A Guide to Writing a Settlement Letter That Gets Results

Your settlement letter is your opening salvo in the fight to resolve a personal injury claim without setting foot in a courtroom. Think of it as the document that officially gets the ball rolling. It lays out the facts, pins down the other party's liability, meticulously details your client's damages, and—most importantly—makes a clear, specific demand for compensation.

A well-written letter does more than just state a number; it kicks off the negotiation and sets the entire tone for what's to come.

The Strategic Role of Your Settlement Letter

I always tell my associates to think of the settlement letter as their opening move in a chess match. It's not just a tally of medical bills. It’s a compelling, persuasive argument crafted to convince an insurance adjuster that settling now is their best and most logical option.

The core purpose is to open a real channel for negotiation and sidestep the costs and headaches of litigation. That's a goal both sides usually share, which is why over 95% of personal injury cases settle before trial.

This document is your chance to frame the narrative. You get to tell your client's story in a structured, professional manner, backed by irrefutable evidence. A strong letter immediately signals that you're organized, you're serious, and you know exactly what the claim is worth.

Finding the Optimal Timing

When you send this letter is just as important as what's in it. Fire it off too early, and you shoot yourself in the foot. If your client hasn't finished their medical treatment or reached what we call Maximum Medical Improvement (MMI), you simply don't have the full picture. You can't possibly calculate future medical expenses, long-term care needs, or the true extent of their pain and suffering.

On the other hand, dragging your feet can make you look disorganized and less motivated, which can weaken your leverage. The sweet spot is right after medical treatment has wrapped up and you've collected every piece of paper you need—but long before you're bumping up against the statute of limitations.

This timing is strategic. It ensures your demand is based on a complete and final assessment of all losses, giving the adjuster no excuse for not being able to properly evaluate the claim.

Setting the Stage for Negotiation

The tone of your letter really dictates how the negotiation will unfold. You want to be firm and confident, but always professional. Leave the aggressive, chest-thumping language out of it.

Your goal isn't to start a war; it's to start a productive conversation. An overly emotional or hostile letter just puts the adjuster on the defensive, and that makes reaching a fair settlement much, much harder.

Don't just list facts. Weave them into a narrative that explains why your demand is justified. You're transforming your client from a claim number into a real person who has been seriously harmed. By presenting a logical, evidence-based case from the get-go, you force the adjuster to take the claim seriously and engage with respect.

If you're looking for a more detailed breakdown, you can learn more about what a demand letter is and its function in day-to-day legal practice.

Weaving Your Evidence into a Compelling Story

A settlement letter without solid evidence is just an opinion. And in this business, opinions don't get cases settled. The real muscle behind your demand comes from the factual foundation you build. Adjusters are trained to poke holes in every claim, so your job is to present a story so thoroughly documented that it leaves them little room to argue.

This means you need to transform a messy pile of information—medical bills, police reports, photos, witness statements—into a coherent, evidence-backed narrative. Every document you attach acts as a building block, reinforcing the core of your claim: who's at fault, the severity of your client's injuries, and the full scope of their losses.

Don't ever underestimate this step. A well-supported demand letter is often the catalyst for serious negotiations. In fact, an estimated 95% of personal injury cases resolve before ever seeing the inside of a courtroom, and it all starts right here.

Crafting a Factual, Unbiased Narrative

Your first move is to lay out a clear, chronological account of what happened. This section of your letter must be purely factual and objective. Your goal is to detail exactly what happened, where it happened, and who was involved, stripping out any emotional language that could weaken your credibility.

When you're crafting an objective summary, precision is everything. Vague descriptions won't cut it.

Here’s how to structure the incident description for maximum impact:

- Set the Scene: Pinpoint the exact date, time, and location.

- Describe the Actions: Detail the sequence of events leading to the injury. Be specific about what the at-fault party did—or failed to do.

- Cite Your Proof: Right away, reference the police report by its case number and mention any traffic violations the other party received. This immediately anchors your story in official documentation.

For example, don't just say, "The defendant was careless and hit my client." That's an amateur move.

Instead, write something like this: "On May 15, 2023, at approximately 2:10 PM, Mr. Smith’s vehicle entered the intersection of Elm Street and Oak Avenue against a solid red light, striking the driver’s side of our client's car. The responding officer, M. Davis, cited Mr. Smith for a violation of Vehicle Code §21453(a), as documented in police report #A45-2023."

See the difference? This approach draws a direct, undeniable line from the defendant's negligence to your client's harm, which is the cornerstone of any liability argument.

Assembling and Organizing Your Proof

With the narrative framed, it’s time to back it up. Your mission is to assemble a comprehensive "demand package" where every single document supports a specific part of your claim. Getting—and staying—organized is non-negotiable.

I always tell my team to think like architects. Each piece of evidence is a brick, and your settlement letter is the mortar holding it all together. A jumbled mess of papers just screams disorganization and invites skepticism. A well-organized, tabbed, and indexed package commands respect.

Properly organizing these files from the get-go will save you countless headaches and prevent critical details from slipping through the cracks. If you're looking for a better system, especially for the mountain of medical paperwork, our guide on how to organize medical records lays out a workflow that can really help.

Your Essential Evidence Checklist

Every document you include needs to have a job to do. Here’s a breakdown of the must-have items and the role they play in making your case airtight.

Proving Liability (Who's at Fault)

- Police or Incident Report: This is your best friend for establishing fault, plain and simple.

- Witness Statements: Independent eyewitness accounts are gold. They can shut down any attempt by the other side to change their story.

- Photos and Videos: A picture is worth a thousand words, especially when it shows crumpled cars, a hazardous spill, or the scene of the incident.

Proving Injuries and Medical Treatment

- All Medical Records: Everything. From the initial ER report and ambulance run sheet to physical therapy notes and surgical summaries.

- Itemized Medical Bills: These prove the hard costs of the medical care your client required.

- Physician's Narrative or Report: A letter from a treating doctor explaining the diagnosis, prognosis, and—most importantly—the direct link between the incident and the injuries is incredibly powerful.

Proving Financial Losses (Special Damages)

- Pay Stubs and Employer Letter: This is how you document lost wages from time missed at work.

- Repair Estimates and Invoices: For property damage, these quantify the exact cost of repairs or replacement.

- Receipts for Out-of-Pocket Expenses: Don't forget the small stuff. It adds up. This includes prescriptions, medical devices, and even mileage for trips to the doctor.

When you systematically gather and present this evidence, you paint an undeniable picture of the incident’s impact. This methodical, professional approach tells the adjuster you’re serious and fully prepared to take the next step if they don’t come to the table with a fair offer.

How to Structure Your Letter for Maximum Impact

An insurance adjuster’s desk is overflowing with claims. For yours to get the attention it deserves, it needs to be professional, clear, and logical—not a disorganized mess. The structure of your settlement letter is your first and best shot at making a good impression and walking the adjuster through your argument smoothly.

A well-organized letter that’s easy to scan and professional in tone is just flat-out more persuasive. It lets the adjuster quickly get the facts, understand why their insured is liable, and see a clear line from your evidence to the settlement figure you're demanding. Think of it as building your case on paper, where each section supports the next.

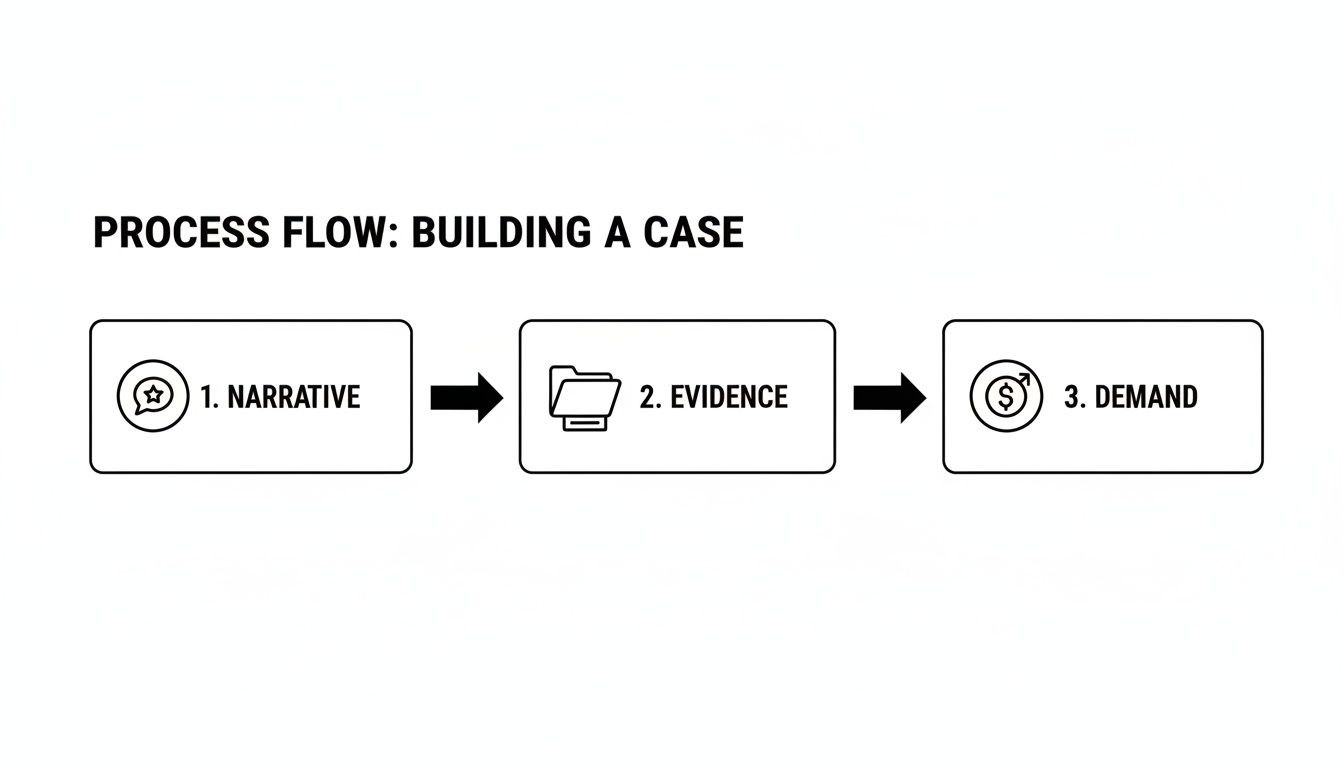

This is the fundamental workflow I follow: start with the story, back it up with hard evidence, and then make the demand.

This process shows that a strong demand isn't just a random number; it's the logical endpoint of a compelling story backed by undeniable proof.

To help you build this kind of impactful letter, here’s a look at the key sections and what each one needs to accomplish.

Key Components of an Effective Settlement Letter

| Component | Objective and Key Information to Include |

|---|---|

| Header and Introduction | Set a professional tone. Include all identifying info: your details, the adjuster's info, client's name, insured's name, date of loss, and the claim number. State the letter's purpose clearly: a formal demand for settlement. |

| Liability and Incident Details | Prove fault. Provide a concise, factual narrative of the incident, referencing the police report number. Avoid emotion and stick to provable facts to show liability is not in dispute. |

| Injuries and Medical Treatment | Connect the incident to the harm caused. Detail every injury, from major to minor. List all medical providers and provide a chronological summary of the treatment journey to illustrate the full scope of the client's experience. |

| Damages Breakdown | Quantify the losses. Itemize Special Damages (medical bills, lost wages, out-of-pocket costs) and articulate General Damages (pain, suffering, emotional distress) by describing the real-world impact on your client's life. |

| The Demand and Conclusion | State your final number. Present a specific total settlement figure that is the sum of all damages. Set a reasonable response deadline (e.g., 30 days) and attach all supporting documents as labeled exhibits. |

Each part of the letter builds on the last, creating a solid foundation for your demand and making it difficult for the adjuster to push back without a very good reason.

The Professional Header and Introduction

Every formal letter starts with the basics, but getting them right immediately signals you’re a professional. Your header should be clean and have all the necessary information right at the top.

- Your Information: Full name and address.

- Recipient Information: The adjuster’s full name, title, and the insurance company’s address.

- Claim Details: Your client’s name, the insured’s name, the date of loss, and, most importantly, the claim number.

The introduction itself should be short and direct. Get straight to it. State that this letter is a formal demand for settlement for the incident on a specific date, introduce your client, and clarify your goal: to resolve the claim without litigation.

Detailing Liability and the Incident

This is where you make your case for why their insured is at fault. Start by painting a clear, factual picture of what happened. You need to stick to the facts here—no emotional language or guesswork.

For example, instead of saying, "Their driver was speeding like a maniac," you write, "The insured, Mr. Jones, was traveling at 65 mph in a 45-mph zone when he failed to stop for a red light, striking our client's vehicle." Always reference the police report number to immediately ground your claim in official documentation.

The key is to be assertive, not aggressive. You're presenting the facts with confidence. Your goal is to show the adjuster that liability is clear and not reasonably in dispute, which makes a fair settlement their most logical next step.

Describing Injuries and Medical Treatment

Once you've established fault, you have to connect that incident directly to your client’s injuries. This section needs to detail every single injury sustained, from major fractures all the way down to soft tissue damage.

List every medical provider your client saw—from the ER visit right after the crash to the months of physical therapy. A chronological summary of the treatment works best. It creates a narrative that shows the adjuster the full scope and duration of the medical journey, painting a vivid picture of the physical toll this incident took. When it comes to refining the language here for maximum impact, you might find that advanced AI writing tools like the GPT-4 API can help you craft more persuasive and compelling arguments.

Presenting a Comprehensive Breakdown of Damages

This is where the rubber meets the road—translating your client’s pain, suffering, and financial losses into hard numbers. Transparency is everything. Break down the damages into two distinct categories so the adjuster can easily follow your math.

1. Special Damages (Economic Losses)

These are the tangible, out-of-pocket expenses. I always create an itemized list for total clarity.

- Past Medical Expenses: List the total billed amount from each provider. (e.g., Mercy General Hospital: $15,250.00)

- Future Medical Expenses: If future treatment is needed, include the projected costs and make sure it’s backed up by a doctor’s report.

- Lost Wages: Document all income lost from time off work. Support this with pay stubs and a letter from their employer.

- Out-of-Pocket Costs: Don't forget prescriptions, medical equipment, mileage to appointments, and other related expenses.

2. General Damages (Non-Economic Losses)

This category covers the intangible stuff—pain, suffering, emotional distress. It’s harder to put a number on, but it’s a huge part of the claim. Here, you need to explain the real-world impact. Talk about the missed family events, the inability to enjoy hobbies, the chronic pain that disrupts sleep, and the emotional trauma of the event.

The Concluding Demand

You've built your case, now it's time to close. State your formal demand as a specific, total settlement amount—the sum of your special and general damages. My advice is to demand a figure that is firm and well-justified but still leaves a little bit of room for negotiation.

Finish the letter by giving the adjuster a reasonable deadline for a response, usually 30 days. Reiterate that you’re ready to negotiate in good faith to get this resolved. And don’t forget to attach all your supporting documents as clearly labeled exhibits that you’ve referenced throughout the letter. This structured, evidence-first approach turns your settlement letter from a simple request into a powerful tool of persuasion.

Calculating and Justifying Your Demand

This is the moment of truth in your letter—where your narrative, evidence, and legal arguments all converge on a single, strategic number. Getting the demand right is more art than science, but a figure pulled from thin air is a rookie mistake that will get your letter tossed aside.

A strong demand isn't just a big number; it’s a defensible one. Your goal is to present a figure that's ambitious enough to leave room for negotiation but so well-supported by the facts that the adjuster has to take it seriously. You need to show them not just what you want, but precisely why your client is entitled to it.

Differentiating Special and General Damages

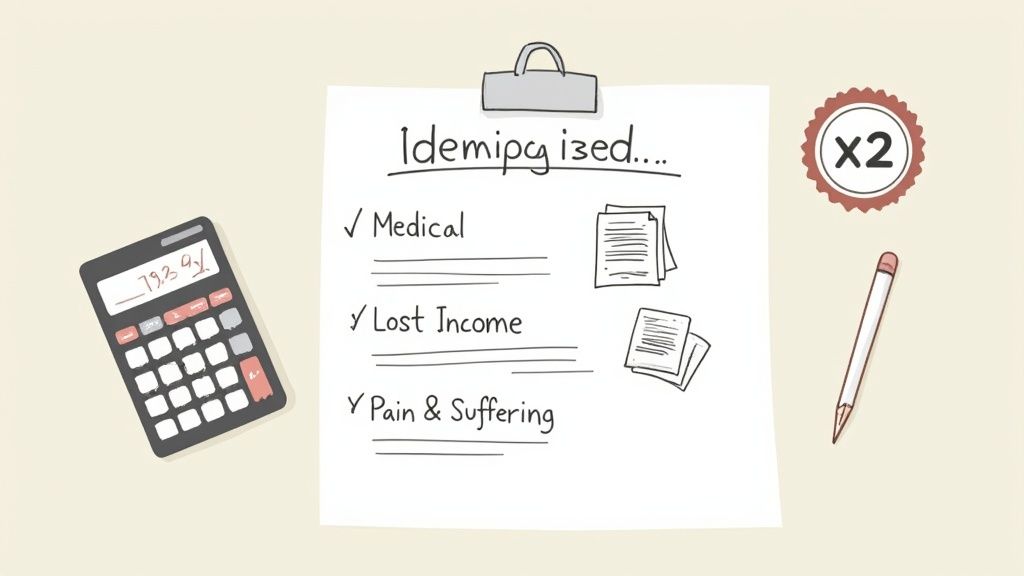

The first step is to create a crystal-clear financial picture for the adjuster. You do this by separating the hard costs from the human costs. This simple organization makes your math easy to follow and forces the adjuster to evaluate your claim on your terms.

Special Damages (The Hard Numbers)

These are the tangible, out-of-pocket economic losses your client has suffered. Think of these as the black-and-white receipts of the case.

- Medical Expenses: Itemize everything. Ambulance transport, ER bills, surgical costs, physical therapy, prescriptions—every single cent gets tallied.

- Lost Income: Calculate the exact wages lost because your client couldn't work. You'll need pay stubs and a letter from their employer to make this number solid.

- Future Medical Care: If the doctors anticipate future treatments, like another surgery or long-term physical therapy, you must include a cost projection from a medical expert.

- Miscellaneous Costs: Don't forget the smaller things that add up, like transportation to appointments, medical equipment (crutches, braces), and prescription co-pays.

General Damages (The Human Cost)

This is where you give a voice to the pain and suffering your client endured. It's less about a spreadsheet and more about painting a compelling picture of their experience.

- Pain and Suffering: Go beyond the clinical diagnosis. Describe the daily physical pain, the sleepless nights, and the frustrating limitations the injury has imposed.

- Emotional Anguish: Detail the anxiety, fear, or depression that followed the incident. Has it affected their relationships or mental well-being?

- Loss of Enjoyment: This is about what was taken from them. Explain how the injury has stopped them from enjoying hobbies, playing with their kids, or simply living their life as they did before.

Using the Multiplier Method to Value Suffering

So, how do you put a number on something as subjective as pain? The most common tool in the personal injury world is the multiplier method. It’s a straightforward concept: you total up all the special damages and multiply that figure by a number, typically between 1.5 and 5.

What determines the right multiplier? It comes down to a few key factors:

- Injury Severity: A broken wrist that heals perfectly might command a 1.5x multiplier. A spinal cord injury resulting in permanent disability could easily justify a 5x multiplier or even higher.

- Recovery Timeline: A long, grueling recovery process with multiple setbacks warrants a much higher multiplier than a quick and easy one.

- Life Impact: How profoundly did the injury disrupt your client’s life? The greater the disruption, the stronger your argument for a higher number.

- Strength of Liability: If the defendant is clearly 100% at fault, you have far more leverage to demand a higher multiplier.

Remember, the adjuster's entire job is to minimize this number. They will try to argue that your client's pain isn't as bad as you claim. Your job is to use medical records and your client's story to make a low multiplier seem completely out of touch with reality.

The multiplier method isn't the only way, of course. For some cases, a "per diem" approach (assigning a daily dollar value to suffering) might be more effective. To get a better handle on these valuation strategies, take a look at our complete guide on how to calculate pain and suffering damages.

Presenting Your Final Demand

Once you’ve calculated the specials and generals, add them together to get your final demand figure. But don't just drop that number into the letter without context.

Your demand should be presented clearly and methodically. First, provide an itemized list of the special damages with a subtotal. Then, explain how you calculated the general damages, referencing the multiplier you used and briefly justifying why that multiplier is appropriate given the facts of the case.

This transparent approach accomplishes two critical things:

- It shows your homework. The adjuster can immediately see that your number isn't arbitrary.

- It anchors the negotiation. It forces them to argue against your specific calculations and evidence, not just make a lowball counteroffer.

This practice of writing a compelling demand letter is a critical skill, and its principles are used across legal and financial sectors. In fact, the global debt settlement market, which was valued at USD 9.83 billion, is projected to hit USD 18.28 billion by 2034, largely driven by these same negotiation fundamentals.

Finally, always start with a number that gives you room to negotiate. An experienced attorney knows that the first demand is an opening bid, not a final ultimatum. By building in a reasonable buffer, you can make strategic concessions during negotiations without ever compromising your client's bottom line.

Navigating the Negotiation Process

Your work isn't over once the settlement letter is in the mail. In fact, sending the letter kicks off a whole new phase—one that demands patience, a solid strategy, and a real understanding of the insurance company’s playbook. What you do next is just as critical as the words you put on the page.

Before you send a single thing, give it one last, thorough review. Your demand package needs to be airtight, with every single supporting document attached as a clearly labeled exhibit. Make sure your letter points directly to each exhibit, creating a paper trail so clean the adjuster can’t miss it. This kind of organization shows them you’re serious and prepared.

Always, and I mean always, send the complete package via certified mail with a return receipt requested. This gives you undeniable proof of the exact date the insurance company received your demand, which is crucial for setting timelines and keeping the adjuster accountable.

Preparing for the Response

Once it's sent, the waiting game begins. You should expect some kind of acknowledgment within a couple of weeks, but a real, substantive response or an initial offer usually takes about 30 to 45 days. Don't get discouraged if the first offer is ridiculously low; that’s just a standard opening move.

An adjuster’s first offer is almost never their best. It's designed to probe for weakness and see if you actually know what your claim is worth. Your job is to stay calm, evaluate their number against your documented damages, and prepare a thoughtful, evidence-based counteroffer.

When you write back, hammer home the strongest points of your case. For instance, you could respond with something like, "Your offer of $15,000 completely overlooks the projected $10,000 in future physical therapy recommended by Dr. Evans, which we detailed in Exhibit D." This tactic ties your argument directly back to the evidence, making your position much harder to brush aside.

Negotiation Tactics and Common Pitfalls

Negotiation is a bit of a dance. You have to stand firm on your valuation while also showing you're willing to have a reasonable conversation. The real skill is in knowing when to hold your ground and when a small concession might be the key to moving things toward a fair resolution.

One of the biggest traps to avoid is giving a recorded statement to the adjuster without talking to a lawyer first. Adjusters are trained to ask leading questions that can trick you into minimizing your own injuries or even admitting partial fault. If they ask, just politely decline.

Remember, the adjuster is not on your side. Their goal is to settle the claim for as little money as possible. Your goal is to get fair compensation based on the facts. Keep it professional, but don't ever forget that you're on opposite sides of the table.

Strong negotiation always comes back to a solid strategy, and a well-crafted settlement letter is central to that. This principle holds true across different fields. Take the debt settlement industry, where the effectiveness of these letters has driven massive market growth. Experts are even predicting a continued expansion in the years ahead. You can read the full research about debt settlement market trends to see how these fundamentals play out on a larger scale.

Knowing When to Settle and When to Escalate

As the back-and-forth continues, you’ll get a sense of whether a fair agreement is within reach. A reasonable settlement is one that fully covers your economic losses and provides a just amount for your pain and suffering—even if it doesn't match your initial demand to the dollar.

But what if the adjuster won't budge from an unreasonably low number, even after you’ve laid out all your evidence? That’s when it’s time to start thinking about your next move. This could mean mediation or, if it comes to it, filing a lawsuit. The very settlement letter you spent so much time perfecting will then become a cornerstone of your legal complaint. By handling this final stage with the same care and strategic thinking, you put yourself in the best possible position for a successful outcome.

Common Questions About Writing a Settlement Letter

Even with a solid plan, you're bound to have questions when you're deep in the trenches of drafting a settlement letter. It's just part of the process. Let's walk through some of the most common issues that come up so you can move forward with confidence.

What Are the Biggest Mistakes to Avoid?

I see the same handful of damaging mistakes over and over again. They usually come down to tone, timing, and accuracy.

A letter dripping with emotional, aggressive language is a surefire way to put an adjuster on the defensive right out of the gate. The same goes for getting your facts wrong or throwing out a pie-in-the-sky demand without any real justification. That's the quickest way to torpedo your credibility.

Another classic blunder is sending the demand too early, especially before your client has reached Maximum Medical Improvement (MMI). But maybe the most frequent—and easily avoidable—error is failing to attach and reference every single piece of supporting evidence. When you do that, you're basically handing the adjuster a legitimate reason to stall or lowball your claim.

A settlement letter isn't just about what you say—it's about what you can prove. Every claim made without a corresponding exhibit is an invitation for the insurance company to push back.

Should I Write This Letter Myself or Hire an Attorney?

This really boils down to the complexity of your case. For a truly minor fender-bender where liability is crystal clear and the injuries were minimal and are now fully healed, you might be able to handle it yourself. But honestly, that’s a rare exception.

You should seriously consider hiring an attorney for any case that involves:

- Serious Injuries: We're talking long-term recovery, any kind of permanent impairment, or a mountain of medical bills.

- Complex Liability: Any situation where fault is being questioned or multiple parties are involved.

- Significant Damages: When you're dealing with substantial lost wages, future medical needs, or significant pain and suffering.

An experienced PI attorney knows the ins and outs of valuing a claim correctly. They’ve seen all the insurance company tactics and know how to counter them effectively. More often than not, their expertise leads to a final settlement that's significantly higher—far more than enough to cover their fee.

How Long Should I Wait for a Response?

This is a waiting game, so you have to be patient—but not forever. Generally, you can expect a real, substantive response within 30 to 45 days after the insurance company gets your complete demand package. Adjusters are juggling huge caseloads, so you won't get a reply overnight.

If that window closes and you've heard nothing but crickets, it's completely fine to make a polite follow-up call or send a short email. You're not being pushy. You're just confirming they got everything and asking for a quick status update. It shows you're on top of your file.

What Should I Do If the Offer Is Too Low?

First things first: don't get discouraged. A low initial offer is a classic negotiation tactic, not the final word. It's the adjuster's opening move, designed to see if you actually know what your claim is worth.

Your job is to respond with a firm, professional counteroffer. Don't just demand more money. In your response letter, calmly walk them back through the strongest parts of your case. You can point to specific evidence they might have glossed over, like a doctor’s note about future therapy needs, and explain exactly why their offer doesn't even begin to cover the documented damages. This keeps the conversation focused on the facts and moves you toward a number that's actually fair.

Streamline this entire process and build stronger demand letters in a fraction of the time. Ares uses an AI-powered platform to automate medical record reviews and draft comprehensive demands, helping personal injury firms eliminate manual work and settle faster. Discover how you can save over 10 hours per case by visiting https://areslegal.ai.