the best approach is to simply communicate that to the attorney who sent the letter.

A demand letter is not a court order, but it is a formal precursor to legal action. Treating it with the seriousness it deserves can prevent a simple dispute from escalating into costly and time-consuming litigation.

What Happens if the Demand Is Unreasonable?

It’s not uncommon for the initial demand to feel inflated. If the amount seems way out of line or isn't justified by the evidence they've sent, the next step is to make a counteroffer. This is a standard part of the back-and-forth of negotiation. Your counteroffer should be grounded in your own evaluation of the damages and liability, presenting a logical, evidence-based case for why your figure is more appropriate.

Drafting a powerful demand letter backed by perfectly organized evidence is critical for success. Ares eliminates hours of manual medical record review, instantly extracting the key facts you need to build a compelling case and settle faster. Discover how our AI-powered platform can transform your workflow at https://areslegal.ai.