What Is Protected Health Information in a PI Case

Protected Health Information, or PHI, is essentially any piece of health data that can be tied back to a specific person. In the world of personal injury law, this information is everything. From a client's initial diagnosis and treatment records to the final billing statements, PHI is the factual bedrock you use to prove damages and fight for a fair settlement.

Decoding PHI: The DNA of a Personal Injury Case

For a personal injury firm, defining PHI goes way beyond some textbook definition. It’s better to think of it as the DNA of your case. It holds all the unique, verifiable details that tell the true story of your client's injury, their suffering, and the financial toll it has taken. Every medical record, prescription history, or therapist's note is a critical piece of the puzzle, helping you build an undeniable argument for damages.

This information is so powerful because it's so specific. You're not just arguing about a "back injury"; you're presenting MRI results that show the exact vertebrae affected, the detailed physical therapy regimen prescribed, and the line-item costs for every procedure. That level of detail is what turns a vague claim into a well-documented, evidence-based demand that insurers can't ignore.

The Two Sides of PHI: Asset and Liability

While PHI is your greatest asset in proving a case, it's also a major liability if you get it wrong. The Health Insurance Portability and Accountability Act (HIPAA) of 1996 put strict federal laws in place to protect this very data. The law dictates how healthcare providers, insurers, and their business associates—which includes law firms—must collect, store, and share any identifiable health information.

This dual role is critical to understand. You absolutely need PHI to win, but one slip-up in how you handle it can expose your firm to crippling penalties, shatter your professional reputation, and even put the client's case in jeopardy. Managing this sensitive information correctly isn't just good practice; it's a non-negotiable part of running a modern PI firm. For a deeper dive, take a look at our complete guide on HIPAA-compliant document management.

Protected Health Information is the evidentiary core of a PI claim. It’s the raw material you use to demonstrate causation, quantify damages, and ultimately persuade an adjuster or jury. Neglecting its security is like leaving your most critical evidence unguarded.

The 18 HIPAA Identifiers

So, what exactly turns regular health data into protected health information? HIPAA spells it out clearly, listing 18 specific identifiers. If even one of these is attached to health information, the entire record gets the full protection of HIPAA law.

Knowing these identifiers is the first and most fundamental step toward compliance. Think about it this way: a doctor's note about a patient's condition is just health information. But the moment you add the patient’s name, their date of birth, or a medical record number, it officially becomes PHI. This distinction matters for every single document that crosses your desk, from the first intake form to the final expert witness report.

The 18 HIPAA Identifiers That Define PHI

This table breaks down the 18 identifiers that HIPAA uses to define PHI. When any of these are combined with health or payment information, the data must be protected under HIPAA rules. For personal injury firms, these identifiers show up constantly in client files, making awareness absolutely essential.

| Identifier Category | Examples and Relevance to PI Cases |

|---|---|

| Names | The most obvious identifier. Full names or even last names are found on every medical record, client file, and piece of correspondence. |

| Geographic Data | Street addresses, cities, counties, and ZIP codes (beyond the first three digits) are all identifiers. Essential for client addresses but must be protected. |

| Dates | All dates directly related to an individual, including birth dates, admission dates, discharge dates, and date of death. Crucial for establishing timelines in a case. |

| Contact Information | Telephone numbers and fax numbers are common in client communication and medical provider records. |

| Electronic Addresses | Email addresses are used for client communication and are considered PHI when linked to health data. |

| Social Security Numbers | A highly sensitive identifier often found on insurance forms and hospital intake paperwork. |

| Medical Record Numbers | Unique numbers assigned by hospitals or clinics to identify a patient's chart. Central to organizing a client's medical history. |

| Health Plan Beneficiary Numbers | Numbers used by insurance companies to identify members. Found on all insurance cards and billing statements. |

| Account Numbers | Any financial account numbers, including bank or payment card numbers, used for billing. |

| Certificate/License Numbers | Includes driver's license numbers or any other state-issued identification numbers. |

| Vehicle Identifiers | Vehicle Identification Numbers (VINs), serial numbers, and license plate numbers. Directly relevant in motor vehicle accident cases. |

| Device Identifiers | Serial numbers for medical devices or implants (e.g., a pacemaker). Can be critical in product liability or medical malpractice claims. |

| Web URLs | Any unique URLs linked to an individual. Less common in PI but still a defined identifier. |

| IP Addresses | Internet Protocol (IP) addresses collected through online client portals or websites. |

| Biometric Identifiers | Includes fingerprints, retinal scans, voiceprints, and other unique biological data. |

| Full-Face Photographs | Any full-face photos or comparable images that could identify an individual. Often part of accident scene evidence or injury documentation. |

| Unique Identifying Numbers | Any other unique number, characteristic, or code assigned to an individual that could be used to identify them. |

| Catch-All Provision | Any other characteristic that could uniquely identify the individual. This ensures that new technologies or methods of identification are covered. |

Mastering this list is more than just a compliance exercise—it's about fundamentally understanding the nature of the evidence you work with every single day. Recognizing PHI on sight is the first line of defense in protecting your client, your case, and your firm.

The Critical Difference Between Consent and Authorization

In the day-to-day hustle of a personal injury firm, getting a client's signature to access their medical records can feel like just another box to check. But one of the most common and costly mistakes we see is confusing a general "consent" form with a formal HIPAA "authorization." This isn't just a matter of semantics; it's a misunderstanding that can grind your case to a halt and even open you up to challenges from opposing counsel.

Think of it like this: consent is what a patient gives their doctor for routine healthcare activities. It's the general permission that allows a hospital to bill insurance or lets two specialists in the same network discuss a patient's care. It’s an implied agreement for the basics: treatment, payment, and internal operations.

But when your law firm needs to get its hands on that same patient's records for a legal case, that general consent is useless. You need something much more specific.

Authorization: A Specific Key for a Specific Lock

A HIPAA-compliant authorization is entirely different. It’s a formal, highly detailed document that gives a covered entity—like a hospital or clinic—explicit permission to disclose a patient's PHI to a third party, like your law firm, for a reason completely unrelated to their healthcare.

That generic "medical release form" you had your client sign during intake? There's a good chance it won't cut it. Relying on a flimsy form is a huge gamble. A healthcare provider is well within their rights to reject it, leaving you stuck until you can get a valid authorization signed. This distinction is a legal firewall built to give people ultimate control over who sees their most sensitive information.

An authorization is the patient's explicit, written permission that tells a healthcare provider, "I am allowing you to share my protected health information with this specific person for this specific reason." Without it, your request for records is legally powerless.

What a Valid HIPAA Authorization Must Contain

To be legally sound, a HIPAA authorization has to be more than a simple request—it’s a precise legal instrument. If it’s missing even one of the required components, a records clerk can (and often will) send it right back, creating frustrating delays.

Take a hard look at your firm’s authorization forms. Do they include every single one of these elements?

- A Specific Description of the Information: Be clear about what you need. "All medical records related to the motor vehicle accident of January 15, 2024" is much better than "all medical records."

- The Disclosing Party: Name the specific person or entity releasing the records (e.g., "Main Street General Hospital").

- The Receiving Party: Clearly identify who is getting the information (e.g., "Smith & Jones Law, LLC").

- A Stated Purpose: Explain why you need it (e.g., "for evaluation and use in a personal injury claim").

- An Expiration Date: The authorization can't be open-ended. It needs an expiration date or an event that triggers its expiration (e.g., "one year from the date of signature" or "upon the settlement of this legal matter").

- The Individual's Signature and Date: This is non-negotiable. The client must sign and date the form.

- A Statement of Rights: The document must tell the client they have the right to revoke the authorization in writing and must also explain that their information may not be protected by HIPAA once it's disclosed to you.

Making your intake process bulletproof with a rock-solid, HIPAA-compliant authorization form is one of the smartest things you can do. It cuts out the painful back-and-forth with medical records departments and ensures you get the information you need to build your case without wasting precious time.

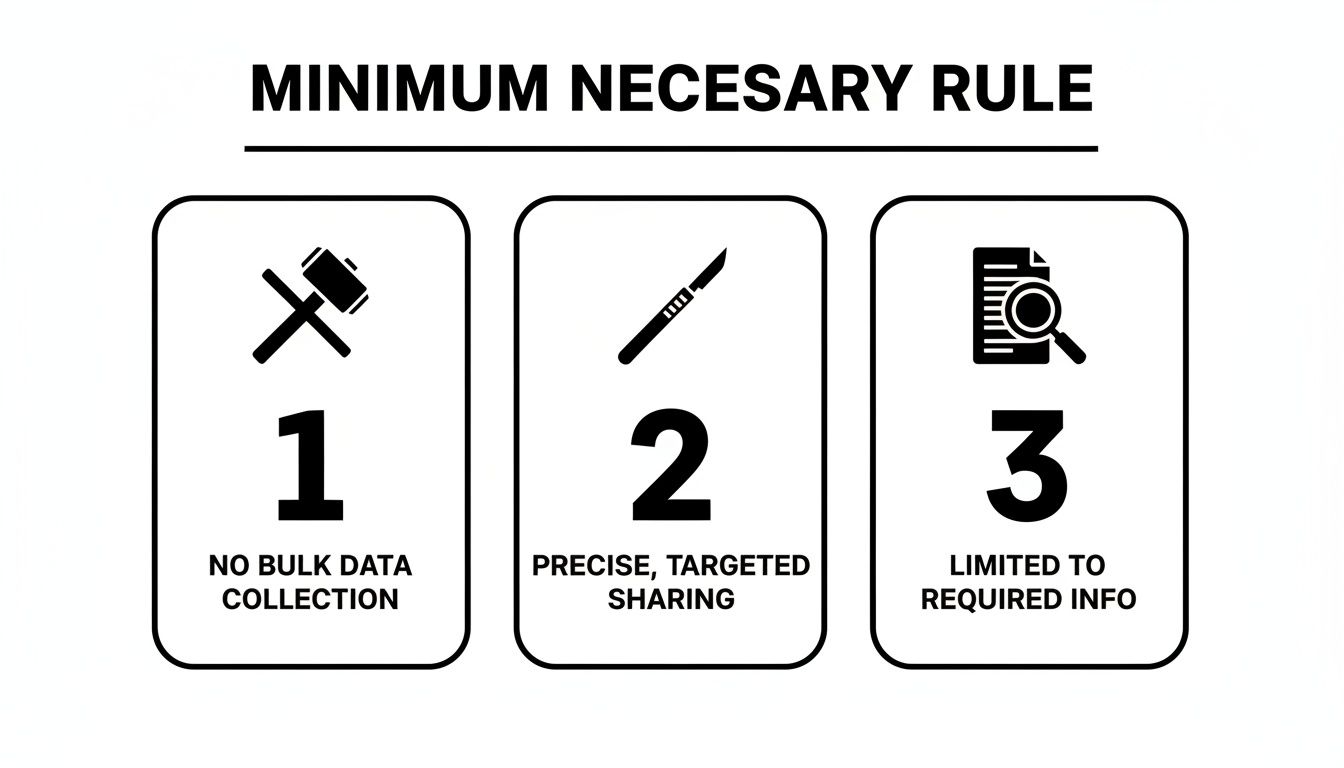

Applying the Minimum Necessary Standard in Litigation

In the world of personal injury law, one of the most important HIPAA principles to master is the Minimum Necessary Standard. At its core, this rule is about restraint. It mandates that you should only use, disclose, or request the bare minimum amount of protected health information required to get the job done.

For a busy law firm, this creates a constant tug-of-war. You need enough medical evidence to build a winning case, but you also have a legal and ethical duty to protect your client's privacy.

Think of it as the difference between using a scalpel and a sledgehammer. The sledgehammer approach is requesting a client’s entire lifetime medical history, hoping to stumble upon something useful. This not only drowns your team in irrelevant paperwork but also massively increases your compliance risk. It's a clumsy, inefficient, and dangerous strategy.

The minimum necessary standard, on the other hand, is a surgical strike. It’s about precisely identifying and requesting only the records, dates, and details directly relevant to the injury claim. This focused approach is not only respectful of your client but also makes your review process far more efficient and keeps your firm safely on the right side of HIPAA.

The Standard in Action for PI Firms

Putting this principle into practice means being deliberate. Instead of firing off broad, all-encompassing requests, your team needs to make targeted inquiries that are directly tied to the facts of the case. This isn't about kneecapping your ability to gather evidence; it's about being strategic and having a clear justification for every single piece of information you request.

And remember, this standard cuts both ways. It applies just as much to how you request PHI from a hospital as it does to how you share it with an expert witness or co-counsel. Every time PHI leaves your control, it must be limited to only what is essential for that specific purpose.

The Minimum Necessary Standard boils down to asking one critical question at every step: "Do I absolutely need this specific piece of information to do my job, or is it just 'nice to have'?" Sticking to this discipline protects your client, sharpens your case's focus, and shields your firm from a world of HIPAA-related trouble.

Practical Examples of Minimum Necessary Compliance

Let's look at how this plays out in the day-to-day work of a personal injury firm:

- Requesting Records: Your client broke their leg in a car accident. Instead of asking for their complete medical file from birth, you'd request only the records related to the accident and its aftermath. Think ER reports, orthopedic consults, surgical notes, physical therapy logs, and the associated bills, all dated from the accident forward.

- Consulting an Expert Witness: You've hired a spinal surgeon to provide an opinion. You wouldn't just forward them the client's entire medical chart, which might contain sensitive but irrelevant details about past dermatological issues or mental health counseling. Instead, you'd provide the expert with only the records pertinent to the spinal injury.

- Internal Access Controls: Not everyone in your firm needs to see everything. A paralegal building the medical timeline needs access to the treatment notes. The staff member in accounting who is processing the settlement check, however, only needs to see the final billing summaries—not the graphic details of the client’s injuries.

By adopting this "scalpel, not sledgehammer" mindset, you're doing more than just checking a HIPAA compliance box. You're making your entire case management process leaner and more effective. Your team stops wasting time wading through irrelevant data and can focus on the facts that actually move the needle and win the case. It’s smarter, safer, and ultimately, a better way to serve your client.

The High-Stakes World of PHI Data Breaches

Understanding what protected health information is and how to handle it isn't just an academic exercise anymore. For today's personal injury firms, the risks tied to PHI are climbing at a shocking pace. Data breaches aren't some far-off threat; they're an immediate danger that can derail a case, shatter client trust, and put your firm's future in jeopardy.

The environment is more hazardous than ever. Just look at the trends: 2023 set a grim record with 746 large breaches exposing a staggering 168 million records. Hacking was the culprit 81% of the time. Even more telling is that business associates—vendors and service providers you rely on—were responsible for two-thirds of all affected records, a detail highlighted in recent healthcare data breach statistics.

This is a critical reality check. The biggest threat isn't always a hacker trying to break into your firm's server. Often, the weakest link is a third-party vendor you've entrusted with your client's most sensitive information.

Your Firm's Hidden Vulnerability

Take a moment to think about your day-to-day work. You partner with court reporters, medical records retrieval services, IT support teams, and expert witnesses. Every single one of these is a "business associate" under HIPAA, and each one represents a potential back door for a data breach. If your records retrieval partner gets hit with a ransomware attack, your client's PHI is instantly in criminal hands.

This is where a core HIPAA principle comes into play: minimizing your exposure. This infographic compares the clumsy "sledgehammer" approach to the precise "surgical tool" method of handling PHI.

It’s a perfect illustration of the Minimum Necessary Standard. Being precise isn't just about compliance; it's about smart risk management. The less data you handle, the smaller the potential damage if a breach ever happens.

When a breach does occur, the consequences are severe.

- Case Sabotage: Imagine opposing counsel getting their hands on privileged information. It could completely undermine your legal strategy.

- Crushing Fines: HIPAA violations aren't cheap. Fines can run into the millions, depending on the level of negligence.

- Reputational Ruin: Clients come to you with their most private struggles. A breach destroys that trust, making it incredibly difficult to attract new clients and keep your current ones.

How Breaches Happen and What's at Stake

Cybercriminals are skilled, and they see law firms as high-value targets. You hold the keys to incredibly sensitive, and therefore valuable, data. They use a handful of common tactics to get to it.

A data breach is more than a technical failure; it's a catastrophic business failure. For a PI firm, it means losing control of the very evidence that defines your client’s case, exposing them to further harm and your firm to immense liability.

The most common threats are hacking, phishing scams cleverly designed to steal login credentials, and ransomware attacks that lock you out of your own files until a massive ransom is paid. But the fallout doesn't stop there. A breach forces you to divert precious time and money to damage control, pulling your focus away from what matters most: your clients and their cases.

In this high-stakes world, solid PHI security isn't just a box to check for compliance. It's a foundational pillar of a successful, sustainable law practice.

Best Practices for Managing PHI in Your Law Firm

Knowing the rules is one thing; putting them into practice is another. For a personal injury firm, managing PHI isn't a passive task—it’s an active, vigilant strategy that has to cover every single stage of a case, from the moment a client walks through your door to the final settlement. The best defense against breaches and compliance headaches is to build robust, common-sense internal protocols.

The idea is to create a culture of security where every team member, from paralegal to partner, understands their role in protecting client data. This means creating clear, repeatable processes for how medical records are collected, accessed, shared, and eventually stored or destroyed. Without these guardrails, your firm is just guessing, which is a dangerous way to handle information this sensitive.

Secure Collection and Intake Procedures

Your firm's journey with PHI starts the second a potential client makes contact. How you collect those initial medical details and signed authorizations sets the tone for the entire case. This first step absolutely must be secure and compliant to create a solid foundation for everything that follows.

First, make sure your client authorization forms are ironclad and fully HIPAA-compliant. Vague or incomplete forms are a classic bottleneck. Then, think about how you're receiving these documents.

- Secure Client Portals: Using a secure online portal for clients to upload documents is exponentially safer than standard email.

- Encrypted Email: If you absolutely have to use email, make sure you're using a service that offers end-to-end encryption for both the message and its attachments.

- Fax Security: Faxing is still common, but it's a weak link if you're not careful. To prevent records from ending up on the wrong machine, make sure you know how to create a flawless HIPAA compliant fax cover sheet.

Responsible Internal Sharing and Access

Once PHI is inside your firm, the next challenge is controlling who sees it. Not everyone on your team needs access to every detail of a client's medical history. Implementing role-based access controls is the practical application of the Minimum Necessary Standard.

For example, a paralegal drafting a medical chronology needs full access to treatment records. An administrative assistant scheduling a deposition, however, probably only needs to see the client's name and the provider's contact info. By limiting access on a strict need-to-know basis, you drastically reduce the risk of an internal breach, whether it's accidental or malicious.

A strong PHI management strategy operates on the principle of least privilege. Grant each team member access to only the specific data they absolutely need to do their job—and nothing more.

Automating these workflows is a great way to enforce your rules consistently. For firms looking to improve efficiency and lock down their processes, you can learn more about legal workflow automation in our detailed guide.

Vetting Third-Party Vendors and Business Associates

Your firm’s security is only as strong as your weakest link, and often, that link is a vendor. Any third party that handles PHI on your behalf—a records retrieval service, an IT provider, or a cloud storage platform—is considered a Business Associate under HIPAA. The law requires you to have a signed Business Associate Agreement (BAA) with every single one.

A BAA is a contract that legally binds the vendor to protect PHI according to HIPAA standards. Before you sign on with any new partner, do your homework. A simple checklist can save you a world of trouble:

- Do they have a BAA? Ask for their standard BAA and have it reviewed. If they don’t have one or seem hesitant to sign yours, that’s a massive red flag. Walk away.

- What are their security protocols? Ask them directly about their data encryption, access controls, and employee training. Get specifics.

- Have they undergone security audits? See if they have certifications like HITRUST or have completed third-party security assessments. This shows they take security seriously.

- What is their breach notification process? The BAA should spell out exactly how and when they will notify you if a breach involves your client's data.

By meticulously vetting every partner, you extend your firm's security perimeter. This ensures your client’s protected health information stays safe even when it leaves your direct control.

Automating Medical Record Review Securely with AI

The traditional way of reviewing medical records in personal injury cases is a grind. It’s slow, it’s expensive, and frankly, it’s loaded with risk. Paralegals can spend hundreds of hours sifting through thousands of pages, trying to build a coherent medical timeline while juggling the immense responsibility of handling Protected Health Information. This manual slog isn’t just inefficient; it’s a major liability, opening the door to human error and potential data breaches at every turn.

Thankfully, there’s a better way. AI-powered platforms can turn this cumbersome workflow into a fast, precise, and HIPAA-compliant process. By automating how critical data is pulled and organized, these tools solve the core problems that bog down PI firms, all while strengthening the security of your clients’ most sensitive information.

Bridging the Gap Between Data and Strategy

Think of an AI medical review platform as a hyper-intelligent, incredibly fast paralegal. The process starts when you securely upload all case-related medical documents into an encrypted, HIPAA-compliant environment. Once the files are in, the AI gets to work.

Instead of a human reading line-by-line, the system uses sophisticated algorithms to find and extract key data points with stunning accuracy. This includes:

- Diagnoses and Injuries: Instantly identifying the specific medical conditions at the heart of the claim.

- Treatment Timelines: Automatically arranging procedures, therapies, and appointments into a clear, chronological story.

- Providers and Facilities: Mapping out every doctor, clinic, and hospital that treated your client.

- Billing and Costs: Pulling the financial data needed to accurately calculate damages.

This kind of automation gets rid of the tedious manual work, freeing up your team to focus on high-value strategy. It also dramatically cuts the risk of missing a critical detail buried in a 500-page record, giving you a much more solid foundation for your case. You can learn more about this process in our guide to the essentials of a medical record review service.

Enhancing Security and Ensuring Compliance

Beyond speed and accuracy, the biggest advantage of a dedicated AI platform is its enterprise-grade security. These systems are built from the ground up with HIPAA compliance as a core principle, offering a level of protection that’s tough for any single law firm to replicate on its own. Every document is handled within a secure, controlled ecosystem.

This robust security is non-negotiable in today's environment. The HIPAA Privacy Rule, which first defined PHI through its 18 identifiers back in December 2000, is more relevant than ever. By 2024, data breaches had already impacted over 846 million individuals. For a PI attorney managing a case with records from half a dozen providers, an unsecured chain of PHI can destroy leverage and expose the firm to serious liability.

Adopting a HIPAA-compliant AI tool isn't just about working faster. It's a strategic move to shield your firm and your clients from the ever-present threat of data breaches. It replaces vulnerable manual processes with a secure, automated, and defensible workflow.

Platforms like Ares go a step further. They don't just pull data; they generate structured, actionable summaries. This gives attorneys a quick grasp of the case's essential facts, helping them build stronger narratives and walk into negotiations with a crystal-clear overview of the medical evidence. By automating the most labor-intensive parts of case prep within a secure framework, these tools help firms take on more cases and settle them faster—without ever compromising on quality or security. This is the modern answer to the age-old challenge of managing PHI.

Frequently Asked Questions About PHI and HIPAA

Even with a good grasp of the rules, questions about protected health information pop up all the time in the day-to-day work of a personal injury firm. Let's tackle some of the most common points of confusion with straightforward answers to help your team handle these situations with confidence.

Are Photos and Videos of a Client's Injuries Considered PHI?

Yes, they absolutely are. Any photo or video that shows a client’s full face or other unique identifying features is considered PHI when it's connected to their medical condition. HIPAA’s list of identifiers specifically includes “Full face photographic images and any comparable images.”

This means you have to treat these visual files with the same level of security as a written medical record. They need to be collected, stored, and shared using secure, encrypted methods to prevent a data breach.

What Is a Business Associate Agreement and When Do I Need One?

A Business Associate Agreement (BAA) is a legally required contract between your law firm and any outside vendor that handles PHI for you. If a third-party service creates, receives, maintains, or transmits PHI on your firm's behalf, you must have a signed BAA with them. It’s a critical part of your compliance puzzle.

Think about the vendors you use every day. You'll likely need a BAA with partners like:

- Cloud storage providers (like Dropbox or Google Drive for Business)

- Your IT support company if they have access to your network

- Medical record retrieval services

- Secure, AI-powered software platforms you use for case management

A BAA is your legal proof that your vendors are just as serious about protecting client data as you are. It officially makes them directly liable for any PHI breaches that happen on their watch.

Without that BAA in place, the liability for a vendor’s security mistake could fall squarely on your firm.

Can I Text or Email Medical Records?

It’s a bad idea, and I strongly advise against it unless you are using a secure, end-to-end encrypted platform built for that exact purpose. Standard text messages and typical email services are simply not secure enough to meet HIPAA's tough security requirements for transmitting PHI.

An unencrypted email with medical records can be easily intercepted, read, or forwarded—and that’s an instant data breach. The best practice is to always use a HIPAA-compliant tool, like a secure client portal or an encrypted email service, when sharing sensitive documents. For more guidance on your obligations, there are excellent resources on HIPAA compliance standards. At the end of the day, protecting this data is one of your most fundamental duties.

Ready to eliminate hours of manual work and strengthen your PHI security? Ares provides an AI-powered, HIPAA-compliant platform that automates medical record review and demand letter drafting. Turn thousands of pages into clear, case-ready summaries in minutes. Discover how Ares can help you settle faster at https://areslegal.ai.